| The DTREE Procedure |

Example 7.6 Petroleum Distributor’s Decision Problem

The president of a petroleum distribution company currently faces a serious problem. His company supplies refined products to its customers under long-term contracts at guaranteed prices. Recently, the price for petroleum has risen substantially and his company will lose $ this year because of its long-term contract with a particular customer. After a great deal of discussion with his legal advisers and his marketing staff, the president learns that the contract contains a clause that may be beneficial to his company. The clause states that when circumstances are beyond its control, the company may ask its customers to pay the prevailing market prices for up to

this year because of its long-term contract with a particular customer. After a great deal of discussion with his legal advisers and his marketing staff, the president learns that the contract contains a clause that may be beneficial to his company. The clause states that when circumstances are beyond its control, the company may ask its customers to pay the prevailing market prices for up to  of the promised amount.

of the promised amount.

Several scenarios are possible if the clause is invoked. If the customer accepts the invocation of the clause and agrees to pay the higher price for the  , the company would turn a loss of $

, the company would turn a loss of $ into a net profit of $

into a net profit of $ . If the customer does not accept the invocation, the customer may sue for damages or accept a settlement of $

. If the customer does not accept the invocation, the customer may sue for damages or accept a settlement of $ (resulting in a loss of $

(resulting in a loss of $ ) or simply decline to press the issue. In any case, the distribution company could then sell the

) or simply decline to press the issue. In any case, the distribution company could then sell the  on the open market for an expected value of $

on the open market for an expected value of $ . However, the lawsuit would result in one of three possible outcomes: the company wins and pays no damages; the company loses and pays normal damages of $

. However, the lawsuit would result in one of three possible outcomes: the company wins and pays no damages; the company loses and pays normal damages of $ ; the company loses and pays double damages of $

; the company loses and pays double damages of $ . The lawyers also feel that this case might last three to five years if the customer decides to sue the company. The cost of the legal proceedings is estimated as $

. The lawyers also feel that this case might last three to five years if the customer decides to sue the company. The cost of the legal proceedings is estimated as $ for the initial fee and $

for the initial fee and $ per year. The likelihood of the various outcomes are also assessed and reported as in Table 7.38. Suppose that the company decides to use a discount rate of

per year. The likelihood of the various outcomes are also assessed and reported as in Table 7.38. Suppose that the company decides to use a discount rate of  to determine the present value of future funds.

to determine the present value of future funds.

Uncertainty |

Outcome |

Probability |

Customer’s Response |

Accept the Invocation |

0.1 |

Reject the Invocation |

0.9 |

|

Customer’s Action |

Press the Issue |

0.1 |

if the Invocation |

Settle the Case |

0.45 |

is being Rejected |

Sue for Damages |

0.45 |

Case Last |

|

0.3 |

|

0.4 |

|

|

0.3 |

|

Lawsuit Result |

Pay No Damages |

0.15 |

Pay Normal Damages |

0.65 |

|

Pay Double Damages |

0.2 |

The structure for this decision problem is given in the STAGEIN= data set named Stage7.

/* -- create the STAGEIN= data set -- */

data Stage7;

format _OUTCOM1 $14. _OUTCOM2 $14. ;

input _STNAME_ $ _STTYPE_ $ _OUTCOM1 $

_SUCC1 $ _OUTCOM2 $ _SUCC2 $ ;

datalines;

Action D Invoking Response Not_Invoking .

Response C Accept . Refuse Lawsuit

Lawsuit C Press_Issue . Settle .

. . Sue Last . .

Last C 3_Years Result 4_Years Result

. . 5_Years Result . .

Result C No_Damages . Normal_Damages .

. . Double_Damages . . .

;

The PROBIN= data set Prob7 contains the probability distributions for the chance nodes.

/* -- create the PROBIN= data set -- */ data Prob7; format _EVENT1_ _EVENT2_ $14.; input _EVENT1_ $ _PROB1_ _EVENT2_ $ _PROB2_ ; datalines; Accept 0.1 Refuse 0.9 Press_Issue 0.1 Settle 0.45 Sue 0.45 . . 3_Years 0.3 4_Years 0.4 5_Years 0.3 . . No_Damages 0.15 Normal_Damages 0.65 Double_Damages 0.20 . . ;

The PAYOFFS= data set Payoff7 defines the payoffs for the various scenarios.

/* -- create the PAYOFFS= data set -- */

data Payoff7(drop=i j k D PCOST);

length _ACTION_ _STATE1-_STATE4 $16;

/* possible outcomes for the case last */

array YEARS{3} $16. _TEMPORARY_ ('3_Years',

'4_Years',

'5_Years' );

/* numerical values for the case last */

array Y{3} _TEMPORARY_ (3, 4, 5);

/* possible outcomes for the size of judgment */

array DAMAGES{3} $16. _TEMPORARY_ ('No_Damages',

'Normal_Damages',

'Double_Damages' );

/* numerical values for the size of judgment */

array C{3} _TEMPORARY_ (0, 1500, 3000);

D=0.1; /* discount rate */

/* payoff for the scenario which the */

/* 10 percent clause is not invoked */

_ACTION_='Not_Invoking'; _VALUE_=-450; output;

/* the clause is invoked */

_ACTION_='Invoking';

/* payoffs for scenarios which the clause is */

/* invoked and the customer accepts the */

/* invocation */

_STATE1='Accept'; _VALUE_=600; output;

/* the customer refuses the invocation */

_STATE1='Refuse';

/* payoffs for scenarios which the clause is */

/* invoked and the customer refuses the */

/* invocation but decline to press the issue */

_STATE2='Press_Issue'; _VALUE_=500; output;

/* payoffs for scenarios which the clause is */

/* invoked and the customer refuses the */

/* invocation but willing to settle out of */

/* court for 900K */

_STATE2='Settle'; _VALUE_=500-900; output;

/* the customer will sue for damages */

_STATE2='Sue';

do i=1 to 3;

_STATE3=YEARS{i};

/* determine the cost of proceedings */

PCOST=30; /* initial cost of the proceedings */

/* additional cost for every years in */

/* in present value */

do k=1 to Y{i};

PCOST=PCOST+(20/((1+D)**k));

end;

/* loop for all poss. of the lawsuit result */

do j=1 to 3;

_STATE4=DAMAGES{j}; /* the damage have to paid */

/* compute the net return in present value */

_VALUE_=500-PCOST-(C{j}/((1+D)**Y{i}));

/* output an observation for the payoffs */

/* of this scenario */

output;

end;

end;

run;

/* -- print the payoff table -- */

title "Petroleum Distributor's Decision";

title3 "Payoff table";

proc print;

run;

The payoff table of this problem is displayed in Output 7.6.1.

| Petroleum Distributor's Decision |

| Payoff table |

| Obs | _ACTION_ | _STATE1 | _STATE2 | _STATE3 | _STATE4 | _VALUE_ |

|---|---|---|---|---|---|---|

| 1 | Not_Invoking | -450.00 | ||||

| 2 | Invoking | Accept | 600.00 | |||

| 3 | Invoking | Refuse | Press_Issue | 500.00 | ||

| 4 | Invoking | Refuse | Settle | -400.00 | ||

| 5 | Invoking | Refuse | Sue | 3_Years | No_Damages | 420.26 |

| 6 | Invoking | Refuse | Sue | 3_Years | Normal_Damages | -706.71 |

| 7 | Invoking | Refuse | Sue | 3_Years | Double_Damages | -1833.68 |

| 8 | Invoking | Refuse | Sue | 4_Years | No_Damages | 406.60 |

| 9 | Invoking | Refuse | Sue | 4_Years | Normal_Damages | -617.92 |

| 10 | Invoking | Refuse | Sue | 4_Years | Double_Damages | -1642.44 |

| 11 | Invoking | Refuse | Sue | 5_Years | No_Damages | 394.18 |

| 12 | Invoking | Refuse | Sue | 5_Years | Normal_Damages | -537.20 |

| 13 | Invoking | Refuse | Sue | 5_Years | Double_Damages | -1468.58 |

Note that the payoffs of the various scenarios in Output 7.6.1 are in thousands of dollars and are net present values (NPV) (Baird 1989). For example, the payoff for the following scenario "invoking the clause; the customer refuses to accept this and sues for damages; the case lasts four years and the petroleum distribution company loses and pays double damages" is calculated as

|

|

|

|||

|

|

|

|||

|

|

|

where

|

and

|

This is because the company can sell the  for $

for $ immediately and pay the $

immediately and pay the $ damages four years from now. The net present value of the proceedings is determined by paying the $

damages four years from now. The net present value of the proceedings is determined by paying the $ initial fee now and a fee of $

initial fee now and a fee of $ after every year up to four years. The value of

after every year up to four years. The value of  is the discount rate used.

is the discount rate used.

The following statements evaluate the problem and plot the optimal solution.

/* -- define graphics options -- */

goptions colors=(green red blue);

goptions hsize=8 in vsize=8.4 in;

/* -- define title -- */

title f=zapfb h=2.5 "Petroleum Distributor's Decision";

/* -- PROC DTREE statements -- */

proc dtree stagein=Stage7 probin=Prob7 payoffs=Payoff7;

evaluate / summary;

treeplot / graphics compress nolg name="dt6p1" ftext='Cumberland AMT'

ybetween=1 cell lwidth=2 lwidthb=3 hsymbol=3;

quit;

The optimal decision summary in Output 7.6.2 suggests that the president should invoke the  clause because it would turn a loss of $

clause because it would turn a loss of $ into an expected loss of $

into an expected loss of $ in present value.

in present value.

| Order of Stages | |

|---|---|

| Stage | Type |

| Action | Decision |

| Response | Chance |

| Lawsuit | Chance |

| Last | Chance |

| Result | Chance |

| _ENDST_ | End |

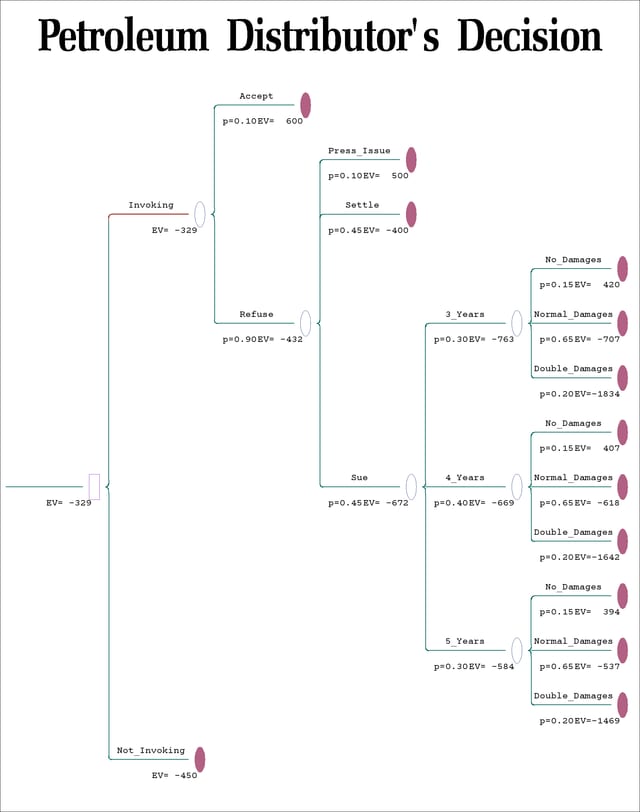

The decision tree for this problem is shown in Output 7.6.3. There you can find the expected value of each scenario.

The president feels that the estimated likelihood of lawsuit outcomes is fairly reliable. However, the assessment of the likelihood of the customer’s response and reaction is extremely difficult to estimate. Because of this, the president would like to keep the analysis as general as possible. His staff suggests using the symbols

and

and  to represent the probability that the customer will accept the invocation and the probability that the customer will decline to press the issue if he refuses the invocation, respectively. The probabilities of the other possible outcomes about the customer’s response and reaction to the invocation of the

to represent the probability that the customer will accept the invocation and the probability that the customer will decline to press the issue if he refuses the invocation, respectively. The probabilities of the other possible outcomes about the customer’s response and reaction to the invocation of the  clause are listed in Table 7.39.

clause are listed in Table 7.39.

Uncertainty |

Outcome |

Probability |

Customer’s Response |

Accept the Invocation |

|

Reject the Invocation |

|

|

Customer’s Action |

Press the Issue |

|

if the Invocation |

Settle the Case |

|

is being Rejected |

Sue for Damages |

|

Now from the decision tree shown in Output 7.6.3, the expected value of the outcome 'Refuse' is

|

|

|

|||

|

|

|

|||

|

|

|

Hence, the expected payoff if the petroleum distribution company invokes the clause is

|

|

|

|||

|

|

|

|||

|

|

|

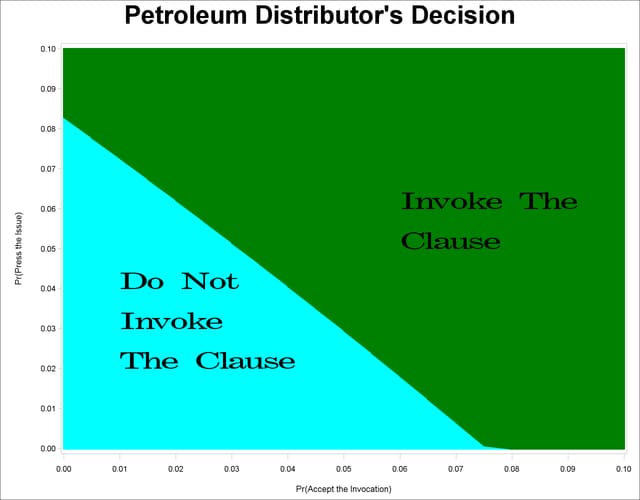

Therefore, the president should invoke the  clause if

clause if

|

or

|

This result is depicted in Output 7.6.4, which is produced by the following statements:

/* -- create data set for decision diagram -- */

data Data7(drop=i);

P=0.0; /* initialize P */

/* loop for all possible values of P */

do i=1 to 21;

/* determine the corresponding Q */

Q=(86-(1136*P))/(1036*(1.0-P));

if Q < 0.0 then Q=0.0;

/* output this data point */

output;

/* set next possible value of P */

P=P+0.005;

end;

run;

/* create the ANNOTATE= data set for labels of */

/* decision diagram */

data label;

length FUNCTION STYLE COLOR $8;

length XSYS YSYS $1;

length WHEN POSITION $1;

length X Y 8;

length SIZE ROTATE 8;

WHEN = 'A';

POSITION='0';

XSYS='2';

YSYS='2';

input FUNCTION $ X Y STYLE $ SIZE COLOR $

ROTATE TEXT $ & 16.;

datalines;

label 0.01 0.04 centx 2 black . Do Not

label 0.01 0.03 centx 2 black . Invoke

label 0.01 0.02 centx 2 black . The Clause

label 0.06 0.06 centx 2 black . Invoke The

label 0.06 0.05 centx 2 black . Clause

;

/* -- define symbol characteristics for boundary -- */

symbol1 i=joint v=NONE l=1 ci=black;

/* -- define pattern for area fill -- */

pattern1 value=msolid color=cyan;

pattern2 value=msolid color=green;

/* -- define axis characteristics -- */

axis1 label=('Pr(Accept the Invocation)')

order=(0 to 0.1 by 0.01) minor=none;

axis2 label=(angle=90 'Pr(Press the Issue)')

order=(0 to 0.1 by 0.01) minor=none;

/* -- plot decision diagram -- */

title h=2.5 "Petroleum Distributor's Decision";

proc gplot data=Data7 ;

plot Q*P=1 / haxis=axis1

vaxis=axis2

annotate=label

name="dt6p2"

frame

areas=2;

run;

quit;

The decision diagram in Output 7.6.4 is an analysis of the sensitivity of the solution to the probabilities that the customer will accept the invocation and that the customer will decline to press the issue. He should invoke the clause if he feels the customer’s probabilities of outcomes 'Accept' and 'Press_Issue',  and

and  , are located in the upper-right area marked as 'Invoke The Clause' in Output 7.6.4 and should not invoke the clause otherwise. Note that the values

, are located in the upper-right area marked as 'Invoke The Clause' in Output 7.6.4 and should not invoke the clause otherwise. Note that the values  and

and  used in this example are located on the upper right corner on the diagram.

used in this example are located on the upper right corner on the diagram.

Copyright © SAS Institute, Inc. All Rights Reserved.

Years

Years  Years

Years  Years

Years