| Language Reference |

CONVEXIT Function

calculates and returns a scalar containing the convexity of a noncontingent cash flow

- CONVEXIT( times,flows,ytm)

The CONVEXIT function calculates and returns a scalar containing the convexity of a noncontingent cash flow.

- times

- is an

-dimensional column vector of times.

Elements should be nonnegative.

-dimensional column vector of times.

Elements should be nonnegative.

- flows

- is an

-dimensional column vector of cash flows.

-dimensional column vector of cash flows.

- ytm

- is the per-period yield-to-maturity of the cash-flow stream. This is a scalar and should be positive.

Convexity is essentially a measure of how duration, the sensitivity of price to yield, changes as interest rates change:

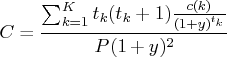

With cash flows that are not yield sensitive, and the assumption of parallel shifts to a flat term structure, convexity is given by

Consider the following statements:

timesn=T(do(1,100,1));

flows=repeat(10,100);

ytm=0.1;

convexit=convexit(timesn,flows,ytm);

print convexit;

These statements result in the following output:

CONVEXIT

199.26229

Copyright © 2009 by SAS Institute Inc., Cary, NC, USA. All rights reserved.