Decisions

Each modeling node can

make a decision for each case in a scoring data set, based on numerical

consequences specified via a decision matrix and cost variables or

cost constants. The decision matrix can specify profit, loss, or revenue.

In the GUI, the decision matrix is provided via the Target Profile.

With a previously scored data set containing posterior probabilities,

decisions can also be made using PROC DECIDE, which reads the decision

matrix from a decision data set.

When you use decision

processing, the modeling nodes compute summary statistics giving the

total and average profit or loss for each model. These profit and

loss summary statistics are useful for selecting models. To use these

summary statistics for model selection, you must specify numeric consequences

for making each decision for each value of the target variable. It

is your responsibility to provide reasonable numbers for the decision

consequences based on your particular application.

In some applications,

the numeric consequences of each decision might not all be known at

the time you are training the model. Hence, you might want to perform

what-if analyses to explore the effects of different decision consequences

using the Model Comparison node. In particular, when one of the decisions

is to "do nothing," the profit charts in the Model Comparison node

provide a convenient way to see the effect of applying different thresholds

for the do-nothing decision.

To use profit charts,

the do-nothing decision should not be included in the decision matrix;

the Model Comparison node will implicitly supply a do-nothing decision

when computing the profit charts. When you omit the do-nothing decision

from the profit matrix so you can obtain profit charts, you should

not use the profit and loss summary statistics for comparing models,

since these summary statistics will not incorporate the implicit do-nothing

decision. This topic is discussed further in Decision Thresholds and

Profit Charts.

The decision matrix

contains columns (decision variables) corresponding to each decision,

and rows (observations) corresponding to target values. The values

of the decision variables represent target-specific consequences,

which might be profit, loss, or revenue. These consequences are the

same for all cases being scored. A decision data set might contain

prior probabilities in addition to the decision matrix.

For a categorical target

variable, there should be one row for each class. The value in the

decision matrix located at a given row and column specifies the consequence

of making the decision corresponding to the column when the target

value corresponds to the row. The decision matrix is allowed to contain

rows for classes that do not appear in the data being analyzed. For

a profit or revenue matrix, the decision is chosen to maximize the

expected profit. For a loss matrix, the decision is chosen to minimize

the expected loss.

For an interval target

variable, each row defines a knot in a piecewise linear spline function.

The consequence of making a decision is computed by linear interpolation

in the corresponding column of the decision matrix. If the predicted

target value is outside the range of knots in the decision matrix,

the consequence of a decision is computed by linear extrapolation.

Decisions are made to maximize the predicted profit or minimize the

predicted loss.

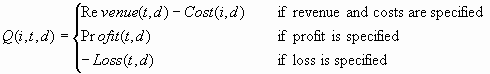

For each decision, there

might also be either a cost variable or a numeric cost constant. The

values of cost variables represent case-specific consequences, which

are always treated as costs. These consequences do not depend on the

target values of the cases being scored. Costs are used for computing

return on investment as (revenue-cost)/cost.

Cost variables can be

specified only if the decision matrix contains revenue, not profit

or loss. Hence, if revenues and costs are specified, profits are computed

as revenue minus cost. If revenues are specified without costs, the

costs are assumed to be zero. The interpretation of consequences as

profits, losses, revenues, and costs is needed only to compute return

on investment. You can specify values in the decision matrix that

are target-specific consequences but that might have some practical

interpretation other than profit, loss, or revenue. Likewise, you

can specify values for the cost variables that are case-specific consequences

but that might have some practical interpretation other than costs.

If the revenue/ cost interpretation is not applicable, the values

computed for return on investment might not be meaningful. There are

some restrictions on the use of cost variables in the Decision

Tree node; see the documentation on the Decision Tree node for more

information.

In principle, consequences

need not be the sum of target-specific and case-specific terms, but

Enterprise Miner does not support such nonadditive consequences.

For a categorical target

variable, you can use a decision matrix to classify cases by specifying

the same number of decisions as classes and having each decision correspond

to one class. However, there is no requirement for the number of decisions

to equal the number of classes except for ordinal target variables

in the Decision Tree node.

For example, suppose

there are three classes designated red, blue, and green. For an identity

decision matrix, the average profit is equal to the correct-classification

rate:

To obtain the misclassification

rate, you can specify a loss matrix with zeros on the diagonal and

ones everywhere else:

If it is 20 times more

important to classify red cases correctly than blue or green cases,

you can specify a diagonal profit matrix with a profit of 20 for classifying

red cases correctly and a profit of one for classifying blue or green

cases correctly:

When you use a diagonal

profit matrix, the decisions depend only on the products of the prior

probabilities and the corresponding profits, not on their separate

values. Hence, for any given combination of priors and diagonal profit

matrix, you can make any change to the priors (other than replacing

a zero with a nonzero value) and find a corresponding change to the

diagonal profit matrix that leaves the decisions unchanged, even though

the expected profit for each case might change.

Similarly, for any given

combination of priors and diagonal profit matrix, you can find a set

of priors that will yield the same decisions when used with an identity

profit matrix. Therefore, using a diagonal profit matrix does not

provide you with any power in decision making that could not be achieved

with no profit matrix by choosing appropriate priors (although the

profit matrix might provide an advantage in interpretability). Furthermore,

any two by two decision matrix can be transformed into a diagonal

profit matrix as discussed in the following section on Decision Thresholds

and Profit Charts.

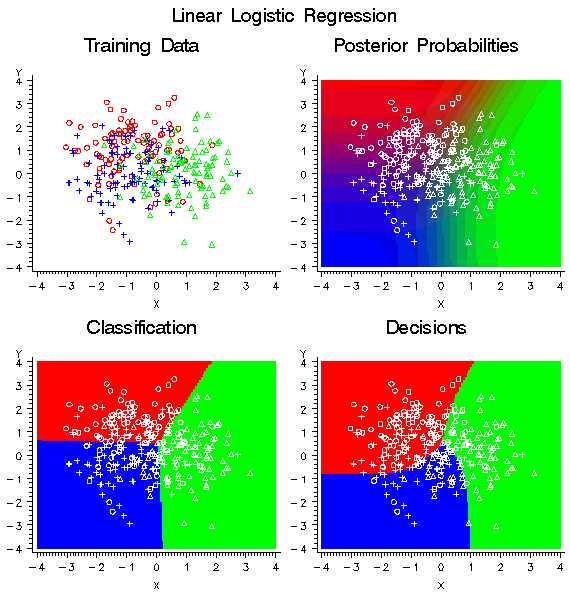

When the decision matrix

is three by three or larger, it might not be possible to diagonalize

the profit matrix, and some nondiagonal profit matrices will produce

effects that could not be achieved by manipulating the priors. To

show the effect of a non-diagonalizable decision matrix, the data

in the upper left plot of the following figure were generated to have

three classes, shown as red circles, blue crosses, and green triangles.

Each class has 100 training

cases with a bivariate normal distribution. The training data were

used to fit a linear logistic regression model using the Neural Network

engine. The posterior probabilities are shown in the upper right plot.

Classification according to the posterior probabilities yields linear

classification boundaries as shown in the lower left plot. Use of

a non-diagonalizable decision matrix causes the decision boundaries

in the lower right plot to be rotated in comparison with the classification

boundaries, and the decision boundaries are curved rather than linear.

In each row, the two

profit values for misclassification are different. Hence, it is impossible

to diagonalize the matrix by adding a constant to each row. Consider

the blue row. The greatest profit is for a correct assignment into

blue, but there is also a smaller but still substantial profit for

assignment into red. There is no profit for assigning red into blue,

so the red-blue decision boundary is moved toward the blue mean in

comparison with the classification boundary based on posterior probabilities.

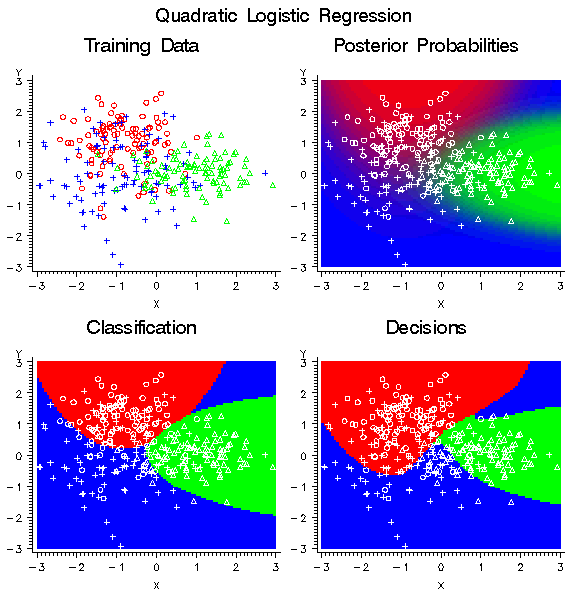

The following figure shows the effect of the same nondiagonal profit

matrix on a quadratic logistic regression model.

For the Neural Network

and Regression nodes, a separate decision is made for each case. For

the Decision Tree node, a common decision is made for all cases in

the same leaf of the tree, so when different cases have different

costs, the average cost in the leaf is used in place of the individual

costs for each case. That is, the profit equals the revenue minus

the average cost among all training cases in the same leaf. Hence,

a single decision is assigned to all cases in the same leaf of a tree.

The decision alternative

assigned to a validation, test, or scoring case ignores any cost associated

with the case. The new data are assumed similar to the training data

in cost as well as predictive relations. However, the actual cost

values for each case are used for the investment cost, ROI, and quantities

that depend on the actual target value.

Decision and cost matrices

will by default affect the following processes if and only if there

are two or more decisions:

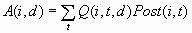

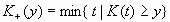

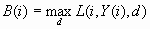

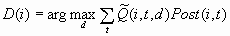

For each case i, the

decision is made by choosing D(i) to be the value of d that maximizes

the expected profit:

If two or more decisions

are tied for maximum expected profit, the first decision in the user-specified

list of decisions is chosen.

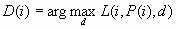

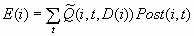

The expected profit

E(i) is the expected combined consequence for the chosen decision

D(i), computed as a weighted average over the target values of the

combined consequences, using the posterior probabilities as weights:

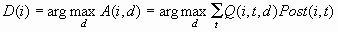

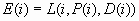

Note that E(i) and D(i)

can be computed without knowing the target index T(i). When T(i) is

known, two more quantities useful for evaluating the model can also

be computed. C(i) is the profit computed from the target value using

the decision chosen by the model:

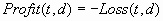

The loss computed from

the target value is the negative of C(i). C(i) is the most important

variable for assessing and comparing models. The best possible profit

for any of the decisions, which is an upper bound for C(i), is:

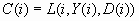

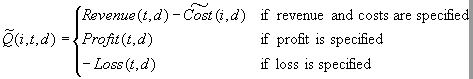

For interval targets,

the predicted value is assumed to be accurate enough that no integration

over the predictive distribution is required. Define the functions:

When Y(i) is known,

the profit computed from the target value using the decision chosen

by the model is:

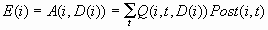

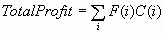

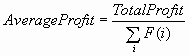

For both categorical

and interval targets, the summary statistics for decision processing

with profit and revenue matrices are computed by summation over cases

with nonmissing cost values. If no adjustment for prior probabilities

is used, the sums are weighted only by the case frequencies. Hence,

total profit and average profit are given by the following formulas:

For loss matrices, total

loss and average loss are the negatives of total profit and average

profit, respectively.

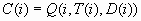

If total and average

profit are adjusted for prior probabilities, an additional weight

Paw(t)is used:

If any class with a

positive prior probability has a total frequency of zero, total and

average profit and loss cannot be computed and are assigned missing

values. Note that the adjustment of total and average profit and loss

is done only if you explicitly specify prior probabilities; the adjustment

is not done when the implicit priors based on the training set proportions

are used.

The adjustment for prior

probabilities is not done for fit statistics such as SSE, deviance,

likelihood, or misclassification rate. For example, consider the situation

shown in the following table:

There is a rare class

comprising 10% of the operational data, and a common class comprising

90%. For reasons discussed in the section below on Detecting

Rare Classes, you might want to train using a balanced sample with

50% from each class. To obtain correct posterior probabilities and

decisions, you specify prior probabilities of .1 and .9 that are equal

to the operational proportions of the two classes.

Suppose the conditional

misclassification rate for the common class is low, just 20%, but

the conditional misclassification rate for the rare class is high,

80%. If it is important to detect the rare class accurately, these

misclassification rates are poor.

The unconditional misclassification

rate computed using the training proportions without adjustment for

priors is a mediocre 50%. But adjusting for priors, the unconditional

misclassification rate is apparently much better at only 26%. Hence,

the adjusted misclassification rate is misleading.

![ROI = [C(i)/IC(i)] if IC(i) > 0, = I(infinity) if IC(i) <= 0 and C(i) > 0, = (missing) if IC(i) <= 0 and C(i) = 0, = M (-infinity) if IC(i) <= 0 and C(i) < 0.](images/prede97.png)

![L(i,y,d) = Q(i,K_(y),d) + [(y – K_(y))/(K+ (y) – K_(y))][Q(i,K+ (y),d) – Q(i,K_(y),d)]](images/prede100.png)

![Average Profit = [Total Profit/Sum(i)F(i)]](images/prede106.png)

![Paw(t) = [[(Prior(t))/Sum(i element of Class(t))F(i)]Sum(i)F(i)]](images/prede107.png)

![Total Profit = Sum(i)F(i)C(i)Paw[T(i)] = Sum(i)Paw(t) Sum(i element of Class(t))F(i)C(i)](images/prede108.png)

![Cost(i,d) = [(Sum(j element of Leaf(i)) F(j)Cost(j,d)) / (Sum(J element of Leaf(i)) F(j))]](images/prede110.png)

![L(i,t,d) = Q(i,K_(y),d) + [(y – K_(y))/(K+ (y) – K_(y))][Q(i,K_(y),d)]](images/prede114.png)

![D(i) = [(arg max(d) Sum(j element of Leaf(i)) F(j)L(j, P(j), d))/(Sum(j element of Leaf(i)) F(j))]](images/prede115.png)

![D(i) = [(arg max(d) Sum(j element of Leaf(i)) F(j)L(j, P(j), D(i))/(Sum(j element of Leaf(i)) F(j))]](images/prede116.png)