| Language Reference |

PV Function

calculates the present value of a vector of cash flows and returns a scalar

- PV( times,flows,freq,rates)

The PV function returns a scalar containing the present value of the cash flows based on the specified frequency and rates.

- times

- is an

column vector of times.

Elements should be nonnegative.

column vector of times.

Elements should be nonnegative.

- flows

- is an

column vector of cash flows.

column vector of cash flows.

- freq

- is a scalar that represents the base of the rates to be used for discounting the cash flows. If positive, it represents discrete compounding as the reciprocal of the number of compoundings per period. If zero, it represents continuous compounding. If -1, the rates represent per-period discount factors. No other negative values are accepted.

- rates

- is an

column vector of rates

to be used for discounting the cash flows.

Elements should be positive.

column vector of rates

to be used for discounting the cash flows.

Elements should be positive.

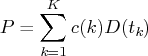

A general present value relationship can be written as

With per-unit-time-period discount factors

The following code presents an example of the PV function:

data a;

pv=mort(.,438.79,.10/12,30*12);

run;

proc print data=a;

run;

/* Use PROC IML PV function to compute PV. */

proc iml;

/* If rate is specified as annual rate divided */

/* by 12 and FREQ=1, then results are equal */

/* to those computed by the MORT function. */

timesn=t(do(1,360,1));

flows=repeat(438.79,360);

rate=repeat(.10/12,360);

freq=1;

pv=pv(timesn,flows,freq,rate);

print pv;

/* If rate is specified as annual rate, then */

/* the cash flow TIMES need to be specified */

/* in 1/12 increments and the FREQ=1/12. This */

/* specification returns the same result as */

/* the MORT function and the previous PV run. */

timesn=t(do(1/12,30,1/12));

flows=repeat(438.79,360);

rate=repeat(.10,360); /* specify annual rate */

freq=1/12; /* 12 compoundings annually: freq=1/12 */

pv=pv(timesn,flows,freq,rate);

print pv;

quit;

The result is as follows:

Obs pv

1 50000.48

pv

50000.48

pv

50000.48

Copyright © 2009 by SAS Institute Inc., Cary, NC, USA. All rights reserved.