The Decomposition Algorithm

- Overview

-

Getting Started

-

Syntax

Decomposition Algorithm Options in the PROC OPTLP Statement or the SOLVE WITH LP Statement in PROC OPTMODELDecomposition Algorithm Options in the PROC OPTMILP Statement or the SOLVE WITH MILP Statement in PROC OPTMODELDECOMP StatementDECOMP_MASTER StatementDECOMP_MASTER_IP StatementDECOMP_SUBPROB Statement

Decomposition Algorithm Options in the PROC OPTLP Statement or the SOLVE WITH LP Statement in PROC OPTMODELDecomposition Algorithm Options in the PROC OPTMILP Statement or the SOLVE WITH MILP Statement in PROC OPTMODELDECOMP StatementDECOMP_MASTER StatementDECOMP_MASTER_IP StatementDECOMP_SUBPROB Statement -

Details

-

Examples

Multicommodity Flow Problem and METHOD=NETWORKGeneralized Assignment ProblemBlock-Diagonal Structure and METHOD=CONCOMP in Single-Machine ModeBlock-Diagonal Structure and METHOD=CONCOMP in Distributed ModeBlock-Angular Structure and METHOD=AUTOBin Packing ProblemResource Allocation ProblemVehicle Routing ProblemATM Cash Management in Single-Machine ModeATM Cash Management in Distributed ModeKidney Donor Exchange and METHOD=SET

Multicommodity Flow Problem and METHOD=NETWORKGeneralized Assignment ProblemBlock-Diagonal Structure and METHOD=CONCOMP in Single-Machine ModeBlock-Diagonal Structure and METHOD=CONCOMP in Distributed ModeBlock-Angular Structure and METHOD=AUTOBin Packing ProblemResource Allocation ProblemVehicle Routing ProblemATM Cash Management in Single-Machine ModeATM Cash Management in Distributed ModeKidney Donor Exchange and METHOD=SET - References

Example 15.9 ATM Cash Management in Single-Machine Mode

This example describes an optimization model that is used in the management of cash flow for a bank’s automated teller machine (ATM) network. The goal of the model is to determine a replenishment schedule for the bank to use in allocating cash inventory at its branches when servicing a preassigned subset of ATMs. Given a history of withdrawals per day for each ATM, the bank can use SAS forecasting tools to predict the expected cash need. The modeling of this prediction depends on various seasonal factors, including the days of the week, weeks of the month, holidays, typical salary disbursement days, location of the ATMs, and other demographic data. The prediction is a parametric mixture of models whose parameters depend on each ATM.

The optimization model performs a polynomial regression that minimizes the error (measured by the  norm) between the predicted and actual withdrawals. The parameter settings in the regression determine the replenishment

policy. The amount of cash that is allocated to each day is subject to a budget constraint. In addition, a constraint for

each ATM limits the number of days that a cash-out (a situation in which the cash flow is less than the predicted withdrawal) can occur. The goal is to determine a policy for

cash distribution that balances the predicted inventory levels while satisfying the budget and cash-out constraints. By keeping

too much cash on hand for ATM fulfillment, the bank loses an investment opportunity. Moreover, regulatory agencies in many

countries enforce a minimum cash reserve ratio at branch banks; according to regulatory policy, the cash in ATMs or in transit

does not contribute toward this threshold.

norm) between the predicted and actual withdrawals. The parameter settings in the regression determine the replenishment

policy. The amount of cash that is allocated to each day is subject to a budget constraint. In addition, a constraint for

each ATM limits the number of days that a cash-out (a situation in which the cash flow is less than the predicted withdrawal) can occur. The goal is to determine a policy for

cash distribution that balances the predicted inventory levels while satisfying the budget and cash-out constraints. By keeping

too much cash on hand for ATM fulfillment, the bank loses an investment opportunity. Moreover, regulatory agencies in many

countries enforce a minimum cash reserve ratio at branch banks; according to regulatory policy, the cash in ATMs or in transit

does not contribute toward this threshold.

Mixed Integer Nonlinear Programming Formulation

The most natural formulation for this model is in the form of a mixed integer nonlinear program (MINLP). Let A denote the set of ATMs and D denote the set of days that are used in the training data. The predictive model fit is defined by the following data for

each ATM a on each day d:  , and

, and  . The model-fitting parameters define the variables

. The model-fitting parameters define the variables  for each ATM that, when applied to the predictive model, estimate the necessary cash flow per day per ATM. In addition, define

a surrogate variable

for each ATM that, when applied to the predictive model, estimate the necessary cash flow per day per ATM. In addition, define

a surrogate variable  for each ATM on each day that defines the cash inventory (replenished from the branch) minus withdrawals. The variable

for each ATM on each day that defines the cash inventory (replenished from the branch) minus withdrawals. The variable  also represents the error in the regression model. Let

also represents the error in the regression model. Let  define the budget per day,

define the budget per day,  define the limit on cash-outs per ATM, and

define the limit on cash-outs per ATM, and  define the historical withdrawals at a particular ATM on a particular day. Then the following MINLP models this problem:

define the historical withdrawals at a particular ATM on a particular day. Then the following MINLP models this problem:

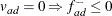

![\begin{align*} & \text {minimize} & \sum _{a \in A} \sum _{d \in D} | f_{ad} | \\ & \text {subject to} & c^ x_{ad} x_{a} + c^ y_{ad} y_{a} + \\ & & c^ z_{ad} x_{a} y_{a} + c^{u}_{ad} u_{a} + c_{ad} - w_{ad} & = f_{ad} & & a \in A,\ d \in D & & \text {(CashFlowDefCon)}\\ & & \sum _{a \in A} \left(f_{ad} + w_{ad}\right) & \leq B_ d & & d \in D & & \text {(BudgetCon)}\\ & & | \{ d \in D \; | \; f_{ad} < 0\} | & \leq K_ a & & a \in A & & \text {(CashOutLimitCon)}\\ & & x_{a}, y_{a} & \in [0,1] & & a \in A \\ & & u_{a} & \geq 0 & & a \in A \\ & & f_{ad} & \geq -w_{ad} & & a \in A,\ d \in D \end{align*}](images/ormpug_decomp0117.png)

The CashFlowDefCon constraint defines the surrogate variable  , which gives the estimated net cash flow. The BudgetCon and CashOutLimitCon constraints ensure that the solution satisfies

the budget and cash-out constraints, respectively.

, which gives the estimated net cash flow. The BudgetCon and CashOutLimitCon constraints ensure that the solution satisfies

the budget and cash-out constraints, respectively.

To express this model in a more standard form, you can first use some standard model reformulations to linearize the absolute value and the CashOutLimitCon constraint.

Linearization of Absolute Value

A well-known reformulation for linearizing the absolute value of a variable is to introduce one variable for each side of the absolute value. The following systems are equivalent:

|

![\[ \begin{array}{lcll} \textrm{minimize} & |y| \\ \textrm{subject to} & A y & \leq & b \end{array} \]](images/ormpug_decomp0118.png)

|

is equivalent to |

![\[ \begin{array}{llll} \textrm{minimize} & y^+ + y^- \\ \textrm{subject to} & A (y^+ - y^-) & \leq & b \\ & y^+, y^- & \ge & 0 \end{array} \]](images/ormpug_decomp0119.png)

|

Let  and

and  represent the positive and negative parts, respectively, of the net cash flow

represent the positive and negative parts, respectively, of the net cash flow  . Then you can rewrite the model, removing the absolute value, as the following:

. Then you can rewrite the model, removing the absolute value, as the following:

![\begin{align*} & \text {minimize} & \sum _{a \in A} \sum _{d \in D} \left(f^+_{ad} + f^-_{ad}\right) \\ & \text {subject to} & c^ x_{ad} x_{a} + c^ y_{ad} y_{a} + \\ & & c^ z_{ad} x_{a} y_{a} + c^{u}_{ad} u_{a} + c_{ad} - w_{ad} & = f^+_{ad} - f^-_{ad} & & a \in A,\ d \in D \\ & & \sum _{a \in A} \left( f^+_{ad} - f^-_{ad} + w_{ad}\right) & \leq B_ d & & d \in D \\ & & | \{ d \in D \; | \; (f^{+}_{ad} - f^{-}_{ad}) < 0\} | & \leq K_ a & & a \in A \\ & & x_{a}, y_{a} & \in [0,1] & & a \in A\\ & & u_{a} & \geq 0 & & a \in A\\ & & f^+_{ad} & \geq 0 & & a \in A,\ d \in D\\ & & f^-_{ad} & \in [0,w_{ad}] & & a \in A,\ d \in D \end{align*}](images/ormpug_decomp0122.png)

Modeling the Cash-Out Constraints

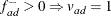

To count the number of times a cash-out occurs, you need to introduce a binary variable to keep track of when this event

occurs. Let  be an indicator variable that takes the value 1 when the net cash flow is negative. You can model the implication

be an indicator variable that takes the value 1 when the net cash flow is negative. You can model the implication  , or its contrapositive

, or its contrapositive  , by adding the constraint

, by adding the constraint

Now you can model the cash-out constraint by counting the number of days that the net-cash flow is negative for each ATM, as follows:

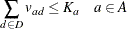

The MINLP model can now be written as follows:

![\begin{align*} & \text {minimize} & \sum _{a \in A} \sum _{d \in D} \left(f^+_{ad} + f^-_{ad}\right) \\ & \text {subject to} & c^ x_{ad} x_{a} + c^ y_{ad} y_{a} + \\ & & c^ z_{ad} x_{a} y_{a} + c^{u}_{ad} u_{a} + c_{ad} - w_{ad} & = f^+_{ad} - f^-_{ad} & & a \in A,\ d \in D\\ & & \sum _{a \in A} \left(f^+_{ad} - f^-_{ad} + w_{ad} \right) & \leq B_ d & & d \in D\\ & & f^{-}_{ad} & \leq w_{ad} v_{ad} & & a \in A,\ d \in D\\ & & \sum _{ d \in D} v_{ad} & \leq K_ a & & a \in A\\ & & x_{a}, y_{a} & \in [0,1] & & a \in A\\ & & u_{a} & \geq 0 & & a \in A\\ & & f^+_{ad} & \geq 0 & & a \in A,\ d \in D \\ & & f^-_{ad} & \in [0,w_{ad}] & & a \in A,\ d \in D \\ & & v_{ad} & \in \{ 0,1\} & & a \in A,\ d \in D\\ \end{align*}](images/ormpug_decomp0128.png)

This MINLP is difficult to solve, in part because the prediction function is not convex. Another approach is to use mixed integer linear programming (MILP) to formulate an approximation of the problem, as described in the next section.

Mixed Integer Linear Programming Approximation

Because the predictive model is a forecast, finding the optimal parameters that are based on nondeterministic data is not of primary importance. Rather, you want to provide as good a solution as possible in a reasonable amount of time. So using MILP to approximate the MINLP is perfectly acceptable. In the original problem you have products of two continuous variables that are both bounded by 0 (lower bound) and 1 (upper bound). This arrangement enables you to create an approximate linear model by using a few standard modeling reformulations.

Discretization of Continuous Variables

The first step is to discretize one of the continuous variables  . The goal is to transform the product

. The goal is to transform the product  of a continuous variable and another continuous variable instead to the product of a continuous variable and a binary variable.

This transformation enables you to linearize the product form.

of a continuous variable and another continuous variable instead to the product of a continuous variable and a binary variable.

This transformation enables you to linearize the product form.

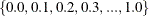

You must assume some level of approximation by defining a binary variable (from some discrete set) for each possible setting

of the continuous variable For example, if you let  , then you allow x to be chosen from the set

, then you allow x to be chosen from the set  . Let

. Let  represent the possible steps and

represent the possible steps and  . Then you apply the following transformation to variable

. Then you apply the following transformation to variable  :

:

The MINLP model can now be approximated as the following:

![\begin{align*} & \text {minimize} & \sum _{a \in A} \sum _{d \in D} \left(f^+_{ad} + f^-_{ad}\right) \\ & \text {subject to} & c^ x_{ad} \sum _{t \in T} c_ t x_{at} + c^ y_{ad} y_{a} + \\ & & c^ z_{ad} \sum _{t \in T} c_ t x_{at} y_{a} + c^{u}_{ad} u_{a} + c_{ad} - w_{ad} & = f^+_{ad} - f^-_{ad} & & a \in A,\ d \in D \\ & & \sum _{t \in T} x_{at} & = 1 & & a \in A \\ & & \sum _{a \in A} \left(f^+_{ad} - f^-_{ad} + w_{ad} \right) & \leq B_ d & & d \in D\\ & & f^{-}_{ad} & \leq w_{ad} v_{ad} & & a \in A,\ d \in D \\ & & \sum _{ d \in D} v_{ad} & \leq K_ a & & a \in A\\ & & y_{a} & \in [0,1] & & a \in A\\ & & u_{a} & \geq 0 & & a \in A \\ & & f^+_{ad} & \geq 0 & & a \in A,\ d \in D\\ & & f^-_{ad} & \in [0,w_{ad}] & & a \in A,\ d \in D\\ & & v_{ad} & \in \{ 0,1\} & & a \in A,\ d \in D\\ & & x_{at} & \in \{ 0,1\} & & a \in A,\ t \in T \end{align*}](images/ormpug_decomp0137.png)

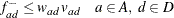

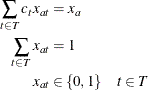

Linearization of Products

You still need to linearize the product terms  in the cash flow constraint. Because these terms are products of a bounded continuous variable and a binary variable, you

can linearize them by introducing for each product another variable,

in the cash flow constraint. Because these terms are products of a bounded continuous variable and a binary variable, you

can linearize them by introducing for each product another variable,  , which serves as a surrogate. In general, you know the following relationship between the original variables and their surrogates:

, which serves as a surrogate. In general, you know the following relationship between the original variables and their surrogates:

|

![\[ \begin{array}{lcll} z_ t & = & x_ t y & t \in T \\ \sum _{t \in T} x_{t} & = & 1 \\ x_ t & \in & \{ 0,1\} & t \in T \\ y & \in & [0,1] \end{array} \]](images/ormpug_decomp0140.png)

is equivalent to

![\[ \begin{array}{lcll} z_ t & \ge & 0 & t \in T\\ z_ t & \le & x_ t & t \in T\\ \sum _{t \in T} x_{t} & = & 1 \\ \sum _{t \in T} z_{t} & = & y \\ x_ t & \in & \{ 0,1\} & t \in T \\ y & \in & [0,1] \end{array} \]](images/ormpug_decomp0141.png)

|

Using this relationship to replace each product form, you now can write the problem as an approximate MILP as follows:

![\begin{align*} & \text {minimize} & \sum _{a \in A} \sum _{d \in D} \left( f^+_{ad} + f^-_{ad}\right) \\ & \text {subject to} & c^ x_{ad} \sum _{t \in T} c_ t x_{at} + c^ y_{ad} y_{a} + \\ & & c^ z_{ad} \sum _{t \in T} c_ t z_{at} + c^{u}_{ad} u_{a} + c_{ad} - w_{ad} & = f^+_{ad} - f^-_{ad} & & a \in A,\ d \in D \\ & & \sum _{t \in T} x_{at} & = 1 & & a \in A\\ & & \sum _{a \in A} \left(f^+_{ad} - f^-_{ad} + w_{ad} \right) & \leq B_ d & & d \in D & & \text {(BudgetCon)}\\ & & f^{-}_{ad} & \leq w_{ad} v_{ad} & & a \in A,\ d \in D\\ & & \sum _{ d \in D} v_{ad} & \leq K_ a & & a \in A\\ & & z_{at} & \leq x_{at} & & a \in A,\ t \in T\\ & & \sum _{t \in T} z_{at} & = y_{a} & & a \in A\\ & & z_{at} & \geq 0 & & a \in A,\ t \in T\\ & & y_{a} & \in [0,1] & & a \in A\\ & & u_{a} & \geq 0 & & a \in A\\ & & f^+_{ad} & \geq 0 & & a \in A,\ d \in D\\ & & f^-_{ad} & \in [0,w_{ad}] & & a \in A,\ d \in D\\ & & v_{ad} & \in \{ 0,1\} & & a \in A,\ d \in D\\ & & x_{at} & \in \{ 0,1\} & & a \in A,\ t \in T \end{align*}](images/ormpug_decomp0142.png)

PROC OPTMODEL Code

Because it is difficult to solve the MINLP model directly, the approximate MILP formulation is attractive. Unfortunately, the approximate MILP is much larger than the associated MINLP. Direct methods for solving this MILP do not work well. However, the problem is nicely suited for the decomposition algorithm.

When you examine the structure of the MILP model, you see clearly that the constraints can be easily decomposed by ATM. In fact, the only set of constraints that involve decision variables across ATMs is the BudgetCon constraint. That is, if you relax the budget constraint, you are left with independent blocks of constraints, one for each ATM.

To show how this is done in PROC OPTMODEL, consider the following data sets, which describe an example that tracks 20 ATMs over a period of 100 days. This particular example was submitted to MIPLIB 2010, which is a collection of difficult MILPs in the public domain (Koch et al. 2011).

The first data set, budget_data, provides the cash budget on each particular day:

data budget_data; input d $ budget; datalines; DATE0 70079 DATE1 66418 DATE10 52656 DATE11 50439 DATE12 58688 DATE13 45002 DATE14 52369 ... ;

The second data set, cashout_data, provides the limit on the number of cash-outs that are allowed at each ATM:

data cashout_data; input a $ cashOutLimit; datalines; ATM0 31 ATM1 24 ATM2 41 ATM3 43 ATM4 29 ATM5 24 ATM6 52 ATM7 44 ATM8 35 ATM9 48 ATM10 31 ATM11 47 ATM12 26 ATM13 34 ATM14 29 ATM15 32 ATM16 33 ATM17 32 ATM18 43 ATM19 28 ;

The final data set, polyfit_data, provides the polynomial fit coefficients for each ATM on each date. It also provides the historical cash withdrawals.

data polyfit_data; input a $ d $ cx cy cz cu c withdrawal; datalines; ATM0 DATE0 2822 1984 -1984 1045 1373 780 ATM0 DATE1 1337 2530 -2530 1510 174 2351 ATM0 DATE2 2685 -67 67 145 2820 2288 ATM0 DATE3 -595 -3135 3135 581 3319 1357 ... ATM19 DATE96 -734 3392 -3392 162 1648 914 ATM19 DATE97 -1062 969 -969 444 1746 2264 ATM19 DATE98 7676 2308 -2308 59 1388 972 ATM19 DATE99 3062 1308 -1308 1080 654 698 ;

The following PROC OPTMODEL statements read in the data and define the necessary sets and parameters:

proc optmodel;

set<str> DATES;

set<str> ATMS;

/* cash budget per date */

num budget{DATES};

/* maximum number of cash-outs allowed at each atm */

num cashOutLimit{ATMS};

/* historical withdrawal amount per atm each date */

num withdrawal{ATMS, DATES};

/* polynomial fit coefficients for predicted cash flow needed */

num c {ATMS, DATES};

num cx{ATMS, DATES};

num cy{ATMS, DATES};

num cz{ATMS, DATES};

num cu{ATMS, DATES};

/* number of points used in approximation of continuous range */

num nSteps = 10;

set STEPS = {0..nSteps};

read data budget_data into DATES=[d] budget;

read data cashout_data into ATMS=[a] cashOutLimit;

read data polyfit_data into [a d] cx cy cz cu c withdrawal;

The following statements declare the variables:

var x{ATMS,STEPS} binary;

var v{ATMS,DATES} binary;

var z{ATMS,STEPS} >= 0 <= 1;

var y{ATMS} >= 0 <= 1;

var u{ATMS} >= 0;

var fPlus{ATMS,DATES} >= 0;

var fMinus{a in ATMS, d in DATES} >= 0 <= withdrawal[a,d];

The following statements declare the objective and the constraints:

min CashFlowDiff =

sum{a in ATMS, d in DATES} (fPlus[a,d] + fMinus[a,d]);

con BudgetCon{d in DATES}:

sum{a in ATMS} (fPlus[a,d] - fMinus[a,d] + withdrawal[a,d])

<= budget[d];

con CashFlowDefCon{a in ATMS, d in DATES}:

cx[a,d] * sum{t in STEPS} (t/nSteps) * x[a,t] +

cy[a,d] * y[a] +

cz[a,d] * sum{t in STEPS} (t/nSteps) * z[a,t] +

cu[a,d] * u[a] +

c[a,d] - withdrawal[a,d] = fPlus[a,d] - fMinus[a,d];

con PickOneStepCon{a in ATMS}:

sum{t in STEPS} x[a,t] = 1;

con CashOutLinkCon{a in ATMS, d in DATES}:

fMinus[a,d] <= withdrawal[a,d] * v[a,d];

con CashOutLimitCon{a in ATMS}:

sum{d in DATES} v[a,d] <= cashOutLimit[a];

con Linear1Con{a in ATMS, t in STEPS}:

z[a,t] <= x[a,t];

con Linear2Con{a in ATMS}:

sum{t in STEPS} z[a,t] = y[a];

The following statements define the block decomposition by ATM. The .block suffix expects numeric indices, whereas the SET<STR> ATMS statement declares a set of strings. You can create a mapping from the string identifier to a numeric identifier as follows:

/* create numeric block index */

num blockIndex {ATMS};

num index init 0;

for{a in ATMS} do;

blockIndex[a] = index;

index = index + 1;

end;

Then, each constraint can be added to its associated ATM block as follows:

/* define blocks for each ATM */

for{a in ATMS} do;

PickOneStepCon[a].block = blockIndex[a];

CashOutLimitCon[a].block = blockIndex[a];

Linear2Con[a].block = blockIndex[a];

for{d in DATES} do;

CashFlowDefCon[a,d].block = blockIndex[a];

CashOutLinkCon[a,d].block = blockIndex[a];

end;

for{t in STEPS}

Linear1Con[a,t].block = blockIndex[a];

end;

The budget constraint links all the ATMs, and it remains in the master problem. Finally, the following statements use the decomposition algorithm to solve the problem to within 1% of proven optimality:

/* set the number of threads and get performance details */ performance details nthreads=4; /* solve with the decomposition algorithm */ solve with milp / relobjgap=0.01 decomp; quit;

The solution summary, performance information, and procedure task timing tables are displayed in Output 15.9.1.

Output 15.9.1: Performance Information, Solution Summary, and Task Timing Tables

| Solution Summary | |

|---|---|

| Solver | MILP |

| Algorithm | Decomposition |

| Objective Function | CashFlowDiff |

| Solution Status | Optimal within Relative Gap |

| Objective Value | 2463991.7254 |

| Relative Gap | 0.0003566183 |

| Absolute Gap | 878.39121522 |

| Primal Infeasibility | 4.774847E-12 |

| Bound Infeasibility | 3.330669E-15 |

| Integer Infeasibility | 3.330669E-15 |

| Best Bound | 2463113.3342 |

| Nodes | 1 |

| Iterations | 7 |

| Presolve Time | 0.28 |

| Solution Time | 68.27 |

The iteration log, which contains the problem statistics, the progress of the solution, and the optimal objective value, is shown in Output 15.9.2.

Output 15.9.2: Log

| NOTE: There were 100 observations read from the data set WORK.BUDGET_DATA. |

| NOTE: There were 20 observations read from the data set WORK.CASHOUT_DATA. |

| NOTE: There were 2000 observations read from the data set WORK.POLYFIT_DATA. |

| NOTE: Problem generation will use 4 threads. |

| NOTE: The problem has 6480 variables (0 free, 0 fixed). |

| NOTE: The problem has 2220 binary and 0 integer variables. |

| NOTE: The problem has 4380 linear constraints (2340 LE, 2040 EQ, 0 GE, 0 range). |

| NOTE: The problem has 58878 linear constraint coefficients. |

| NOTE: The problem has 0 nonlinear constraints (0 LE, 0 EQ, 0 GE, 0 range). |

| NOTE: The MILP presolver value AUTOMATIC is applied. |

| NOTE: The MILP presolver removed 308 variables and 209 constraints. |

| NOTE: The MILP presolver removed 726 constraint coefficients. |

| NOTE: The MILP presolver modified 0 constraint coefficients. |

| NOTE: The presolved problem has 6172 variables, 4171 constraints, and 58152 constraint |

| coefficients. |

| NOTE: The MILP solver is called. |

| NOTE: The Decomposition algorithm is used. |

| NOTE: The Decomposition algorithm is executing in single-machine mode. |

| NOTE: The DECOMP method value USER is applied. |

| NOTE: The problem has a decomposable structure with 20 blocks. The largest block covers 5.131% |

| of the constraints in the problem. |

| NOTE: The decomposition subproblems cover 6172 (100%) variables and 4071 (97.6%) constraints. |

| NOTE: The deterministic parallel mode is enabled. |

| NOTE: The Decomposition algorithm is using up to 4 threads. |

| Iter Best Master Best LP IP CPU Real |

| Bound Objective Integer Gap Gap Time Time |

| NOTE: Starting phase 1. |

| 1 0.0000 1.1767 . 1.18e+00 . 63 20 |

| 2 0.0000 0.0000 . 0.00% . 63 20 |

| NOTE: Starting phase 2. |

| 3 2.4432e+06 2.6130e+06 . 6.95% . 101 33 |

| 4 2.4525e+06 2.4831e+06 . 1.25% . 138 46 |

| 7 2.4631e+06 2.4631e+06 . 0.00% . 200 67 |

| . 2.4631e+06 2.4631e+06 2.4640e+06 0.00% 0.04% 200 67 |

| NOTE: The Decomposition algorithm stopped on the integer RELOBJGAP= option. |

| Node Active Sols Best Best Gap CPU Real |

| Integer Bound Time Time |

| 0 0 1 2.4640e+06 2.4631e+06 0.04% 200 67 |

| NOTE: The Decomposition algorithm used 4 threads. |

| NOTE: The Decomposition algorithm time is 67.91 seconds. |

| NOTE: Optimal within relative gap. |

| NOTE: Objective = 2463991.7254. |