The HPCOUNTREG Procedure

-

Overview

- Getting Started

-

Syntax

-

Details

Missing ValuesPoisson RegressionConway-Maxwell-Poisson RegressionNegative Binomial RegressionZero-Inflated Count Regression OverviewZero-Inflated Poisson RegressionZero-Inflated Conway-Maxwell-Poisson RegressionZero-Inflated Negative Binomial RegressionParameter Naming Conventions for the RESTRICT, TEST, BOUNDS, and INIT StatementsComputational ResourcesCovariance Matrix TypesDisplayed OutputOUTPUT OUT= Data SetOUTEST= Data SetODS Table Names

Missing ValuesPoisson RegressionConway-Maxwell-Poisson RegressionNegative Binomial RegressionZero-Inflated Count Regression OverviewZero-Inflated Poisson RegressionZero-Inflated Conway-Maxwell-Poisson RegressionZero-Inflated Negative Binomial RegressionParameter Naming Conventions for the RESTRICT, TEST, BOUNDS, and INIT StatementsComputational ResourcesCovariance Matrix TypesDisplayed OutputOUTPUT OUT= Data SetOUTEST= Data SetODS Table Names -

Examples

- References

Negative Binomial Regression

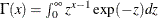

The Poisson regression model can be generalized by introducing an unobserved heterogeneity term for observation i. Thus, the individuals are assumed to differ randomly in a manner that is not fully accounted for by the observed covariates. This is formulated as

![\[ E(y_{i}|\mathbf{x}_{i}, \tau _{i}) = \mu _{i} \tau _{i} = e^{\mathbf{x}_{i}'\bbeta + \epsilon _{i}} \]](images/etshpug_hpcountreg0113.png)

where the unobserved heterogeneity term  is independent of the vector of regressors

is independent of the vector of regressors  . Then the distribution of

. Then the distribution of  conditional on

conditional on  and

and  is Poisson with conditional mean and conditional variance

is Poisson with conditional mean and conditional variance  :

:

![\[ f(y_{i}|\mathbf{x}_{i},\tau _{i}) = \frac{\exp (-\mu _{i}\tau _{i}) (\mu _{i}\tau _{i})^{y_{i}}}{y_{i}!} \]](images/etshpug_hpcountreg0117.png)

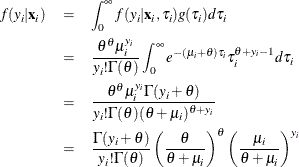

Let  be the probability density function of

be the probability density function of  . Then, the distribution

. Then, the distribution  (no longer conditional on

(no longer conditional on  ) is obtained by integrating

) is obtained by integrating  with respect to

with respect to  :

:

![\[ f(y_{i}|\mathbf{x}_{i}) = \int _{0}^{\infty } f(y_{i}|\mathbf{x}_{i},\tau _{i}) g(\tau _{i}) d\tau _{i} \]](images/etshpug_hpcountreg0121.png)

An analytical solution to this integral exists when  is assumed to follow a gamma distribution. This solution is the negative binomial distribution. If the model contains a constant

term, then in order to identify the mean of the distribution, it is necessary to assume that

is assumed to follow a gamma distribution. This solution is the negative binomial distribution. If the model contains a constant

term, then in order to identify the mean of the distribution, it is necessary to assume that  . Thus, it is assumed that

. Thus, it is assumed that  follows a gamma(

follows a gamma( ) distribution with

) distribution with  and

and  ,

,

![\[ g(\tau _{i}) = \frac{\theta ^{\theta }}{\Gamma (\theta )} \tau _{i}^{\theta -1}\exp (-\theta \tau _{i}) \]](images/etshpug_hpcountreg0126.png)

where  is the gamma function and

is the gamma function and  is a positive parameter. Then, the density of

is a positive parameter. Then, the density of  given

given  is derived as

is derived as

If you make the substitution  (

( ), the negative binomial distribution can then be rewritten as

), the negative binomial distribution can then be rewritten as

![\[ f(y_{i}|\mathbf{x}_{i}) = \frac{\Gamma (y_{i}+\alpha ^{-1})}{y_{i}!\Gamma (\alpha ^{-1})} \left(\frac{\alpha ^{-1}}{\alpha ^{-1}+\mu _{i}}\right)^{\alpha ^{-1}} \left(\frac{\mu _{i}}{\alpha ^{-1}+\mu _{i}}\right)^{y_{i}}, \quad y_{i} = 0,1,2,\ldots \]](images/etshpug_hpcountreg0133.png)

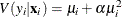

Thus, the negative binomial distribution is derived as a gamma mixture of Poisson random variables. It has the conditional mean

![\[ E(y_{i}|\mathbf{x}_{i})=\mu _{i} = e^{\mathbf{x}_{i}'\bbeta } \]](images/etshpug_hpcountreg0134.png)

and the conditional variance

![\[ V(y_{i}|\mathbf{x}_{i}) = \mu _{i} [1+\frac{1}{\theta }\mu _{i}] = \mu _{i}[1+\alpha \mu _{i}] > E(y_{i}|\mathbf{x}_{i}) \]](images/etshpug_hpcountreg0135.png)

The conditional variance of the negative binomial distribution exceeds the conditional mean. Overdispersion results from

neglected unobserved heterogeneity. The negative binomial model with variance function  , which is quadratic in the mean, is referred to as the NEGBIN2 model Cameron and Trivedi (1986). To estimate this model, specify DIST=NEGBIN(P=2) in the MODEL statement. The Poisson distribution is a special case of

the negative binomial distribution where

, which is quadratic in the mean, is referred to as the NEGBIN2 model Cameron and Trivedi (1986). To estimate this model, specify DIST=NEGBIN(P=2) in the MODEL statement. The Poisson distribution is a special case of

the negative binomial distribution where  . A test of the Poisson distribution can be carried out by testing the hypothesis that

. A test of the Poisson distribution can be carried out by testing the hypothesis that  . A Wald test of this hypothesis is provided (it is the reported t statistic for the estimated

. A Wald test of this hypothesis is provided (it is the reported t statistic for the estimated  in the negative binomial model).

in the negative binomial model).

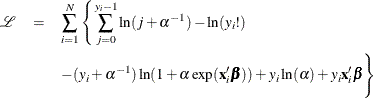

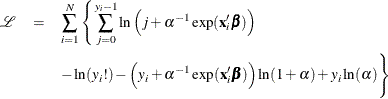

The log-likelihood function of the negative binomial regression model (NEGBIN2) is given by

where use of the following fact is made if y is an integer:

![\[ \Gamma (y+a)/\Gamma (a)= \prod _{j=0}^{y-1} (j+a) \]](images/etshpug_hpcountreg0140.png)

Cameron and Trivedi (1986) consider a general class of negative binomial models that have mean  and variance function

and variance function  . The NEGBIN2 model, with

. The NEGBIN2 model, with  , is the standard formulation of the negative binomial model. Models that have other values of p,

, is the standard formulation of the negative binomial model. Models that have other values of p,  , have the same density

, have the same density  , except that

, except that  is replaced everywhere by

is replaced everywhere by  . The negative binomial model NEGBIN1, which sets

. The negative binomial model NEGBIN1, which sets  , has the variance function

, has the variance function  , which is linear in the mean. To estimate this model, specify DIST=NEGBIN(P=1) in the MODEL statement.

, which is linear in the mean. To estimate this model, specify DIST=NEGBIN(P=1) in the MODEL statement.

The log-likelihood function of the NEGBIN1 regression model is given by

For more information about the negative binomial regression model, see the section Negative Binomial Regression in SAS/ETS 14.1 User's Guide.