The VARMAX Procedure

- Overview

-

Getting Started

-

Syntax

-

Details

Missing Values VARMAX Model Dynamic Simultaneous Equations Modeling Impulse Response Function Forecasting Tentative Order Selection VAR and VARX Modeling Bayesian VAR and VARX Modeling VARMA and VARMAX Modeling Model Diagnostic Checks Cointegration Vector Error Correction Modeling I(2) Model Multivariate GARCH Modeling Output Data Sets OUT= Data Set OUTEST= Data Set OUTHT= Data Set OUTSTAT= Data Set Printed Output ODS Table Names ODS Graphics Computational Issues

Missing Values VARMAX Model Dynamic Simultaneous Equations Modeling Impulse Response Function Forecasting Tentative Order Selection VAR and VARX Modeling Bayesian VAR and VARX Modeling VARMA and VARMAX Modeling Model Diagnostic Checks Cointegration Vector Error Correction Modeling I(2) Model Multivariate GARCH Modeling Output Data Sets OUT= Data Set OUTEST= Data Set OUTHT= Data Set OUTSTAT= Data Set Printed Output ODS Table Names ODS Graphics Computational Issues -

Examples

- References

Example 35.2 Analysis of German Economic Variables

This example considers a three-dimensional VAR(2) model. The model contains the logarithms of a quarterly, seasonally adjusted West German fixed investment, disposable income, and consumption expenditures. The data used are in Lütkepohl (1993, Table E.1).

title 'Analysis of German Economic Variables';

data west;

date = intnx( 'qtr', '01jan60'd, _n_-1 );

format date yyq. ;

input y1 y2 y3 @@;

y1 = log(y1);

y2 = log(y2);

y3 = log(y3);

label y1 = 'logarithm of investment'

y2 = 'logarithm of income'

y3 = 'logarithm of consumption';

datalines;

180 451 415 179 465 421 185 485 434 192 493 448

... more lines ...

data use; set west; where date < '01jan79'd; keep date y1 y2 y3; run;

proc varmax data=use;

id date interval=qtr;

model y1-y3 / p=2 dify=(1)

print=(decompose(6) impulse=(stderr) estimates diagnose)

printform=both lagmax=3;

causal group1=(y1) group2=(y2 y3);

output lead=5;

run;

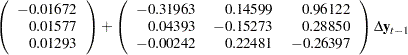

First, the differenced data is modeled as a VAR(2) with the following result:

|

|

|

|||

|

|

|

The parameter estimates AR1_1_2, AR1_1_3, AR2_1_2, and AR2_1_3 are insignificant, and the VARX model is fitted in the next step.

The detailed output is shown in Output 35.2.1 through Output 35.2.8.

Output 35.2.1 shows the descriptive statistics.

| Analysis of German Economic Variables |

| Number of Observations | 75 |

|---|---|

| Number of Pairwise Missing | 0 |

| Observation(s) eliminated by differencing | 1 |

| Simple Summary Statistics | ||||||||

|---|---|---|---|---|---|---|---|---|

| Variable | Type | N | Mean | Standard Deviation |

Min | Max | Difference | Label |

| y1 | Dependent | 75 | 0.01811 | 0.04680 | -0.14018 | 0.19358 | 1 | logarithm of investment |

| y2 | Dependent | 75 | 0.02071 | 0.01208 | -0.02888 | 0.05023 | 1 | logarithm of income |

| y3 | Dependent | 75 | 0.01987 | 0.01040 | -0.01300 | 0.04483 | 1 | logarithm of consumption |

Output 35.2.2 shows that a VAR(2) model is fit to the data.

| Analysis of German Economic Variables |

| Type of Model | VAR(2) |

|---|---|

| Estimation Method | Least Squares Estimation |

| Constant | |

|---|---|

| Variable | Constant |

| y1 | -0.01672 |

| y2 | 0.01577 |

| y3 | 0.01293 |

| AR | ||||

|---|---|---|---|---|

| Lag | Variable | y1 | y2 | y3 |

| 1 | y1 | -0.31963 | 0.14599 | 0.96122 |

| y2 | 0.04393 | -0.15273 | 0.28850 | |

| y3 | -0.00242 | 0.22481 | -0.26397 | |

| 2 | y1 | -0.16055 | 0.11460 | 0.93439 |

| y2 | 0.05003 | 0.01917 | -0.01020 | |

| y3 | 0.03388 | 0.35491 | -0.02223 | |

Output 35.2.3 shows the parameter estimates and their significance.

| Schematic Representation | |||

|---|---|---|---|

| Variable/Lag | C | AR1 | AR2 |

| y1 | . | -.. | ... |

| y2 | + | ... | ... |

| y3 | + | .+. | .+. |

| + is > 2*std error, - is < -2*std error, . is between, * is N/A | |||

| Model Parameter Estimates | ||||||

|---|---|---|---|---|---|---|

| Equation | Parameter | Estimate | Standard Error |

t Value | Pr > |t| | Variable |

| y1 | CONST1 | -0.01672 | 0.01723 | -0.97 | 0.3352 | 1 |

| AR1_1_1 | -0.31963 | 0.12546 | -2.55 | 0.0132 | y1(t-1) | |

| AR1_1_2 | 0.14599 | 0.54567 | 0.27 | 0.7899 | y2(t-1) | |

| AR1_1_3 | 0.96122 | 0.66431 | 1.45 | 0.1526 | y3(t-1) | |

| AR2_1_1 | -0.16055 | 0.12491 | -1.29 | 0.2032 | y1(t-2) | |

| AR2_1_2 | 0.11460 | 0.53457 | 0.21 | 0.8309 | y2(t-2) | |

| AR2_1_3 | 0.93439 | 0.66510 | 1.40 | 0.1647 | y3(t-2) | |

| y2 | CONST2 | 0.01577 | 0.00437 | 3.60 | 0.0006 | 1 |

| AR1_2_1 | 0.04393 | 0.03186 | 1.38 | 0.1726 | y1(t-1) | |

| AR1_2_2 | -0.15273 | 0.13857 | -1.10 | 0.2744 | y2(t-1) | |

| AR1_2_3 | 0.28850 | 0.16870 | 1.71 | 0.0919 | y3(t-1) | |

| AR2_2_1 | 0.05003 | 0.03172 | 1.58 | 0.1195 | y1(t-2) | |

| AR2_2_2 | 0.01917 | 0.13575 | 0.14 | 0.8882 | y2(t-2) | |

| AR2_2_3 | -0.01020 | 0.16890 | -0.06 | 0.9520 | y3(t-2) | |

| y3 | CONST3 | 0.01293 | 0.00353 | 3.67 | 0.0005 | 1 |

| AR1_3_1 | -0.00242 | 0.02568 | -0.09 | 0.9251 | y1(t-1) | |

| AR1_3_2 | 0.22481 | 0.11168 | 2.01 | 0.0482 | y2(t-1) | |

| AR1_3_3 | -0.26397 | 0.13596 | -1.94 | 0.0565 | y3(t-1) | |

| AR2_3_1 | 0.03388 | 0.02556 | 1.33 | 0.1896 | y1(t-2) | |

| AR2_3_2 | 0.35491 | 0.10941 | 3.24 | 0.0019 | y2(t-2) | |

| AR2_3_3 | -0.02223 | 0.13612 | -0.16 | 0.8708 | y3(t-2) | |

Output 35.2.4 shows the innovation covariance matrix estimates, the various information criteria results, and the tests for white noise residuals. The residuals are uncorrelated except at lag 3 for  variable.

variable.

| Covariances of Innovations | |||

|---|---|---|---|

| Variable | y1 | y2 | y3 |

| y1 | 0.00213 | 0.00007 | 0.00012 |

| y2 | 0.00007 | 0.00014 | 0.00006 |

| y3 | 0.00012 | 0.00006 | 0.00009 |

| Information Criteria | |

|---|---|

| AICC | -24.4884 |

| HQC | -24.2869 |

| AIC | -24.5494 |

| SBC | -23.8905 |

| FPEC | 2.18E-11 |

| Cross Correlations of Residuals | ||||

|---|---|---|---|---|

| Lag | Variable | y1 | y2 | y3 |

| 0 | y1 | 1.00000 | 0.13242 | 0.28275 |

| y2 | 0.13242 | 1.00000 | 0.55526 | |

| y3 | 0.28275 | 0.55526 | 1.00000 | |

| 1 | y1 | 0.01461 | -0.00666 | -0.02394 |

| y2 | -0.01125 | -0.00167 | -0.04515 | |

| y3 | -0.00993 | -0.06780 | -0.09593 | |

| 2 | y1 | 0.07253 | -0.00226 | -0.01621 |

| y2 | -0.08096 | -0.01066 | -0.02047 | |

| y3 | -0.02660 | -0.01392 | -0.02263 | |

| 3 | y1 | 0.09915 | 0.04484 | 0.05243 |

| y2 | -0.00289 | 0.14059 | 0.25984 | |

| y3 | -0.03364 | 0.05374 | 0.05644 | |

| Schematic Representation of Cross Correlations of Residuals |

||||

|---|---|---|---|---|

| Variable/Lag | 0 | 1 | 2 | 3 |

| y1 | +.+ | ... | ... | ... |

| y2 | .++ | ... | ... | ..+ |

| y3 | +++ | ... | ... | ... |

| + is > 2*std error, - is < -2*std error, . is between | ||||

| Portmanteau Test for Cross Correlations of Residuals |

|||

|---|---|---|---|

| Up To Lag | DF | Chi-Square | Pr > ChiSq |

| 3 | 9 | 9.69 | 0.3766 |

Output 35.2.5 describes how well each univariate equation fits the data. The residuals are off from the normality, but have no AR effects. The residuals for  variable have the ARCH effect.

variable have the ARCH effect.

| Univariate Model ANOVA Diagnostics | ||||

|---|---|---|---|---|

| Variable | R-Square | Standard Deviation |

F Value | Pr > F |

| y1 | 0.1286 | 0.04615 | 1.62 | 0.1547 |

| y2 | 0.1142 | 0.01172 | 1.42 | 0.2210 |

| y3 | 0.2513 | 0.00944 | 3.69 | 0.0032 |

| Univariate Model White Noise Diagnostics | |||||

|---|---|---|---|---|---|

| Variable | Durbin Watson |

Normality | ARCH | ||

| Chi-Square | Pr > ChiSq | F Value | Pr > F | ||

| y1 | 1.96269 | 10.22 | 0.0060 | 12.39 | 0.0008 |

| y2 | 1.98145 | 11.98 | 0.0025 | 0.38 | 0.5386 |

| y3 | 2.14583 | 34.25 | <.0001 | 0.10 | 0.7480 |

| Univariate Model AR Diagnostics | ||||||||

|---|---|---|---|---|---|---|---|---|

| Variable | AR1 | AR2 | AR3 | AR4 | ||||

| F Value | Pr > F | F Value | Pr > F | F Value | Pr > F | F Value | Pr > F | |

| y1 | 0.01 | 0.9029 | 0.19 | 0.8291 | 0.39 | 0.7624 | 1.39 | 0.2481 |

| y2 | 0.00 | 0.9883 | 0.00 | 0.9961 | 0.46 | 0.7097 | 0.34 | 0.8486 |

| y3 | 0.68 | 0.4129 | 0.38 | 0.6861 | 0.30 | 0.8245 | 0.21 | 0.9320 |

Output 35.2.6 is the output in a matrix format associated with the PRINT=(IMPULSE=) option for the impulse response function and standard errors. The  variable in the first row is an impulse variable. The

variable in the first row is an impulse variable. The  variable in the first column is a response variable. The numbers, 0.96122, 0.41555, –0.40789 at lag 1 to 3 are decreasing.

variable in the first column is a response variable. The numbers, 0.96122, 0.41555, –0.40789 at lag 1 to 3 are decreasing.

| Simple Impulse Response by Variable | ||||

|---|---|---|---|---|

| Variable Response\Impulse |

Lag | y1 | y2 | y3 |

| y1 | 1 | -0.31963 | 0.14599 | 0.96122 |

| STD | 0.12546 | 0.54567 | 0.66431 | |

| 2 | -0.05430 | 0.26174 | 0.41555 | |

| STD | 0.12919 | 0.54728 | 0.66311 | |

| 3 | 0.11904 | 0.35283 | -0.40789 | |

| STD | 0.08362 | 0.38489 | 0.47867 | |

| y2 | 1 | 0.04393 | -0.15273 | 0.28850 |

| STD | 0.03186 | 0.13857 | 0.16870 | |

| 2 | 0.02858 | 0.11377 | -0.08820 | |

| STD | 0.03184 | 0.13425 | 0.16250 | |

| 3 | -0.00884 | 0.07147 | 0.11977 | |

| STD | 0.01583 | 0.07914 | 0.09462 | |

| y3 | 1 | -0.00242 | 0.22481 | -0.26397 |

| STD | 0.02568 | 0.11168 | 0.13596 | |

| 2 | 0.04517 | 0.26088 | 0.10998 | |

| STD | 0.02563 | 0.10820 | 0.13101 | |

| 3 | -0.00055 | -0.09818 | 0.09096 | |

| STD | 0.01646 | 0.07823 | 0.10280 | |

The proportions of decomposition of the prediction error covariances of three variables are given in Output 35.2.7. If you see the  variable in the first column, then the output explains that about 64.713% of the one-step-ahead prediction error covariances of the variable

variable in the first column, then the output explains that about 64.713% of the one-step-ahead prediction error covariances of the variable  is accounted for by its own innovations, about 7.995% is accounted for by

is accounted for by its own innovations, about 7.995% is accounted for by  innovations, and about 27.292% is accounted for by

innovations, and about 27.292% is accounted for by  innovations.

innovations.

| Proportions of Prediction Error Covariances by Variable | ||||

|---|---|---|---|---|

| Variable | Lead | y1 | y2 | y3 |

| y1 | 1 | 1.00000 | 0.00000 | 0.00000 |

| 2 | 0.95996 | 0.01751 | 0.02253 | |

| 3 | 0.94565 | 0.02802 | 0.02633 | |

| 4 | 0.94079 | 0.02936 | 0.02985 | |

| 5 | 0.93846 | 0.03018 | 0.03136 | |

| 6 | 0.93831 | 0.03025 | 0.03145 | |

| y2 | 1 | 0.01754 | 0.98246 | 0.00000 |

| 2 | 0.06025 | 0.90747 | 0.03228 | |

| 3 | 0.06959 | 0.89576 | 0.03465 | |

| 4 | 0.06831 | 0.89232 | 0.03937 | |

| 5 | 0.06850 | 0.89212 | 0.03938 | |

| 6 | 0.06924 | 0.89141 | 0.03935 | |

| y3 | 1 | 0.07995 | 0.27292 | 0.64713 |

| 2 | 0.07725 | 0.27385 | 0.64890 | |

| 3 | 0.12973 | 0.33364 | 0.53663 | |

| 4 | 0.12870 | 0.33499 | 0.53631 | |

| 5 | 0.12859 | 0.33924 | 0.53217 | |

| 6 | 0.12852 | 0.33963 | 0.53185 | |

The table in Output 35.2.8 gives forecasts and their prediction error covariances.

| Forecasts | ||||||

|---|---|---|---|---|---|---|

| Variable | Obs | Time | Forecast | Standard Error |

95% Confidence Limits | |

| y1 | 77 | 1979:1 | 6.54027 | 0.04615 | 6.44982 | 6.63072 |

| 78 | 1979:2 | 6.55105 | 0.05825 | 6.43688 | 6.66522 | |

| 79 | 1979:3 | 6.57217 | 0.06883 | 6.43725 | 6.70708 | |

| 80 | 1979:4 | 6.58452 | 0.08021 | 6.42732 | 6.74173 | |

| 81 | 1980:1 | 6.60193 | 0.09117 | 6.42324 | 6.78063 | |

| y2 | 77 | 1979:1 | 7.68473 | 0.01172 | 7.66176 | 7.70770 |

| 78 | 1979:2 | 7.70508 | 0.01691 | 7.67193 | 7.73822 | |

| 79 | 1979:3 | 7.72206 | 0.02156 | 7.67980 | 7.76431 | |

| 80 | 1979:4 | 7.74266 | 0.02615 | 7.69140 | 7.79392 | |

| 81 | 1980:1 | 7.76240 | 0.03005 | 7.70350 | 7.82130 | |

| y3 | 77 | 1979:1 | 7.54024 | 0.00944 | 7.52172 | 7.55875 |

| 78 | 1979:2 | 7.55489 | 0.01282 | 7.52977 | 7.58001 | |

| 79 | 1979:3 | 7.57472 | 0.01808 | 7.53928 | 7.61015 | |

| 80 | 1979:4 | 7.59344 | 0.02205 | 7.55022 | 7.63666 | |

| 81 | 1980:1 | 7.61232 | 0.02578 | 7.56179 | 7.66286 | |

Output 35.2.9 shows that you cannot reject Granger noncausality from  to

to  using the 0.05 significance level.

using the 0.05 significance level.

The following SAS statements show that the variable  is the exogenous variable and fit the VARX(2,1) model to the data.

is the exogenous variable and fit the VARX(2,1) model to the data.

proc varmax data=use;

id date interval=qtr;

model y2 y3 = y1 / p=2 dify=(1) difx=(1) xlag=1 lagmax=3

print=(estimates diagnose);

run;

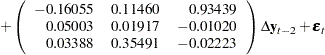

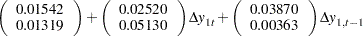

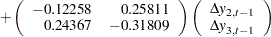

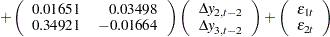

The fitted VARX(2,1) model is written as

|

|

|

|||

|

|

|

|||

|

|

|

The detailed output is shown in Output 35.2.10 through Output 35.2.13.

Output 35.2.10 shows the parameter estimates in terms of the constant, the current and the lag one coefficients of the exogenous variable, and the lag two coefficients of the dependent variables.

| Analysis of German Economic Variables |

| Type of Model | VARX(2,1) |

|---|---|

| Estimation Method | Least Squares Estimation |

| Constant | |

|---|---|

| Variable | Constant |

| y2 | 0.01542 |

| y3 | 0.01319 |

| XLag | ||

|---|---|---|

| Lag | Variable | y1 |

| 0 | y2 | 0.02520 |

| y3 | 0.05130 | |

| 1 | y2 | 0.03870 |

| y3 | 0.00363 | |

| AR | |||

|---|---|---|---|

| Lag | Variable | y2 | y3 |

| 1 | y2 | -0.12258 | 0.25811 |

| y3 | 0.24367 | -0.31809 | |

| 2 | y2 | 0.01651 | 0.03498 |

| y3 | 0.34921 | -0.01664 | |

Output 35.2.11 shows the parameter estimates and their significance.

| Model Parameter Estimates | ||||||

|---|---|---|---|---|---|---|

| Equation | Parameter | Estimate | Standard Error |

t Value | Pr > |t| | Variable |

| y2 | CONST1 | 0.01542 | 0.00443 | 3.48 | 0.0009 | 1 |

| XL0_1_1 | 0.02520 | 0.03130 | 0.81 | 0.4237 | y1(t) | |

| XL1_1_1 | 0.03870 | 0.03252 | 1.19 | 0.2383 | y1(t-1) | |

| AR1_1_1 | -0.12258 | 0.13903 | -0.88 | 0.3811 | y2(t-1) | |

| AR1_1_2 | 0.25811 | 0.17370 | 1.49 | 0.1421 | y3(t-1) | |

| AR2_1_1 | 0.01651 | 0.13766 | 0.12 | 0.9049 | y2(t-2) | |

| AR2_1_2 | 0.03498 | 0.16783 | 0.21 | 0.8356 | y3(t-2) | |

| y3 | CONST2 | 0.01319 | 0.00346 | 3.81 | 0.0003 | 1 |

| XL0_2_1 | 0.05130 | 0.02441 | 2.10 | 0.0394 | y1(t) | |

| XL1_2_1 | 0.00363 | 0.02536 | 0.14 | 0.8868 | y1(t-1) | |

| AR1_2_1 | 0.24367 | 0.10842 | 2.25 | 0.0280 | y2(t-1) | |

| AR1_2_2 | -0.31809 | 0.13546 | -2.35 | 0.0219 | y3(t-1) | |

| AR2_2_1 | 0.34921 | 0.10736 | 3.25 | 0.0018 | y2(t-2) | |

| AR2_2_2 | -0.01664 | 0.13088 | -0.13 | 0.8992 | y3(t-2) | |

Output 35.2.12 shows the innovation covariance matrix estimates, the various information criteria results, and the tests for white noise residuals. The residuals is uncorrelated except at lag 3 for  variable.

variable.

| Covariances of Innovations | ||

|---|---|---|

| Variable | y2 | y3 |

| y2 | 0.00014 | 0.00006 |

| y3 | 0.00006 | 0.00009 |

| Information Criteria | |

|---|---|

| AICC | -18.3902 |

| HQC | -18.2558 |

| AIC | -18.4309 |

| SBC | -17.9916 |

| FPEC | 9.91E-9 |

| Cross Correlations of Residuals | |||

|---|---|---|---|

| Lag | Variable | y2 | y3 |

| 0 | y2 | 1.00000 | 0.56462 |

| y3 | 0.56462 | 1.00000 | |

| 1 | y2 | -0.02312 | -0.05927 |

| y3 | -0.07056 | -0.09145 | |

| 2 | y2 | -0.02849 | -0.05262 |

| y3 | -0.05804 | -0.08567 | |

| 3 | y2 | 0.16071 | 0.29588 |

| y3 | 0.10882 | 0.13002 | |

| Schematic Representation of Cross Correlations of Residuals |

||||

|---|---|---|---|---|

| Variable/Lag | 0 | 1 | 2 | 3 |

| y2 | ++ | .. | .. | .+ |

| y3 | ++ | .. | .. | .. |

| + is > 2*std error, - is < -2*std error, . is between | ||||

| Portmanteau Test for Cross Correlations of Residuals |

|||

|---|---|---|---|

| Up To Lag | DF | Chi-Square | Pr > ChiSq |

| 3 | 4 | 8.38 | 0.0787 |

Output 35.2.13 describes how well each univariate equation fits the data. The residuals are off from the normality, but have no ARCH and AR effects.

| Univariate Model ANOVA Diagnostics | ||||

|---|---|---|---|---|

| Variable | R-Square | Standard Deviation |

F Value | Pr > F |

| y2 | 0.0897 | 0.01188 | 1.08 | 0.3809 |

| y3 | 0.2796 | 0.00926 | 4.27 | 0.0011 |

| Univariate Model White Noise Diagnostics | |||||

|---|---|---|---|---|---|

| Variable | Durbin Watson |

Normality | ARCH | ||

| Chi-Square | Pr > ChiSq | F Value | Pr > F | ||

| y2 | 2.02413 | 14.54 | 0.0007 | 0.49 | 0.4842 |

| y3 | 2.13414 | 32.27 | <.0001 | 0.08 | 0.7782 |

| Univariate Model AR Diagnostics | ||||||||

|---|---|---|---|---|---|---|---|---|

| Variable | AR1 | AR2 | AR3 | AR4 | ||||

| F Value | Pr > F | F Value | Pr > F | F Value | Pr > F | F Value | Pr > F | |

| y2 | 0.04 | 0.8448 | 0.04 | 0.9570 | 0.62 | 0.6029 | 0.42 | 0.7914 |

| y3 | 0.62 | 0.4343 | 0.62 | 0.5383 | 0.72 | 0.5452 | 0.36 | 0.8379 |