The SSM Procedure

-

Overview

- Getting Started

-

Syntax

-

Details

State Space Model and NotationTypes of Sequence DataOverview of Model Specification SyntaxFiltering, Smoothing, Likelihood, and Structural Break DetectionEstimation of User-Specified Linear Combination of State ElementsContrasting PROC SSM with Other SAS Procedures Predefined Trend ModelsPredefined Structural ModelsModels with Dependent LagsCovariance ParameterizationMissing ValuesComputational IssuesDisplayed OutputODS Table NamesODS Graph NamesOUT= Data Set

State Space Model and NotationTypes of Sequence DataOverview of Model Specification SyntaxFiltering, Smoothing, Likelihood, and Structural Break DetectionEstimation of User-Specified Linear Combination of State ElementsContrasting PROC SSM with Other SAS Procedures Predefined Trend ModelsPredefined Structural ModelsModels with Dependent LagsCovariance ParameterizationMissing ValuesComputational IssuesDisplayed OutputODS Table NamesODS Graph NamesOUT= Data Set -

Examples

Bivariate Basic Structural Model Panel Data: Random-Effects and Autoregressive ModelsBackcasting, Forecasting, and InterpolationLongitudinal Data: Smoothing of Repeated MeasuresA User-Defined Trend ModelModel with Multiple ARIMA ComponentsDynamic Factor ModelingDiagnostic Plots and Structural Break AnalysisLongitudinal Data: Variable Bandwidth SmoothingA Transfer Function Model for the Gas Furnace DataPanel Data: Dynamic Panel Model for the Cigar DataMultivariate Modeling: Long-Term Temperature TrendsBivariate Model: Sales of Mink and Muskrat FursFactor Model: Now-Casting the US EconomyLongitudinal Data: Lung Function Analysis

Bivariate Basic Structural Model Panel Data: Random-Effects and Autoregressive ModelsBackcasting, Forecasting, and InterpolationLongitudinal Data: Smoothing of Repeated MeasuresA User-Defined Trend ModelModel with Multiple ARIMA ComponentsDynamic Factor ModelingDiagnostic Plots and Structural Break AnalysisLongitudinal Data: Variable Bandwidth SmoothingA Transfer Function Model for the Gas Furnace DataPanel Data: Dynamic Panel Model for the Cigar DataMultivariate Modeling: Long-Term Temperature TrendsBivariate Model: Sales of Mink and Muskrat FursFactor Model: Now-Casting the US EconomyLongitudinal Data: Lung Function Analysis - References

Getting Started: SSM Procedure

This example illustrates how you can use the SSM procedure to analyze a panel of time series. The following data set, Cigar, contains information about yearly per capita cigarette sales for 46 geographic regions in the United States over the period

1963–1992. The variables lsales, lprice, lndi, and lpimin denote the per capita cigarette sales, price per pack of cigarettes, per capita disposable income, and minimum price in adjoining

regions per pack of cigarettes, respectively (all in the natural log scale). The variable year contains the observation year, and the variable region contains an integer between 1 to 46 that serves as the unique identifier for the region. For additional data description

see Baltagi and Levin (1992); Baltagi (1995). The data are sorted by year.

data cigar;

input year region lsales lprice lndi lpimin;

label lsales = 'Log cigarette sales in packs per capita';

label lprice = 'Log price per pack of cigarettes';

label lndi = 'Log per capita disposable income';

label lpimin = 'Log minimum price in adjoining regions

per pack of cigarettes';

year = intnx( 'year', '1jan63'd, year-63 );

format year year.;

datalines;

63 1 4.54223 3.35341 7.3514 3.26194

63 2 4.82831 3.17388 7.5729 3.21487

63 3 4.63860 3.29584 7.3000 3.25037

63 4 4.95583 3.23080 7.9288 3.17388

63 5 5.05114 3.28840 7.9772 3.26576

... more lines ...

The goal of the analysis is to study the impact of the regressors on the smoking behavior and to understand the changes in

the smoking patterns in different regions over the years. Consider the following model for lsales:

![\[ \mb{lsales}_{i,t} = \pmb {\mu }_{i,t} + \mb{lprice} \; \pmb {\beta }_{1} + \mb{lndi} \; \pmb {\beta }_{2} + \mb{lpimin} \; \pmb {\beta }_{3} + \pmb {\epsilon }_{i,t} \]](images/etsug_ssm0001.png)

This model represents lsales in a region i and in a year t as a sum of region-specific trend components  , the regression effects due to

, the regression effects due to lprice, lndi, and lpimin, and the observation noise  . Different variations of this model are obtained by considering different models for the trend component

. Different variations of this model are obtained by considering different models for the trend component  . Proper modeling of the trend component is important because it captures differences between the regions because of unrecorded

factors such as demographic changes over time, results of anti-smoking campaigns, and so on. The following statements specify

and fit one such model:

. Proper modeling of the trend component is important because it captures differences between the regions because of unrecorded

factors such as demographic changes over time, results of anti-smoking campaigns, and so on. The following statements specify

and fit one such model:

proc ssm data=Cigar plots=residual;

id year interval=year;

array RegionArray{46} region1-region46;

do i=1 to 46;

RegionArray[i] = (region=i);

end;

trend IrwTrend(ll) cross(matchparm)=(RegionArray) levelvar=0;

irregular wn;

model lsales = lprice lndi lpimin IrwTrend wn;

eval TrendPlusReg = IrwTrend + lprice + lndi + lpimin;

output out=forCigar pdv press;

run;

The PROC SSM statement specifies the input data set, Cigar, which contains analysis variables such as the response variable, lsales, and the predictor variables, lprice, lndi, and lpimin. The PLOTS=RESIDUAL option in the PROC SSM statement produces residual diagnostic plots. The optional ID statement specifies

a numeric index variable (often a SAS date or datetime variable), which is year in this case. The INTERVAL=YEAR option in the ID statement indicates that the measurements are collected on a yearly basis.

The next few statements define a 46-dimensional array of dummy variables, RegionArray, such that RegionArray[i] is 1 if region is i and is 0 otherwise. The next three statements, TREND, IRREGULAR, and MODEL, constitute the model specification part of the

program:

-

trend IrwTrend(ll) cross(matchparm)=(RegionArray) levelvar=0;defines a trend, namedIrwTrend, of local linear type (which is signified by the keyword ll used within the parenthesis after the name). A local linear trend—a trend with time-varying level and time-varying slope—depends on two parameters: the disturbance variance of the level equation and the disturbance variance of the slope equation (see the section Local Linear Trend for more information). The LEVELVAR=0 specification fixes the disturbance variance of the level equation to 0, which results in a trend model called an integrated random walk (IRW). An IRW model tends to produce a smoother trend than a general local linear trend. In the limiting case, if the disturbance variance of the slope equation is also 0, the IRW trend reduces to a straight line (with a fixed intercept and slope). In addition, because of the use of the 46-dimensional array,RegionArray, in the CROSS= option (cross(matchparm)=(RegionArray)), this trend specification amounts to fitting a separate IRW trend for each region. This is because, as a result of the CROSS= option,IrwTrendis treated as a linear combination of 46 (the number of variables inRegionArray) stochastically independent, integrated random walks,![\[ \text {IrwTrend}_{t} = \sum _{i=1}^{46} \text {RegionArray}[i] \; \pmb {\mu }_{i,t} \]](images/etsug_ssm0004.png)

where each

is an integrated random walk. Note that since

is an integrated random walk. Note that since RegionArray[i]is a binary variable,IrwTrendequals when

when regionis i. Lastly, the use of MATCHPARM option specifies that the different IRW trends use the same disturbance variance parameter for their slope equation. This is done mainly for parsimony. Based on the model

diagnostics shown later, this appears to be a reasonable model simplification.

use the same disturbance variance parameter for their slope equation. This is done mainly for parsimony. Based on the model

diagnostics shown later, this appears to be a reasonable model simplification.

-

irregular wn;defines the observation noise , named

, named wn, as a sequence of independent, identically distributed, zero-mean, Gaussian variables—a white noise sequence. -

model lsales = lprice lndi lpimin IrwTrend wn;defines the model forlsalesas a sum of regression effects that involvelprice,lndi, andlpimin, a trend term,IrwTrend, and the observation noisewn.

The last two statements, EVAL and OUTPUT, control certain aspects of the procedure output. The following EVAL statement defines

a linear combination, named TrendPlusReg, of selected terms in the MODEL statement.

eval TrendPlusReg = IrwTrend + lprice + lndi + lpimin;

This EVAL statement causes the SSM procedure to produce an estimate of TrendPlusReg (and its standard error), which can then be printed or output to a data set. TrendPlusReg contains all the terms in the model except for the observation noise and thus can be regarded as the explanatory part of the model. In the OUTPUT statement, you can specify an output data set that stores all the component estimates that

are produced by the procedure. The following OUTPUT statement specifies forCigar as the output data set:

output out=forCigar pdv press;

The PDV option causes variables such as region1–region46, which are defined by the DATA step statements within the SSM procedure, also to be included in the output data set. The

PRESS option causes the printing of fit measures that are based on the delete-one cross validation errors (see the section

Delete-One Cross Validation and Structural Breaks for more information).

All the models that are specified in the SSM procedure possess a state space representation. See the section State Space Model and Notation for more information. The SSM procedure output begins with a table (not shown here) of the input data set that provides the name and other information. Next, the "Model Summary" table, shown in Figure 34.1, provides basic model information, such as the following:

-

the dimension of the underlying state equation, 92 (because each of the 46 IRW trends

contributes two elements to the state)

contributes two elements to the state)

-

the diffuse dimension of the model, 95 (which is equal to the three regressors plus the 92 diffuse initial states of

)

)

-

the number of model parameters, 2 (which is the common disturbance variance of the slope equation in

IrwTrendand the variance of the noise termwn)

This information is very useful in determining the computational complexity of the model (the larger state size, 92, explains the relatively long computing time—as much as two minutes on some desktops—for this example).

Figure 34.1: Summary of the Underlying State Space Model

The index variable information is shown in Figure 34.2. Among other things, it categorizes the data to be of the type Regular with Replication, which implies that the data are regularly spaced with respect to the ID variable and at least some observations have the

same ID value. This is clearly true in this example: the data are yearly without any gaps, and there are 46 observations in

each year—one per region.

Figure 34.2: Index Variable Information

Figure 34.3 provides simple summary information about the response variable. It shows that lsales has no missing values and no induced missing values because the predictors in the model, lprice, lndi, and lpimin, do not have any missing values either.

Figure 34.3: Response Variable Summary

The regression coefficients of lprice, lndi, and lpimin are shown in Figure 34.4. As expected, the coefficient of lprice is negative and the coefficients of lndi and lpimin are positive, all being statistically significant. This is consistent with the expectation that the cigarette sales are adversely

affected by the price and are positively correlated with the disposable income. The estimated effect of lpimin, called bootlegging effect by Baltagi and Levin (1992), is statistically significant but smaller than the effects of lprice and lndi.

Figure 34.4: Estimated Regression Coefficients

Figure 34.5: Estimated Model Parameters

Figure 34.5 shows the estimates of the disturbance variance of the slope equation in IrwTrend and the variance of the noise term wn.

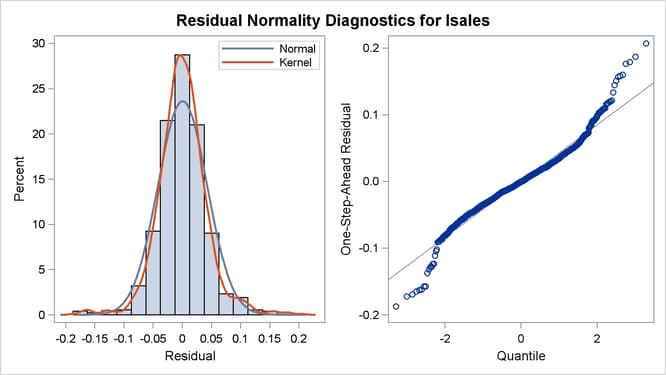

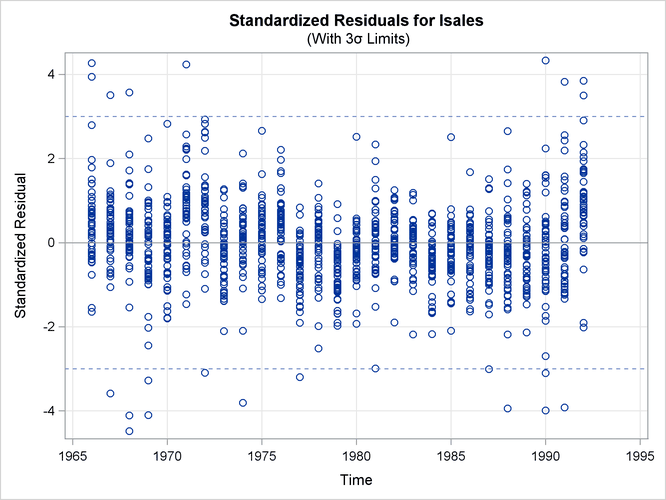

Figure 34.6 shows a panel of residual normality diagnostic plots. These plots show that the residuals are symmetrically distributed but contain slightly larger than expected number of extreme residuals. Figure 34.7 shows the plot of residuals versus time. There the residuals do not exhibit any obvious pattern; however, the plot does show that more extreme residuals appear before 1970 and after 1989. On the whole, however, these plots do not exhibit serious violations of model assumptions.

Figure 34.6: Residual Normality Check

Figure 34.7: Standardized Residuals Plotted against Time

Figure 34.8 shows the details of the likelihood computations such as the number of nonmissing response values used and the likelihood of the fitted model. See the section Likelihood Computation and Model Fitting Phase for more information. Figure 34.8 shows the likelihood-based information criteria in lower-is-better format, which are useful for model comparison.

Figure 34.8: Likelihood Computation Details

Figure 34.9: Information Criteria

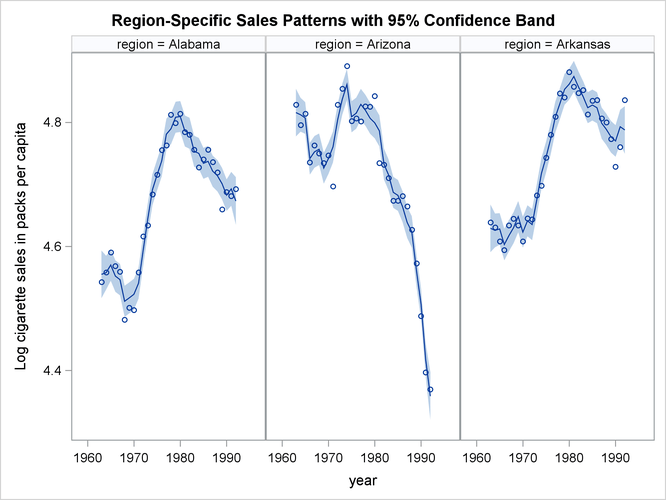

In addition to the regression estimates, it is useful to analyze the estimates of different model components such as the

trend component IrwTrend and the linear combination TrendPlusReg. These estimates can be printed by using the PRINT= option provided in the TREND and EVAL statements, or they can be output

to a data set (as it is done in this illustration). This latter option is particularly useful for graphical exploration of

these components by standard graphical procedures such as SGPLOT and SGPANEL procedures. The following statements produce

a panel of plots that shows how well the proposed model fits the observed cigarette sales in the first three regions, which

correspond to Alabama, Arizona, and Arkansas. The output data set, forCigar, contains all the needed information: Smoothed_TrendPlusReg contains the smoothed (full-sample) estimate of TrendPlusReg, and Smoothed_Lower_TrendPlusReg and Smoothed_Upper_TrendPlusReg contain its 95% lower and upper confidence limits. In addition, for easy readability, a user-defined format (RegionFormat), which is created by using the FORMAT procedure (not shown), is used to associate the region names to region values.

proc sgpanel data=forCigar noautolegend; where region <= 3; format region RegionFormat.; title 'Region-Specific Sales Patterns with 95% Confidence Band'; panelby region / columns=3; band x=year lower=Smoothed_Lower_TrendPlusReg upper=Smoothed_Upper_TrendPlusReg; scatter x=year y=lsales; series x=year y= Smoothed_TrendPlusReg; run;

Figure 34.10: Cigarette Sales Patterns for the First Three Regions

Figure 34.10 seems to indicate that the model fits the data reasonably well. It also shows that Arizona differs markedly from Alabama

and Arkansas in its cigarette sales pattern over the years. The following statements produce a similar panel of plots that

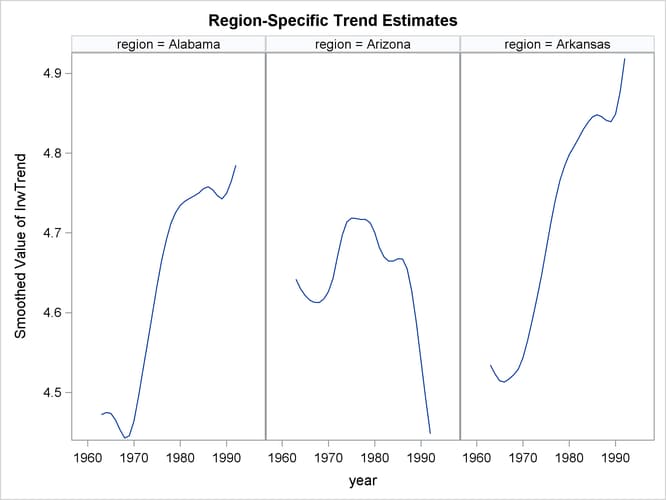

show the estimate of trend without the regression effects:

proc sgpanel data=forCigar noautolegend; where region <= 3; format region RegionFormat.; title 'Region-Specific Trend Estimates'; panelby region / columns=3; series x=year y= smoothed_IrwTrend; run;

Figure 34.11: Estimate of IrwTrend for the First Three Regions

The trend patterns, shown in Figure 34.11, seem to suggest that after accounting for the regression effects, per capita cigarette sales were on the rise in Alabama

and Arkansas while they were declining in Arizona.