The VARMAX Procedure

- Overview

-

Getting Started

-

Syntax

-

Details

Missing ValuesVARMAX ModelDynamic Simultaneous Equations ModelingImpulse Response FunctionForecastingTentative Order SelectionVAR and VARX ModelingBayesian VAR and VARX ModelingVARMA and VARMAX ModelingModel Diagnostic ChecksCointegrationVector Error Correction ModelingI(2) ModelMultivariate GARCH ModelingOutput Data SetsOUT= Data SetOUTEST= Data SetOUTHT= Data SetOUTSTAT= Data SetPrinted OutputODS Table NamesODS GraphicsComputational Issues

Missing ValuesVARMAX ModelDynamic Simultaneous Equations ModelingImpulse Response FunctionForecastingTentative Order SelectionVAR and VARX ModelingBayesian VAR and VARX ModelingVARMA and VARMAX ModelingModel Diagnostic ChecksCointegrationVector Error Correction ModelingI(2) ModelMultivariate GARCH ModelingOutput Data SetsOUT= Data SetOUTEST= Data SetOUTHT= Data SetOUTSTAT= Data SetPrinted OutputODS Table NamesODS GraphicsComputational Issues -

Examples

- References

Vector Error Correction Model

A vector error correction model (VECM) can lead to a better understanding of the nature of any nonstationarity among the different component series and can also improve longer term forecasting over an unconstrained model.

The VECM(![]() ) form with the cointegration rank

) form with the cointegration rank ![]() is written as

is written as

|

|

where ![]() is the differencing operator, such that

is the differencing operator, such that ![]() ;

; ![]() , where

, where ![]() and

and ![]() are

are ![]() matrices;

matrices; ![]() is a

is a ![]() matrix.

matrix.

It has an equivalent VAR(![]() ) representation as described in the preceding section.

) representation as described in the preceding section.

|

|

where ![]() is a

is a ![]() identity matrix.

identity matrix.

Example of Vector Error Correction Model

An example of the second-order nonstationary vector autoregressive model is

|

|

with

|

|

This process can be given the following VECM(2) representation with the cointegration rank one:

|

|

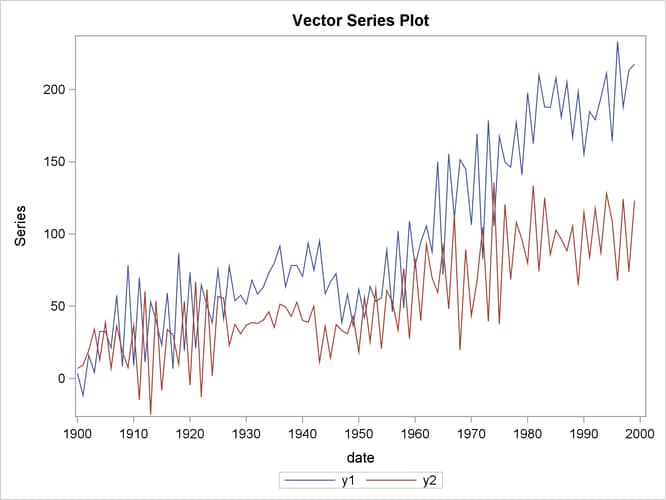

The following PROC IML statements generate simulated data for the VECM(2) form specified above and plot the data as shown in Figure 36.12:

proc iml;

sig = 100*i(2);

phi = {-0.2 0.1, 0.5 0.2, 0.8 0.7, -0.4 0.6};

call varmasim(y,phi) sigma=sig n=100 initial=0

seed=45876;

cn = {'y1' 'y2'};

create simul2 from y[colname=cn];

append from y;

quit;

data simul2;

set simul2;

date = intnx( 'year', '01jan1900'd, _n_-1 );

format date year4. ;

run;

proc timeseries data=simul2 vectorplot=series; id date interval=year; var y1 y2; run;

Figure 36.12: Plot of Generated Data Process

Cointegration Testing

The following statements use the Johansen cointegration rank test. The COINTTEST=(JOHANSEN) option does the Johansen trace test and is equivalent to specifying COINTTEST with no additional options or the COINTTEST=(JOHANSEN=(TYPE=TRACE)) option.

/*--- Cointegration Test ---*/ proc varmax data=simul2; model y1 y2 / p=2 noint dftest cointtest=(johansen); run;

Figure 36.13 shows the output for Dickey-Fuller tests for the nonstationarity of each series and Johansen cointegration rank test between series.

Figure 36.13: Dickey-Fuller Tests and Cointegration Rank Test

| Unit Root Test | |||||

|---|---|---|---|---|---|

| Variable | Type | Rho | Pr < Rho | Tau | Pr < Tau |

| y1 | Zero Mean | 1.47 | 0.9628 | 1.65 | 0.9755 |

| Single Mean | -0.80 | 0.9016 | -0.47 | 0.8916 | |

| Trend | -10.88 | 0.3573 | -2.20 | 0.4815 | |

| y2 | Zero Mean | -0.05 | 0.6692 | -0.03 | 0.6707 |

| Single Mean | -6.03 | 0.3358 | -1.72 | 0.4204 | |

| Trend | -50.49 | 0.0003 | -4.92 | 0.0006 | |

| Cointegration Rank Test Using Trace | ||||||

|---|---|---|---|---|---|---|

| H0: Rank=r |

H1: Rank>r |

Eigenvalue | Trace | 5% Critical Value | Drift in ECM | Drift in Process |

| 0 | 0 | 0.5086 | 70.7279 | 12.21 | NOINT | Constant |

| 1 | 1 | 0.0111 | 1.0921 | 4.14 | ||

In Dickey-Fuller tests, the second column specifies three types of models, which are zero mean, single mean, or trend. The

third column ( Rho ) and the fifth column ( Tau ) are the test statistics for unit root testing. Other columns are their ![]() -values. You can see that both series have unit roots. For a description of Dickey-Fuller tests, see the section PROBDF Function for Dickey-Fuller Tests in Chapter 5: SAS Macros and Functions.

-values. You can see that both series have unit roots. For a description of Dickey-Fuller tests, see the section PROBDF Function for Dickey-Fuller Tests in Chapter 5: SAS Macros and Functions.

In the cointegration rank test, the last two columns explain the drift in the model or process. Since the NOINT option is specified, the model is

|

|

The column Drift In ECM means there is no separate drift in the error correction model, and the column Drift In Process means the process has a constant drift before differencing.

H0 is the null hypothesis, and H1 is the alternative hypothesis. The first row tests ![]() against

against ![]() ; the second row tests

; the second row tests ![]() against

against ![]() . The Trace test statistics in the fourth column are computed by

. The Trace test statistics in the fourth column are computed by ![]() where

where ![]() is the available number of observations and

is the available number of observations and ![]() is the eigenvalue in the third column. By default, the critical values at 5% significance level are used for testing. You

can compare the test statistics and critical values in each row. There is one cointegrated process in this example since the

Trace statistic for testing

is the eigenvalue in the third column. By default, the critical values at 5% significance level are used for testing. You

can compare the test statistics and critical values in each row. There is one cointegrated process in this example since the

Trace statistic for testing ![]() against

against ![]() is greater than the critical value, but the Trace statistic for testing

is greater than the critical value, but the Trace statistic for testing ![]() against

against ![]() is not greater than the critical value.

is not greater than the critical value.

The following statements fit a VECM(2) form to the simulated data. From the result in Figure 36.13, the time series are cointegrated with rank=1. You specify the ECM= option with the RANK=1 option. For normalizing the value of the cointegrated vector, you specify the normalized variable with the NORMALIZE= option. The PRINT=(IARR) option provides the VAR(2) representation. The VARMAX procedure output is shown in Figure 36.14 through Figure 36.16.

/*--- Vector Error-Correction Model ---*/

proc varmax data=simul2;

model y1 y2 / p=2 noint lagmax=3

ecm=(rank=1 normalize=y1)

print=(iarr estimates);

run;

The ECM= option produces the estimates of the long-run parameter, ![]() , and the adjustment coefficient,

, and the adjustment coefficient, ![]() . In Figure 36.14, “1” indicates the first column of the

. In Figure 36.14, “1” indicates the first column of the ![]() and

and ![]() matrices. Since the cointegration rank is 1 in the bivariate system,

matrices. Since the cointegration rank is 1 in the bivariate system, ![]() and

and ![]() are two-dimensional vectors. The estimated cointegrating vector is

are two-dimensional vectors. The estimated cointegrating vector is ![]() . Therefore, the long-run relationship between

. Therefore, the long-run relationship between ![]() and

and ![]() is

is ![]() . The first element of

. The first element of ![]() is 1 since

is 1 since ![]() is specified as the normalized variable.

is specified as the normalized variable.

Figure 36.14: Parameter Estimates for the VECM(2) Form

| Type of Model | VECM(2) |

|---|---|

| Estimation Method | Maximum Likelihood Estimation |

| Cointegrated Rank | 1 |

| Beta | |

|---|---|

| Variable | 1 |

| y1 | 1.00000 |

| y2 | -1.95575 |

| Alpha | |

|---|---|

| Variable | 1 |

| y1 | -0.46680 |

| y2 | 0.10667 |

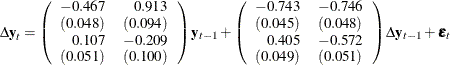

Figure 36.15 shows the parameter estimates in terms of lag one coefficients, ![]() , and lag one first differenced coefficients,

, and lag one first differenced coefficients, ![]() , and their significance. “Alpha * Beta

, and their significance. “Alpha * Beta![]() ” indicates the coefficients of

” indicates the coefficients of ![]() and is obtained by multiplying the “Alpha” and “Beta” estimates in Figure 36.14. The parameter AR1

and is obtained by multiplying the “Alpha” and “Beta” estimates in Figure 36.14. The parameter AR1![]() corresponds to the elements in the “Alpha * Beta

corresponds to the elements in the “Alpha * Beta![]() ” matrix. The

” matrix. The ![]() values and

values and ![]() -values corresponding to the parameters AR1

-values corresponding to the parameters AR1![]() are missing since the parameters AR1

are missing since the parameters AR1![]() have non-Gaussian distributions. The parameter AR2

have non-Gaussian distributions. The parameter AR2![]() corresponds to the elements in the differenced lagged AR coefficient matrix. The “D_” prefixed to a variable name in Figure 36.15 implies differencing.

corresponds to the elements in the differenced lagged AR coefficient matrix. The “D_” prefixed to a variable name in Figure 36.15 implies differencing.

Figure 36.15: Parameter Estimates for the VECM(2) Form

| Parameter Alpha * Beta' Estimates | ||

|---|---|---|

| Variable | y1 | y2 |

| y1 | -0.46680 | 0.91295 |

| y2 | 0.10667 | -0.20862 |

| AR Coefficients of Differenced Lag | |||

|---|---|---|---|

| DIF Lag | Variable | y1 | y2 |

| 1 | y1 | -0.74332 | -0.74621 |

| y2 | 0.40493 | -0.57157 | |

| Model Parameter Estimates | ||||||

|---|---|---|---|---|---|---|

| Equation | Parameter | Estimate | Standard Error |

t Value | Pr > |t| | Variable |

| D_y1 | AR1_1_1 | -0.46680 | 0.04786 | y1(t-1) | ||

| AR1_1_2 | 0.91295 | 0.09359 | y2(t-1) | |||

| AR2_1_1 | -0.74332 | 0.04526 | -16.42 | 0.0001 | D_y1(t-1) | |

| AR2_1_2 | -0.74621 | 0.04769 | -15.65 | 0.0001 | D_y2(t-1) | |

| D_y2 | AR1_2_1 | 0.10667 | 0.05146 | y1(t-1) | ||

| AR1_2_2 | -0.20862 | 0.10064 | y2(t-1) | |||

| AR2_2_1 | 0.40493 | 0.04867 | 8.32 | 0.0001 | D_y1(t-1) | |

| AR2_2_2 | -0.57157 | 0.05128 | -11.15 | 0.0001 | D_y2(t-1) | |

The fitted model is given as

|

Figure 36.16: Change the VECM(2) Form to the VAR(2) Model

| Infinite Order AR Representation | |||

|---|---|---|---|

| Lag | Variable | y1 | y2 |

| 1 | y1 | -0.21013 | 0.16674 |

| y2 | 0.51160 | 0.21980 | |

| 2 | y1 | 0.74332 | 0.74621 |

| y2 | -0.40493 | 0.57157 | |

| 3 | y1 | 0.00000 | 0.00000 |

| y2 | 0.00000 | 0.00000 | |

The PRINT=(IARR) option in the previous SAS statements prints the reparameterized coefficient estimates. For the LAGMAX=3 in the SAS statements, the coefficient matrix of lag 3 is zero.

The VECM(2) form in Figure 36.16 can be rewritten as the following second-order vector autoregressive model:

|

|