| The LP Procedure |

Example 5.5 Price Parametric Programming for the Oil Blending Problem

This example continues to examine the effects of a change in the cost of crude and the selling price of jet fuel. Suppose that you know the cost of ARABIAN_LIGHT crude is likely to increase 30 units, with the effects on oil and fuel prices as described in Example 5.4. The analysis in the last example only accounted for an increase of a little over 4 units (because the minimum  was -4.15891). Because an increase in the cost of ARABIAN_LIGHT beyond 4.15891 units requires a change in the optimal basis, it may also require a change in the optimal production strategy. This type of analysis, where you want to find how the solution changes with changes in the objective function coefficients or right-hand-side vector, is called parametric programming.

was -4.15891). Because an increase in the cost of ARABIAN_LIGHT beyond 4.15891 units requires a change in the optimal basis, it may also require a change in the optimal production strategy. This type of analysis, where you want to find how the solution changes with changes in the objective function coefficients or right-hand-side vector, is called parametric programming.

You can answer this question by using the PRICEPHI= option in the PROC LP statement. The following program instructs PROC LP to continually increase the cost of the crudes and the return from jet fuel using the ratios given previously, until the cost of ARABIAN_LIGHT increases at least 30 units.

proc lp sparsedata primalin=solution pricephi=-30; run;

The PRICEPHI= option in the PROC LP statement tells PROC LP to perform parametric programming on any price change vectors specified in the problem data set. The value of the PRICEPHI= option tells PROC LP how far to change the value of  and in what direction. A specification of PRICEPHI=-30 tells PROC LP to continue pivoting until the problem has objective function equal to (original objective function value)

and in what direction. A specification of PRICEPHI=-30 tells PROC LP to continue pivoting until the problem has objective function equal to (original objective function value)  30

30  (change vector).

(change vector).

Output 5.5.1 shows the result of this analysis. The first page is the Price Sensitivity Analysis Summary, as discussed in Example 5.4. The next page is an accounting for the change in basis as a result of decreasing  beyond -4.1589. It shows that BREGA left the basis at an upper bound and entered the basis at a lower bound. The interpretation of these basis changes can be difficult (Hadley 1962; Dantzig 1963).

beyond -4.1589. It shows that BREGA left the basis at an upper bound and entered the basis at a lower bound. The interpretation of these basis changes can be difficult (Hadley 1962; Dantzig 1963).

The last page of output shows the optimal solution at the displayed value of  , namely -30.6878. At an increase of 30.6878 units in the cost of ARABIAN_LIGHT and the related changes to the other crudes and the jet fuel, it is optimal to modify the production of jet fuel as shown in the activity column. Although this plan is optimal, it results in a profit of 0. This may suggest that the ratio of a unit increase in the price of jet fuel per unit increase in the cost of ARABIAN_LIGHT is lower than desirable.

, namely -30.6878. At an increase of 30.6878 units in the cost of ARABIAN_LIGHT and the related changes to the other crudes and the jet fuel, it is optimal to modify the production of jet fuel as shown in the activity column. Although this plan is optimal, it results in a profit of 0. This may suggest that the ratio of a unit increase in the price of jet fuel per unit increase in the cost of ARABIAN_LIGHT is lower than desirable.

| Problem Summary | |

|---|---|

| Objective Function | Max profit |

| Rhs Variable | _rhs_ |

| Type Variable | _type_ |

| Problem Density (%) | 45.00 |

| Variables | Number |

| Non-negative | 5 |

| Upper Bounded | 3 |

| Total | 8 |

| Constraints | Number |

| EQ | 5 |

| Objective | 1 |

| Total | 6 |

| Solution Summary | |

|---|---|

Terminated Successfully |

|

| Objective Value | 1544 |

| Phase 1 Iterations | 0 |

| Phase 2 Iterations | 0 |

| Phase 3 Iterations | 0 |

| Integer Iterations | 0 |

| Integer Solutions | 0 |

| Initial Basic Feasible Variables | 7 |

| Time Used (seconds) | 0 |

| Number of Inversions | 2 |

| Epsilon | 1E-8 |

| Infinity | 1.797693E308 |

| Maximum Phase 1 Iterations | 100 |

| Maximum Phase 2 Iterations | 100 |

| Maximum Phase 3 Iterations | 99999999 |

| Maximum Integer Iterations | 100 |

| Time Limit (seconds) | 120 |

| Variable Summary | ||||||

|---|---|---|---|---|---|---|

| Col | Variable Name | Status | Type | Price | Activity | Reduced Cost |

| 1 | arabian_heavy | UPPERBD | -165 | 0 | -21.45 | |

| 2 | arabian_light | UPPBD | UPPERBD | -175 | 110 | 11.6 |

| 3 | brega | UPPBD | UPPERBD | -205 | 80 | 3.35 |

| 4 | heating_oil | BASIC | NON-NEG | 0 | 77.3 | 0 |

| 5 | jet_1 | BASIC | NON-NEG | 300 | 60.65 | 0 |

| 6 | jet_2 | BASIC | NON-NEG | 300 | 63.33 | 0 |

| 7 | naphtha_inter | BASIC | NON-NEG | 0 | 21.8 | 0 |

| 8 | naphtha_light | BASIC | NON-NEG | 0 | 7.45 | 0 |

| Constraint Summary | ||||||

|---|---|---|---|---|---|---|

| Row | Constraint Name | Type | S/S Col | Rhs | Activity | Dual Activity |

| 1 | profit | OBJECTVE | . | 0 | 1544 | . |

| 2 | napha_l_conv | EQ | . | 0 | 0 | -60 |

| 3 | napha_i_conv | EQ | . | 0 | 0 | -90 |

| 4 | heating_oil_conv | EQ | . | 0 | 0 | -450 |

| 5 | recipe_1 | EQ | . | 0 | 0 | -300 |

| 6 | recipe_2 | EQ | . | 0 | 0 | -300 |

| Price Sensitivity Analysis Summary | |

|---|---|

| Sensitivity Vector change | |

| Minimum Phi | -4.158907511 |

| Entering Variable | brega |

| Optimal Objective | 1103.0726257 |

| Maximum Phi | 29.72972973 |

| Entering Variable | arabian_heavy |

| Optimal Objective | 4695.9459459 |

| Col | Variable Name | Status | Activity | Minimum Phi | Maximum Phi | ||

|---|---|---|---|---|---|---|---|

| Price | Reduced Cost | Price | Reduced Cost | ||||

| 1 | arabian_heavy | 0 | -169.9907 | -24.45065 | -129.3243 | 0 | |

| 2 | arabian_light | UPPBD | 110 | -179.1589 | 10.027933 | -145.2703 | 22.837838 |

| 3 | brega | UPPBD | 80 | -211.2384 | 0 | -160.4054 | 27.297297 |

| 4 | heating_oil | BASIC | 77.3 | 0 | 0 | 0 | 0 |

| 5 | jet_1 | BASIC | 60.65 | 304.15891 | 0 | 270.27027 | 0 |

| 6 | jet_2 | BASIC | 63.33 | 304.15891 | 0 | 270.27027 | 0 |

| 7 | naphtha_inter | BASIC | 21.8 | 0 | 0 | 0 | 0 |

| 8 | naphtha_light | BASIC | 7.45 | 0 | 0 | 0 | 0 |

| Price Parametric Programming Log | |||

|---|---|---|---|

| Sensitivity Vector change | |||

| Leaving Variable | Entering Variable | Objective | Current Phi |

| brega | brega | 1103.0726 | -4.158908 |

| Price Sensitivity Analysis Summary | |

|---|---|

| Sensitivity Vector change | |

| Minimum Phi | -30.68783069 |

| Entering Variable | arabian_light |

| Optimal Objective | 0 |

| Col | Variable Name | Status | Activity | Minimum Phi | |

|---|---|---|---|---|---|

| Price | Reduced Cost | ||||

| 1 | arabian_heavy | 0 | -201.8254 | -43.59127 | |

| 2 | arabian_light | ALTER | 110 | -205.6878 | 0 |

| 3 | brega | 0 | -251.0317 | -21.36905 | |

| 4 | heating_oil | BASIC | 42.9 | 0 | 0 |

| 5 | jet_1 | BASIC | 33.33 | 330.68783 | 0 |

| 6 | jet_2 | BASIC | 35.09 | 330.68783 | 0 |

| 7 | naphtha_inter | BASIC | 11 | 0 | 0 |

| 8 | naphtha_light | BASIC | 3.85 | 0 | 0 |

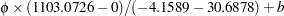

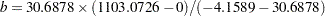

What is the optimal return if  is exactly -30? Because the change in the objective is linear as a function of

is exactly -30? Because the change in the objective is linear as a function of  , you can calculate the objective for any value of

, you can calculate the objective for any value of  between those given by linear interpolation. For example, for any

between those given by linear interpolation. For example, for any  between -4.1589 and -30.6878, the optimal objective value is

between -4.1589 and -30.6878, the optimal objective value is

|

where

|

For  -30, this is 28.5988.

-30, this is 28.5988.

Copyright © SAS Institute, Inc. All Rights Reserved.