| The MODEL Procedure |

Example 18.8 Nonlinear FIML Estimation

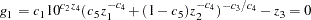

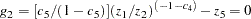

The data and model for this example were obtained from Bard (1974, p.133–138). The example is a two-equation econometric model used by Bodkin and Klein to fit U.S production data for the years 1909–1949. The model is the following:

|

|

where  is capital input,

is capital input,  is labor input,

is labor input,  is real output,

is real output,  is time in years with 1929 as year zero, and

is time in years with 1929 as year zero, and  is the ratio of price of capital services to wage scale. The

is the ratio of price of capital services to wage scale. The  ’s are the unknown parameters.

’s are the unknown parameters.  and

and  are considered endogenous variables. A FIML estimation is performed by using the following statements:

are considered endogenous variables. A FIML estimation is performed by using the following statements:

data bodkin;

input z1 z2 z3 z4 z5;

datalines;

1.33135 0.64629 0.4026 -20 0.24447

1.39235 0.66302 0.4084 -19 0.23454

... more lines ...

title1 "Nonlinear FIML Estimation";

proc model data=bodkin;

parms c1-c5;

endogenous z1 z2;

exogenous z3 z4 z5;

eq.g1 = c1 * 10 **(c2 * z4) * (c5*z1**(-c4)+

(1-c5)*z2**(-c4))**(-c3/c4) - z3;

eq.g2 = (c5/(1-c5))*(z1/z2)**(-1-c4) -z5;

fit g1 g2 / fiml ;

run;

When FIML estimation is selected, the log likelihood of the system is output as the objective value. The results of the estimation are shown in Output 18.8.1.

| Nonlinear FIML Summary of Residual Errors | |||||||

|---|---|---|---|---|---|---|---|

| Equation | DF Model | DF Error | SSE | MSE | Root MSE | R-Square | Adj R-Sq |

| g1 | 4 | 37 | 0.0529 | 0.00143 | 0.0378 | ||

| g2 | 1 | 40 | 0.0173 | 0.000431 | 0.0208 | ||

Copyright © 2008 by SAS Institute Inc., Cary, NC, USA. All rights reserved.