The DISTANCE Procedure

Example 33.2 Financial Data – Stock Dividends

The following data set contains the average dividend yields for 15 utility stocks in the United States. The observations are names of the companies, and the variables correspond to the annual dividend yields for the period 1986–1990. The objective is to group similar stocks into clusters.

Before the cluster analysis is performed, the correlation similarity is chosen for measuring the closeness between each observation. Since distance type of measures are required by PROC CLUSTER, METHOD=DCORR is used in the PROC DISTANCE statement to transform the correlation measures to the distance measures. Notice that in Output 33.2.1, all the values in the distance matrix are between 0 and 2.

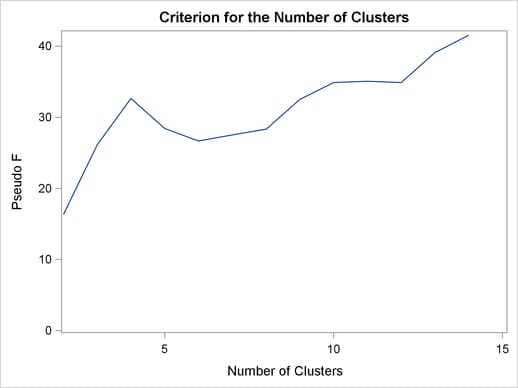

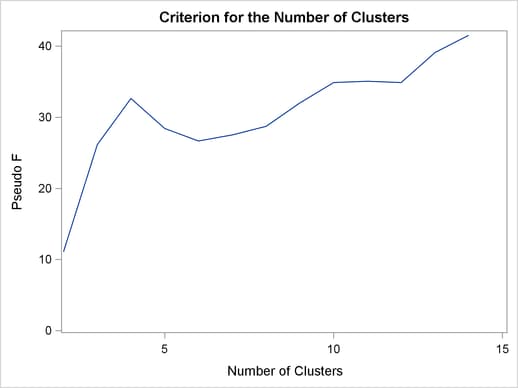

PROC CLUSTER performs hierarchical clustering by using agglomerative methods based on the distance data created from the previous PROC DISTANCE statement. Since the cubic clustering criterion is not suitable for distance data, only the pseudo F statistic is requested to identify the number of clusters.

The two clustering methods are Ward’s and the average linkage methods. Since the results of the pseudo  statistic from both Ward’s and the average linkage methods contain many missing values, only the plot of the pseudo F statistic versus the number of clusters is requested along with the dendrogram by specifying PLOTS(ONLY)=(PSF DENDROGRAM) in the PROC CLUSTER statement.

statistic from both Ward’s and the average linkage methods contain many missing values, only the plot of the pseudo F statistic versus the number of clusters is requested along with the dendrogram by specifying PLOTS(ONLY)=(PSF DENDROGRAM) in the PROC CLUSTER statement.

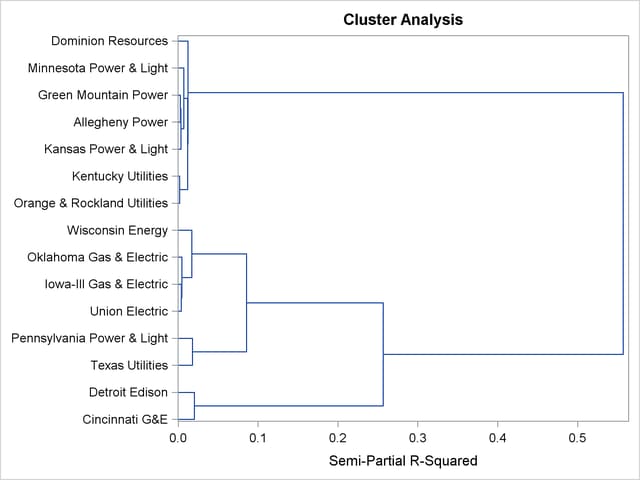

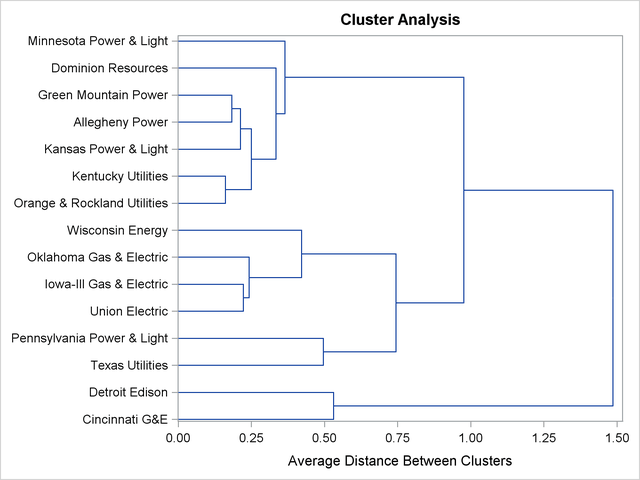

Both Output 33.2.2 and Output 33.2.3 suggest four clusters. Both methods produce the same clustering result, as shown in Output 33.2.4 and Output 33.2.5. The four clusters are as follows:

Cincinnati G&E and Detroit Edison

Texas Utilities and Pennsylvania Power & Light

Union Electric, Iowa-Ill Gas & Electric, Oklahoma Gas & Electric, and Wisconsin Energy

Orange & Rockland Utilities, Kentucky Utilities, Kansas Power & Light, Allegheny Power, Green Mountain Power, Dominion Resources, and Minnesota Power & Light

title 'Stock Dividends'; data stock; input Company $27. Div_1986 Div_1987 Div_1988 Div_1989 Div_1990; datalines; Cincinnati G&E 8.4 8.2 8.4 8.1 8.0 Texas Utilities 7.9 8.9 10.4 8.9 8.3 Detroit Edison 9.7 10.7 11.4 7.8 6.5 Orange & Rockland Utilities 6.5 7.2 7.3 7.7 7.9 Kentucky Utilities 6.5 6.9 7.0 7.2 7.5 Kansas Power & Light 5.9 6.4 6.9 7.4 8.0 Union Electric 7.1 7.5 8.4 7.8 7.7 Dominion Resources 6.7 6.9 7.0 7.0 7.4 Allegheny Power 6.7 7.3 7.8 7.9 8.3 Minnesota Power & Light 5.6 6.1 7.2 7.0 7.5 Iowa-Ill Gas & Electric 7.1 7.5 8.5 7.8 8.0 Pennsylvania Power & Light 7.2 7.6 7.7 7.4 7.1 Oklahoma Gas & Electric 6.1 6.7 7.4 6.7 6.8 Wisconsin Energy 5.1 5.7 6.0 5.7 5.9 Green Mountain Power 7.1 7.4 7.8 7.8 8.3 ;

proc distance data=stock method=dcorr out=distdcorr; var interval(div_1986 div_1987 div_1988 div_1989 div_1990); id company; run;

proc print data=distdcorr; id company; title2 'Distance Matrix for 15 Utility Stocks'; run; title2;

ods graphics on; /* compute pseudo statistic versus number of clusters and create plot */ proc cluster data=distdcorr method=ward pseudo plots(only)=(psf dendrogram); id company; run;

/* compute pseudo statistic versus number of clusters and create plot */ proc cluster data=distdcorr method=average pseudo plots(only)=(psf dendrogram); id company; run; ods graphics off;

| Stock Dividends |

| Distance Matrix for 15 Utility Stocks |

| Company | Cincinnati_G_E | Texas_Utilities | Detroit_Edison | Orange___Rockland_Utilities | Kentucky_Utilities | Kansas_Power___Light | Union_Electric | Dominion_Resources | Allegheny_Power | Minnesota_Power___Light | Iowa_Ill_Gas___Electric | Pennsylvania_Power___Light | Oklahoma_Gas___Electric | Wisconsin_Energy | Green_Mountain_Power |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cincinnati G&E | 0.00000 | . | . | . | . | . | . | . | . | . | . | . | . | . | . |

| Texas Utilities | 0.82056 | 0.00000 | . | . | . | . | . | . | . | . | . | . | . | . | . |

| Detroit Edison | 0.40511 | 0.65453 | 0.00000 | . | . | . | . | . | . | . | . | . | . | . | . |

| Orange & Rockland Utilities | 1.35380 | 0.88583 | 1.27306 | 0.00000 | . | . | . | . | . | . | . | . | . | . | . |

| Kentucky Utilities | 1.35581 | 0.92539 | 1.29382 | 0.12268 | 0.00000 | . | . | . | . | . | . | . | . | . | . |

| Kansas Power & Light | 1.34227 | 0.94371 | 1.31696 | 0.19905 | 0.12874 | 0.00000 | . | . | . | . | . | . | . | . | . |

| Union Electric | 0.98516 | 0.29043 | 0.89048 | 0.68798 | 0.71824 | 0.72082 | 0.00000 | . | . | . | . | . | . | . | . |

| Dominion Resources | 1.32945 | 0.96853 | 1.29016 | 0.33290 | 0.21510 | 0.24189 | 0.76587 | 0.00000 | . | . | . | . | . | . | . |

| Allegheny Power | 1.30492 | 0.81666 | 1.24565 | 0.17844 | 0.15759 | 0.17029 | 0.58452 | 0.27819 | 0.00000 | . | . | . | . | . | . |

| Minnesota Power & Light | 1.24069 | 0.74082 | 1.20432 | 0.32581 | 0.30462 | 0.27231 | 0.48372 | 0.35733 | 0.15615 | 0.00000 | . | . | . | . | . |

| Iowa-Ill Gas & Electric | 1.04924 | 0.43100 | 0.97616 | 0.61166 | 0.61760 | 0.61736 | 0.16923 | 0.63545 | 0.47900 | 0.36368 | 0.00000 | . | . | . | . |

| Pennsylvania Power & Light | 0.74931 | 0.37821 | 0.44256 | 1.03566 | 1.08878 | 1.12876 | 0.63285 | 1.14354 | 1.02358 | 0.99384 | 0.75596 | 0.00000 | . | . | . |

| Oklahoma Gas & Electric | 1.00604 | 0.30141 | 0.86200 | 0.68021 | 0.70259 | 0.73158 | 0.17122 | 0.72977 | 0.58391 | 0.50744 | 0.19673 | 0.60216 | 0.00000 | . | . |

| Wisconsin Energy | 1.17988 | 0.54830 | 1.03081 | 0.45013 | 0.47184 | 0.53381 | 0.37405 | 0.51969 | 0.37522 | 0.36319 | 0.30259 | 0.76085 | 0.28070 | 0.00000 | . |

| Green Mountain Power | 1.30397 | 0.88063 | 1.27176 | 0.26948 | 0.17909 | 0.15377 | 0.64869 | 0.17360 | 0.13958 | 0.19370 | 0.52083 | 1.09269 | 0.64175 | 0.44814 | 0 |