| The PDLREG Procedure |

Example 20.2 Money Demand Model

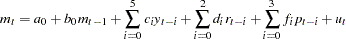

This example estimates the demand for money by using the following dynamic specification:

|

where

log of real money stock (M1)

log of real money stock (M1)  log of real GNP

log of real GNP  interest rate (commercial paper rate)

interest rate (commercial paper rate)  inflation rate

inflation rate  and

and  are coefficients for the lagged variables

are coefficients for the lagged variables

The following DATA step reads the data and transforms the real money and real GNP variables using the natural logarithm. Refer to Balke and Gordon (1986) for a description of the data.

data a;

input m1 gnp gdf r @@;

m = log( 100 * m1 / gdf );

lagm = lag( m );

y = log( gnp );

p = log( gdf / lag( gdf ) );

date = intnx( 'qtr', '1jan1968'd, _n_-1 );

format date yyqc6.;

label m = 'Real Money Stock (M1)'

lagm = 'Lagged Real Money Stock'

y = 'Real GNP'

r = 'Commercial Paper Rate'

p = 'Inflation Rate';

datalines;

... more lines ...

Output 20.2.1 shows a partial list of the data set.

| National Industrial Conference Board Data |

| Quarterly Series - 1952Q1 to 1967Q4 |

| Obs | date | m | lagm | y | r | p |

|---|---|---|---|---|---|---|

| 1 | 1968:1 | 5.44041 | . | 6.94333 | 5.58 | . |

| 2 | 1968:2 | 5.44732 | 5.44041 | 6.96226 | 6.08 | 0.011513 |

| 3 | 1968:3 | 5.45815 | 5.44732 | 6.97422 | 5.96 | 0.008246 |

| 4 | 1968:4 | 5.46492 | 5.45815 | 6.97661 | 5.96 | 0.014865 |

| 5 | 1969:1 | 5.46980 | 5.46492 | 6.98855 | 6.66 | 0.011005 |

The regression model is written for the PDLREG procedure with a MODEL statement. The LAGDEP= option is specified to test for the serial correlation in disturbances since regressors contain the lagged dependent variable LAGM.

title 'Money Demand Estimation using Distributed Lag Model';

title2 'Quarterly Data - 1968Q2 to 1983Q4';

proc pdlreg data=a;

model m = lagm y(5,3) r(2, , ,first) p(3,2) / lagdep=lagm;

run;

The estimated model is shown in Output 20.2.2 and Output 20.2.3.

| Dependent Variable | m |

|---|---|

| Real Money Stock (M1) |

| Money Demand Estimation using Distributed Lag Model |

| Quarterly Data - 1968Q2 to 1983Q4 |

| Ordinary Least Squares Estimates | |||

|---|---|---|---|

| SSE | 0.00169815 | DFE | 48 |

| MSE | 0.0000354 | Root MSE | 0.00595 |

| SBC | -404.60169 | AIC | -427.4546 |

| MAE | 0.00383648 | AICC | -421.83758 |

| MAPE | 0.07051345 | Regress R-Square | 0.9712 |

| Total R-Square | 0.9712 | ||

| Variable | DF | Estimate | Standard Error | t Value | Approx Pr > |t| |

|---|---|---|---|---|---|

| Intercept | 1 | -0.1407 | 0.2625 | -0.54 | 0.5943 |

| lagm | 1 | 0.9875 | 0.0425 | 23.21 | <.0001 |

| y**0 | 1 | 0.0132 | 0.004531 | 2.91 | 0.0055 |

| y**1 | 1 | -0.0704 | 0.0528 | -1.33 | 0.1891 |

| y**2 | 1 | 0.1261 | 0.0786 | 1.60 | 0.1154 |

| y**3 | 1 | -0.4089 | 0.1265 | -3.23 | 0.0022 |

| r**0 | 1 | -0.000186 | 0.000336 | -0.55 | 0.5816 |

| r**1 | 1 | 0.002200 | 0.000774 | 2.84 | 0.0065 |

| r**2 | 1 | 0.000788 | 0.000249 | 3.16 | 0.0027 |

| p**0 | 1 | -0.6602 | 0.1132 | -5.83 | <.0001 |

| p**1 | 1 | 0.4036 | 0.2321 | 1.74 | 0.0885 |

| p**2 | 1 | -1.0064 | 0.2288 | -4.40 | <.0001 |

| Estimate of Lag Distribution | |||||

|---|---|---|---|---|---|

| Variable | Estimate | Standard Error | t Value | Approx Pr > |t| |

-0.196 0 0.2686 |

| y(0) | 0.268619 | 0.0910 | 2.95 | 0.0049 | | |************************| |

| y(1) | -0.196484 | 0.0612 | -3.21 | 0.0024 | |****************| | |

| y(2) | -0.163148 | 0.0537 | -3.04 | 0.0038 | | *************| | |

| y(3) | 0.063850 | 0.0451 | 1.42 | 0.1632 | | |****** | |

| y(4) | 0.179733 | 0.0588 | 3.06 | 0.0036 | | |**************** | |

| y(5) | -0.120276 | 0.0679 | -1.77 | 0.0827 | | *********| | |

| Estimate of Lag Distribution | |||||

|---|---|---|---|---|---|

| Variable | Estimate | Standard Error | t Value | Approx Pr > |t| |

-0.001 0 0.0018 |

| r(0) | -0.001341 | 0.000388 | -3.45 | 0.0012 | |*****************| | |

| r(1) | -0.000751 | 0.000234 | -3.22 | 0.0023 | | *********| | |

| r(2) | 0.001770 | 0.000754 | 2.35 | 0.0230 | | |***********************| |

| Estimate of Lag Distribution | |||||

|---|---|---|---|---|---|

| Variable | Estimate | Standard Error | t Value | Approx Pr > |t| |

-1.104 0 0.2634 |

| p(0) | -1.104051 | 0.2027 | -5.45 | <.0001 | |********************************| | |

| p(1) | 0.082892 | 0.1257 | 0.66 | 0.5128 | | |*** | |

| p(2) | 0.263391 | 0.1381 | 1.91 | 0.0624 | | |********| |

| p(3) | -0.562556 | 0.2076 | -2.71 | 0.0093 | | ****************| | |

Copyright © 2008 by SAS Institute Inc., Cary, NC, USA. All rights reserved.