| Analyses |

| Computing a Uniform Periodic Equivalent |

Suppose you need a warehouse for ten years. You have two options:

pay rent for ten years at $23,000 per year

build a two-stage facility that you will maintain and which you intend to sell at the end of those ten years

Data sets describing these scenarios are available in the portfolio SASHELP.INVSAMP.BUYRENT. Which option is more financially sound if you desire a 12% MARR?

Open the portfolio SASHELP.INVSAMP.BUYRENT and compare the options.

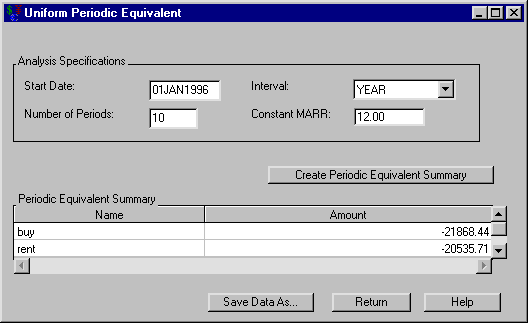

To perform the periodic equivalent, follow these steps:

Load the portfolio SASHELP.INVSAMP.BUYRENT.

Select both cashflows.

Select Analyze

Periodic Equivalent. This opens the Uniform Periodic Equivalent dialog box.

Periodic Equivalent. This opens the Uniform Periodic Equivalent dialog box. Enter 01JAN1996 for the Start Date.

Enter 10 for the Number of Periods.

Select YEAR for the Interval.

Enter 12 for the Constant MARR.

Click Create Time Value Summary.

Figure 52.6 indicates that renting costs about $1,300 less each year. Hence, renting is more financially sound. Notice the periodic equivalent for renting is not $23,000. This is because the $23,000 per year does not account for the MARR.

Copyright © SAS Institute, Inc. All Rights Reserved.