| The VARMAX Procedure |

| Cointegration |

This section briefly introduces the concepts of cointegration (Johansen 1995b).

- Definition 1.

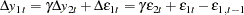

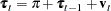

(Engle and Granger 1987): If a series

with no deterministic components can be represented by a stationary and invertible ARMA process after differencing

with no deterministic components can be represented by a stationary and invertible ARMA process after differencing  times, the series is integrated of order

times, the series is integrated of order  , that is,

, that is,  .

. - Definition 2.

(Engle and Granger 1987): If all elements of the vector

are

are  and there exists a cointegrating vector

and there exists a cointegrating vector  such that

such that  for any

for any  , the vector process is said to be cointegrated

, the vector process is said to be cointegrated  .

.

A simple example of a cointegrated process is the following bivariate system:

|

|

|

|||

|

|

|

with  and

and  being uncorrelated white noise processes. In the second equation,

being uncorrelated white noise processes. In the second equation,  is a random walk,

is a random walk,  ,

,  . Differencing the first equation results in

. Differencing the first equation results in

|

Thus, both  and

and  are

are  processes, but the linear combination

processes, but the linear combination  is stationary. Hence

is stationary. Hence  is cointegrated with a cointegrating vector

is cointegrated with a cointegrating vector  .

.

In general, if the vector process  has

has  components, then there can be more than one cointegrating vector

components, then there can be more than one cointegrating vector  . It is assumed that there are

. It is assumed that there are  linearly independent cointegrating vectors with

linearly independent cointegrating vectors with  , which make the

, which make the  matrix

matrix  . The rank of matrix

. The rank of matrix  is

is  , which is called the cointegration rank of

, which is called the cointegration rank of  .

.

Common Trends

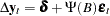

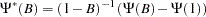

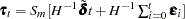

This section briefly discusses the implication of cointegration for the moving-average representation. Let  be cointegrated

be cointegrated  , then

, then  has the Wold representation:

has the Wold representation:

|

where  is

is  ,

,  with

with  , and

, and  .

.

Assume that  if

if  and

and  is a nonrandom initial value. Then the difference equation implies that

is a nonrandom initial value. Then the difference equation implies that

|

where  and

and  is absolutely summable.

is absolutely summable.

Assume that the rank of  is

is  . When the process

. When the process  is cointegrated, there is a cointegrating

is cointegrated, there is a cointegrating  matrix

matrix  such that

such that  is stationary.

is stationary.

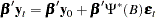

Premultiplying  by

by  results in

results in

|

because  and

and  .

.

Stock and Watson (1988) showed that the cointegrated process  has a common trends representation derived from the moving-average representation. Since the rank of

has a common trends representation derived from the moving-average representation. Since the rank of  is

is  , there is a

, there is a  matrix

matrix  with rank

with rank  such that

such that  . Let

. Let  be a

be a  matrix with rank

matrix with rank  such that

such that  ; then

; then  has rank

has rank  . The

. The  has rank

has rank  . By construction of

. By construction of  ,

,

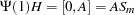

|

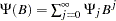

where  . Since

. Since  and

and  ,

,  lies in the column space of

lies in the column space of  and can be written

and can be written

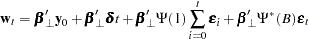

|

where  is a

is a  -dimensional vector. The common trends representation is written as

-dimensional vector. The common trends representation is written as

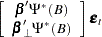

|

|

|

|||

|

|

|

|||

|

|

|

and

|

where  ,

,  ,

,  , and

, and  .

.

Stock and Watson showed that the common trends representation expresses  as a linear combination of

as a linear combination of  random walks (

random walks ( ) with drift

) with drift  plus

plus  components (

components ( .

.

Test for the Common Trends

Stock and Watson (1988) proposed statistics for common trends testing. The null hypothesis is that the  -dimensional time series

-dimensional time series  has

has  common stochastic trends, where

common stochastic trends, where  and the alternative is that it has

and the alternative is that it has  common trends, where

common trends, where  . The test procedure of

. The test procedure of  versus

versus  common stochastic trends is performed based on the first-order serial correlation matrix of

common stochastic trends is performed based on the first-order serial correlation matrix of  . Let

. Let  be a

be a  matrix orthogonal to the cointegrating matrix such that

matrix orthogonal to the cointegrating matrix such that  and

and  . Let

. Let  and

and  . Then

. Then

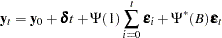

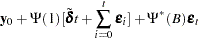

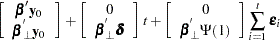

|

Combining the expression of  and

and  ,

,

|

|

|

|||

|

|

|

The Stock-Watson common trends test is performed based on the component  by testing whether

by testing whether  has rank

has rank  against rank

against rank  .

.

The following statements perform the Stock-Watson test for common trends:

proc iml;

sig = 100*i(2);

phi = {-0.2 0.1, 0.5 0.2, 0.8 0.7, -0.4 0.6};

call varmasim(y,phi) sigma=sig n=100 initial=0

seed=45876;

cn = {'y1' 'y2'};

create simul2 from y[colname=cn];

append from y;

quit;

data simul2;

set simul2;

date = intnx( 'year', '01jan1900'd, _n_-1 );

format date year4. ;

run;

proc varmax data=simul2;

model y1 y2 / p=2 cointtest=(sw);

run;

In Figure 30.51, the first column is the null hypothesis that  has

has  common trends; the second column is the alternative hypothesis that

common trends; the second column is the alternative hypothesis that  has

has  common trends; the third column contains the eigenvalues used for the test statistics; the fourth column contains the test statistics using AR(

common trends; the third column contains the eigenvalues used for the test statistics; the fourth column contains the test statistics using AR( ) filtering of the data. The table shows the output of the case

) filtering of the data. The table shows the output of the case  .

.

| Common Trend Test | |||||

|---|---|---|---|---|---|

| H0: Rank=m |

H1: Rank=s |

Eigenvalue | Filter | 5% Critical Value | Lag |

| 1 | 0 | 1.000906 | 0.09 | -14.10 | 2 |

| 2 | 0 | 0.996763 | -0.32 | -8.80 | |

| 1 | 0.648908 | -35.11 | -23.00 | ||

The test statistic for testing for 2 versus 1 common trends is more negative (–35.1) than the critical value (–23.0). Therefore, the test rejects the null hypothesis, which means that the series has a single common trend.

Copyright © 2008 by SAS Institute Inc., Cary, NC, USA. All rights reserved.