The VARMAX Procedure

- Overview

-

Getting Started

-

Syntax

-

Details

Missing Values VARMAX Model Dynamic Simultaneous Equations Modeling Impulse Response Function Forecasting Tentative Order Selection VAR and VARX Modeling Bayesian VAR and VARX Modeling VARMA and VARMAX Modeling Model Diagnostic Checks Cointegration Vector Error Correction Modeling I(2) Model Multivariate GARCH Modeling Output Data Sets OUT= Data Set OUTEST= Data Set OUTHT= Data Set OUTSTAT= Data Set Printed Output ODS Table Names ODS Graphics Computational Issues

Missing Values VARMAX Model Dynamic Simultaneous Equations Modeling Impulse Response Function Forecasting Tentative Order Selection VAR and VARX Modeling Bayesian VAR and VARX Modeling VARMA and VARMAX Modeling Model Diagnostic Checks Cointegration Vector Error Correction Modeling I(2) Model Multivariate GARCH Modeling Output Data Sets OUT= Data Set OUTEST= Data Set OUTHT= Data Set OUTSTAT= Data Set Printed Output ODS Table Names ODS Graphics Computational Issues -

Examples

- References

| Tentative Order Selection |

Sample Cross-Covariance and Cross-Correlation Matrices

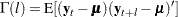

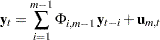

Given a stationary multivariate time series  , cross-covariance matrices are

, cross-covariance matrices are

|

where  , and cross-correlation matrices are

, and cross-correlation matrices are

|

where  is a diagonal matrix with the standard deviations of the components of

is a diagonal matrix with the standard deviations of the components of  on the diagonal.

on the diagonal.

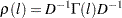

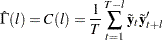

The sample cross-covariance matrix at lag  , denoted as

, denoted as  , is computed as

, is computed as

|

where  is the centered data and

is the centered data and  is the number of nonmissing observations. Thus,

is the number of nonmissing observations. Thus,  has

has  th element

th element  . The sample cross-correlation matrix at lag

. The sample cross-correlation matrix at lag  is computed as

is computed as

|

The following statements use the CORRY option to compute the sample cross-correlation matrices and their summary indicator plots in terms of  and

and  , where

, where  indicates significant positive cross-correlations,

indicates significant positive cross-correlations,  indicates significant negative cross-correlations, and

indicates significant negative cross-correlations, and  indicates insignificant cross-correlations.

indicates insignificant cross-correlations.

proc varmax data=simul1;

model y1 y2 / p=1 noint lagmax=3 print=(corry)

printform=univariate;

run;

Figure 35.39 shows the sample cross-correlation matrices of  and

and  . As shown, the sample autocorrelation functions for each variable decay quickly, but are significant with respect to two standard errors.

. As shown, the sample autocorrelation functions for each variable decay quickly, but are significant with respect to two standard errors.

| Cross Correlations of Dependent Series by Variable |

|||

|---|---|---|---|

| Variable | Lag | y1 | y2 |

| y1 | 0 | 1.00000 | 0.67041 |

| 1 | 0.83143 | 0.84330 | |

| 2 | 0.56094 | 0.81972 | |

| 3 | 0.26629 | 0.66154 | |

| y2 | 0 | 0.67041 | 1.00000 |

| 1 | 0.29707 | 0.77132 | |

| 2 | -0.00936 | 0.48658 | |

| 3 | -0.22058 | 0.22014 | |

| Schematic Representation of Cross Correlations |

||||

|---|---|---|---|---|

| Variable/Lag | 0 | 1 | 2 | 3 |

| y1 | ++ | ++ | ++ | ++ |

| y2 | ++ | ++ | .+ | -+ |

| + is > 2*std error, - is < -2*std error, . is between | ||||

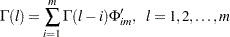

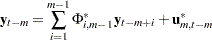

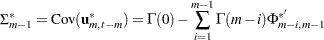

Partial Autoregressive Matrices

For each  you can define a sequence of matrices

you can define a sequence of matrices  , which is called the partial autoregression matrices of lag

, which is called the partial autoregression matrices of lag  , as the solution for

, as the solution for  to the Yule-Walker equations of order

to the Yule-Walker equations of order  ,

,

|

The sequence of the partial autoregression matrices  of order

of order  has the characteristic property that if the process follows the AR(

has the characteristic property that if the process follows the AR( ), then

), then  and

and  for

for  . Hence, the matrices

. Hence, the matrices  have the cutoff property for a VAR(

have the cutoff property for a VAR( ) model, and so they can be useful in the identification of the order of a pure VAR model.

) model, and so they can be useful in the identification of the order of a pure VAR model.

The following statements use the PARCOEF option to compute the partial autoregression matrices:

proc varmax data=simul1;

model y1 y2 / p=1 noint lagmax=3

printform=univariate

print=(corry parcoef pcorr

pcancorr roots);

run;

Figure 35.40 shows that the model can be obtained by an AR order  since partial autoregression matrices are insignificant after lag 1 with respect to two standard errors. The matrix for lag 1 is the same as the Yule-Walker autoregressive matrix.

since partial autoregression matrices are insignificant after lag 1 with respect to two standard errors. The matrix for lag 1 is the same as the Yule-Walker autoregressive matrix.

| Partial Autoregression | |||

|---|---|---|---|

| Lag | Variable | y1 | y2 |

| 1 | y1 | 1.14844 | -0.50954 |

| y2 | 0.54985 | 0.37409 | |

| 2 | y1 | -0.00724 | 0.05138 |

| y2 | 0.02409 | 0.05909 | |

| 3 | y1 | -0.02578 | 0.03885 |

| y2 | -0.03720 | 0.10149 | |

| Schematic Representation of Partial Autoregression |

|||

|---|---|---|---|

| Variable/Lag | 1 | 2 | 3 |

| y1 | +- | .. | .. |

| y2 | ++ | .. | .. |

| + is > 2*std error, - is < -2*std error, . is between | |||

Partial Correlation Matrices

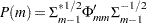

Define the forward autoregression

|

and the backward autoregression

|

The matrices  defined by Ansley and Newbold (1979) are given by

defined by Ansley and Newbold (1979) are given by

|

where

|

and

|

are the partial cross-correlation matrices at lag

are the partial cross-correlation matrices at lag  between the elements of

between the elements of  and

and  , given

, given  . The matrices

. The matrices  have the cutoff property for a VAR(

have the cutoff property for a VAR( ) model, and so they can be useful in the identification of the order of a pure VAR structure.

) model, and so they can be useful in the identification of the order of a pure VAR structure.

The following statements use the PCORR option to compute the partial cross-correlation matrices:

proc varmax data=simul1;

model y1 y2 / p=1 noint lagmax=3

print=(pcorr)

printform=univariate;

run;

The partial cross-correlation matrices in Figure 35.41 are insignificant after lag 1 with respect to two standard errors. This indicates that an AR order of  can be an appropriate choice.

can be an appropriate choice.

| Partial Cross Correlations by Variable | |||

|---|---|---|---|

| Variable | Lag | y1 | y2 |

| y1 | 1 | 0.80348 | 0.42672 |

| 2 | 0.00276 | 0.03978 | |

| 3 | -0.01091 | 0.00032 | |

| y2 | 1 | -0.30946 | 0.71906 |

| 2 | 0.04676 | 0.07045 | |

| 3 | 0.01993 | 0.10676 | |

| Schematic Representation of Partial Cross Correlations |

|||

|---|---|---|---|

| Variable/Lag | 1 | 2 | 3 |

| y1 | ++ | .. | .. |

| y2 | -+ | .. | .. |

| + is > 2*std error, - is < -2*std error, . is between | |||

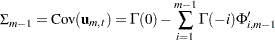

Partial Canonical Correlation Matrices

The partial canonical correlations at lag  between the vectors

between the vectors  and

and  , given

, given  , are

, are  . The partial canonical correlations are the canonical correlations between the residual series

. The partial canonical correlations are the canonical correlations between the residual series  and

and  , where

, where  and

and  are defined in the previous section. Thus, the squared partial canonical correlations

are defined in the previous section. Thus, the squared partial canonical correlations  are the eigenvalues of the matrix

are the eigenvalues of the matrix

|

It follows that the test statistic to test for  in the VAR model of order

in the VAR model of order  is approximately

is approximately

|

and has an asymptotic chi-square distribution with  degrees of freedom for

degrees of freedom for  .

.

The following statements use the PCANCORR option to compute the partial canonical correlations:

proc varmax data=simul1; model y1 y2 / p=1 noint lagmax=3 print=(pcancorr); run;

Figure 35.42 shows that the partial canonical correlations  between

between  and

and  are {0.918, 0.773}, {0.092, 0.018}, and {0.109, 0.011} for lags

are {0.918, 0.773}, {0.092, 0.018}, and {0.109, 0.011} for lags  1 to 3. After lag

1 to 3. After lag  1, the partial canonical correlations are insignificant with respect to the 0.05 significance level, indicating that an AR order of

1, the partial canonical correlations are insignificant with respect to the 0.05 significance level, indicating that an AR order of  can be an appropriate choice.

can be an appropriate choice.

| Partial Canonical Correlations | |||||

|---|---|---|---|---|---|

| Lag | Correlation1 | Correlation2 | DF | Chi-Square | Pr > ChiSq |

| 1 | 0.91783 | 0.77335 | 4 | 142.61 | <.0001 |

| 2 | 0.09171 | 0.01816 | 4 | 0.86 | 0.9307 |

| 3 | 0.10861 | 0.01078 | 4 | 1.16 | 0.8854 |

The Minimum Information Criterion (MINIC) Method

The minimum information criterion (MINIC) method can tentatively identify the orders of a VARMA( ,

, ) process. Note that Spliid (1983), Koreisha and Pukkila (1989), and Quinn (1980) proposed this method. The first step of this method is to obtain estimates of the innovations series,

) process. Note that Spliid (1983), Koreisha and Pukkila (1989), and Quinn (1980) proposed this method. The first step of this method is to obtain estimates of the innovations series,  , from the VAR(

, from the VAR( ), where

), where  is chosen sufficiently large. The choice of the autoregressive order,

is chosen sufficiently large. The choice of the autoregressive order,  , is determined by use of a selection criterion. From the selected VAR(

, is determined by use of a selection criterion. From the selected VAR( ) model, you obtain estimates of residual series

) model, you obtain estimates of residual series

|

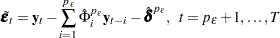

In the second step, you select the order ( ) of the VARMA model for

) of the VARMA model for  in

in  and

and  in

in

|

which minimizes a selection criterion like SBC or HQ.

The following statements use the MINIC= option to compute a table that contains the information criterion associated with various AR and MA orders:

proc varmax data=simul1; model y1 y2 / p=1 noint minic=(p=3 q=3); run;

Figure 35.43 shows the output associated with the MINIC= option. The criterion takes the smallest value at AR order 1.

| Minimum Information Criterion Based on AICC | ||||

|---|---|---|---|---|

| Lag | MA 0 | MA 1 | MA 2 | MA 3 |

| AR 0 | 3.3574947 | 3.0331352 | 2.7080996 | 2.3049869 |

| AR 1 | 0.5544431 | 0.6146887 | 0.6771732 | 0.7517968 |

| AR 2 | 0.6369334 | 0.6729736 | 0.7610413 | 0.8481559 |

| AR 3 | 0.7235629 | 0.7551756 | 0.8053765 | 0.8654079 |