The ARIMA Procedure

- Overview

-

Getting Started

The Three Stages of ARIMA ModelingIdentification StageEstimation and Diagnostic Checking StageForecasting StageUsing ARIMA Procedure StatementsGeneral Notation for ARIMA ModelsStationarityDifferencingSubset, Seasonal, and Factored ARMA ModelsInput Variables and Regression with ARMA ErrorsIntervention Models and Interrupted Time SeriesRational Transfer Functions and Distributed Lag ModelsForecasting with Input VariablesData Requirements

The Three Stages of ARIMA ModelingIdentification StageEstimation and Diagnostic Checking StageForecasting StageUsing ARIMA Procedure StatementsGeneral Notation for ARIMA ModelsStationarityDifferencingSubset, Seasonal, and Factored ARMA ModelsInput Variables and Regression with ARMA ErrorsIntervention Models and Interrupted Time SeriesRational Transfer Functions and Distributed Lag ModelsForecasting with Input VariablesData Requirements -

Syntax

-

Details

The Inverse Autocorrelation FunctionThe Partial Autocorrelation FunctionThe Cross-Correlation FunctionThe ESACF MethodThe MINIC MethodThe SCAN MethodStationarity TestsPrewhiteningIdentifying Transfer Function ModelsMissing Values and AutocorrelationsEstimation DetailsSpecifying Inputs and Transfer FunctionsInitial ValuesStationarity and InvertibilityNaming of Model ParametersMissing Values and Estimation and ForecastingForecasting DetailsForecasting Log Transformed DataSpecifying Series PeriodicityDetecting OutliersOUT= Data SetOUTCOV= Data SetOUTEST= Data SetOUTMODEL= SAS Data SetOUTSTAT= Data SetPrinted OutputODS Table NamesStatistical Graphics

The Inverse Autocorrelation FunctionThe Partial Autocorrelation FunctionThe Cross-Correlation FunctionThe ESACF MethodThe MINIC MethodThe SCAN MethodStationarity TestsPrewhiteningIdentifying Transfer Function ModelsMissing Values and AutocorrelationsEstimation DetailsSpecifying Inputs and Transfer FunctionsInitial ValuesStationarity and InvertibilityNaming of Model ParametersMissing Values and Estimation and ForecastingForecasting DetailsForecasting Log Transformed DataSpecifying Series PeriodicityDetecting OutliersOUT= Data SetOUTCOV= Data SetOUTEST= Data SetOUTMODEL= SAS Data SetOUTSTAT= Data SetPrinted OutputODS Table NamesStatistical Graphics -

Examples

- References

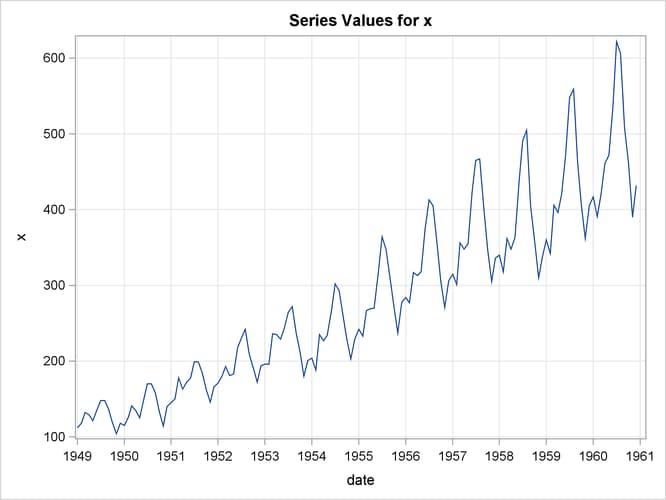

The airline passenger data, given as Series G in Box and Jenkins (1976), have been used in time series analysis literature

as an example of a nonstationary seasonal time series. This example uses PROC ARIMA to fit the airline model, ARIMA(0,1,1)![]() (0,1,1)

(0,1,1)![]() , to Box and Jenkins’ Series G. The following statements read the data and log-transform the series:

, to Box and Jenkins’ Series G. The following statements read the data and log-transform the series:

title1 'International Airline Passengers'; title2 '(Box and Jenkins Series-G)'; data seriesg; input x @@; xlog = log( x ); date = intnx( 'month', '31dec1948'd, _n_ ); format date monyy.; datalines; 112 118 132 129 121 135 148 148 136 119 104 118 ... more lines ...

The following PROC TIMESERIES step plots the series, as shown in Output 7.2.1:

proc timeseries data=seriesg plot=series; id date interval=month; var x; run;

The following statements specify an ARIMA(0,1,1)![]() (0,1,1)

(0,1,1)![]() model without a mean term to the logarithms of the airline passengers series,

model without a mean term to the logarithms of the airline passengers series, xlog. The model is forecast, and the results are stored in the data set B.

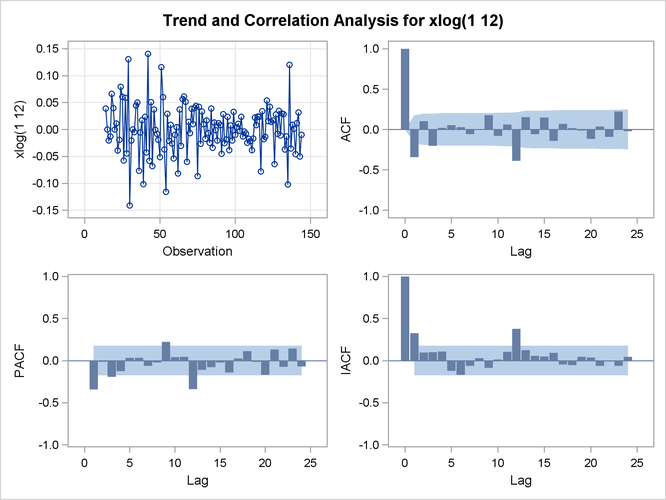

/*-- Seasonal Model for the Airline Series --*/ proc arima data=seriesg; identify var=xlog(1,12); estimate q=(1)(12) noint method=ml; forecast id=date interval=month printall out=b; run;

The output from the IDENTIFY statement is shown in Output 7.2.2. The autocorrelation plots shown are for the twice differenced series ![]() . Note that the autocorrelation functions have the pattern characteristic of a first-order moving-average process combined

with a seasonal moving-average process with lag 12.

. Note that the autocorrelation functions have the pattern characteristic of a first-order moving-average process combined

with a seasonal moving-average process with lag 12.

Output 7.2.2: IDENTIFY Statement Output

| International Airline Passengers |

| (Box and Jenkins Series-G) |

| Name of Variable = xlog | |

|---|---|

| Period(s) of Differencing | 1,12 |

| Mean of Working Series | 0.000291 |

| Standard Deviation | 0.045673 |

| Number of Observations | 131 |

| Observation(s) eliminated by differencing | 13 |

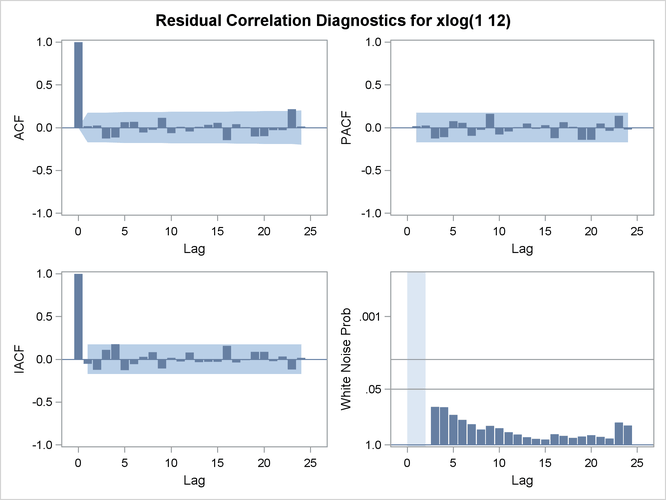

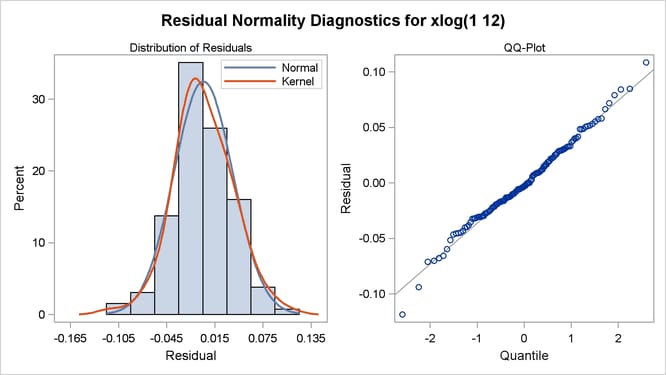

The results of the ESTIMATE statement are shown in Output 7.2.4, Output 7.2.5, and Output 7.2.6. The model appears to fit the data quite well.

Output 7.2.4: ESTIMATE Statement Output

| Maximum Likelihood Estimation | |||||

|---|---|---|---|---|---|

| Parameter | Estimate | Standard Error | t Value | Approx Pr > |t| |

Lag |

| MA1,1 | 0.40194 | 0.07988 | 5.03 | <.0001 | 1 |

| MA2,1 | 0.55686 | 0.08403 | 6.63 | <.0001 | 12 |

| Variance Estimate | 0.001369 |

|---|---|

| Std Error Estimate | 0.037 |

| AIC | -485.393 |

| SBC | -479.643 |

| Number of Residuals | 131 |

| Model for variable xlog | |

|---|---|

| Period(s) of Differencing | 1,12 |

| Moving Average Factors | |

|---|---|

| Factor 1: | 1 - 0.40194 B**(1) |

| Factor 2: | 1 - 0.55686 B**(12) |

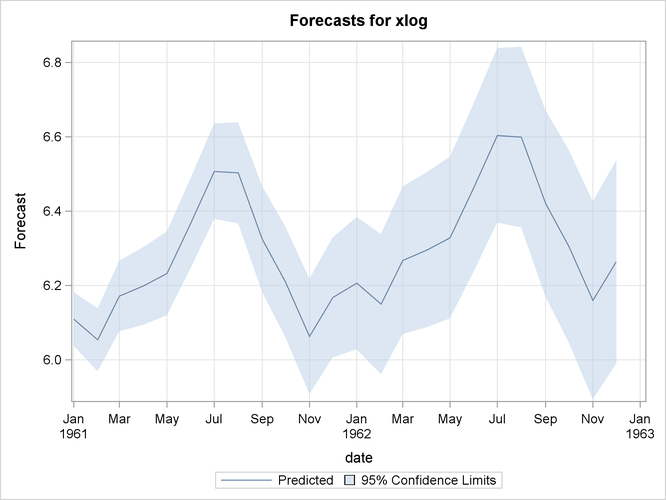

The forecasts and their confidence limits for the transformed series are shown in Output 7.2.7.

The following statements retransform the forecast values to get forecasts in the original scales. See the section Forecasting Log Transformed Data for more information.

data c; set b; x = exp( xlog ); forecast = exp( forecast + std*std/2 ); l95 = exp( l95 ); u95 = exp( u95 ); run;

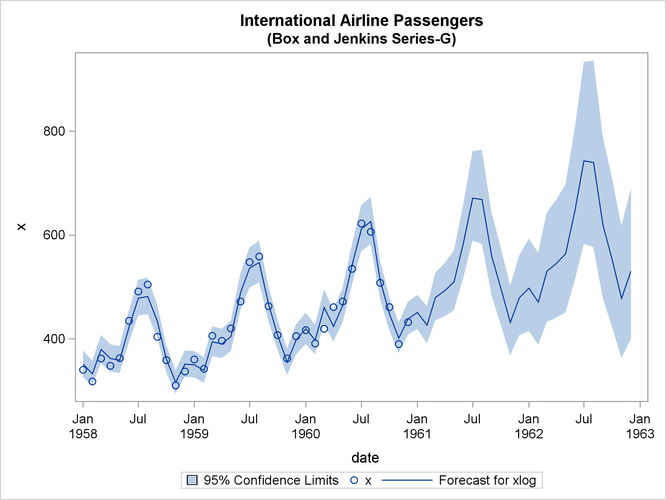

The forecasts and their confidence limits are plotted by using the following PROC SGPLOT step. The plot is shown in Output 7.2.8.

proc sgplot data=c;

where date >= '1jan58'd;

band Upper=u95 Lower=l95 x=date

/ LegendLabel="95% Confidence Limits";

scatter x=date y=x;

series x=date y=forecast;

run;