Time Series Analysis and Examples

Details

This section presents an introductory description of the important topics that are directly related to TIMSAC IML subroutines. The computational details, including algorithms, are described in the section Computational Details. A detailed explanation of each subroutine is not given; instead, basic ideas and common methodologies for all subroutines are described first and are followed by more technical details. Finally, missing values are discussed in the section Missing Values.

Minimum AIC Procedure

The AIC statistic is widely used to select the best model among alternative parametric models. The minimum AIC model selection

procedure can be interpreted as a maximization of the expected entropy (Akaike 1981). The entropy of a true probability density function (PDF)  with respect to the fitted PDF f is written as

with respect to the fitted PDF f is written as

![\[ B(\varphi ,f) = -I(\varphi ,f) \]](images/imlug_timeseriesexpls0149.png)

where  is a Kullback-Leibler information measure, which is defined as

is a Kullback-Leibler information measure, which is defined as

![\[ I(\varphi ,f) = \int \left[ \log \left[ \frac{\varphi (z)}{f(z)} \right] \right] \varphi (z) dz \]](images/imlug_timeseriesexpls0151.png)

where the random variable Z is assumed to be continuous. Therefore,

![\[ B(\varphi ,f) = \mr{E}_ Z \log f(Z) - \mr{E}_ Z \log \varphi (Z) \]](images/imlug_timeseriesexpls0152.png)

where  and E

and E denotes the expectation concerning the random variable Z.

denotes the expectation concerning the random variable Z.  if and only if

if and only if  (a.s.). The larger the quantity E

(a.s.). The larger the quantity E , the closer the function f is to the true PDF

, the closer the function f is to the true PDF  . Given the data

. Given the data  that has the same distribution as the random variable Z, let the likelihood function of the parameter vector

that has the same distribution as the random variable Z, let the likelihood function of the parameter vector  be

be  . Then the average of the log-likelihood function

. Then the average of the log-likelihood function  is an estimate of the expected value of

is an estimate of the expected value of  . Akaike (1981) derived the alternative estimate of E

. Akaike (1981) derived the alternative estimate of E by using the Bayesian predictive likelihood. The AIC is the bias-corrected estimate of

by using the Bayesian predictive likelihood. The AIC is the bias-corrected estimate of  , where

, where  is the maximum likelihood estimate.

is the maximum likelihood estimate.

![\[ \mr{AIC} = - 2(\mi{maximum log-likelihood}) + 2(\mi{number of free parameters}) \]](images/imlug_timeseriesexpls0165.png)

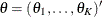

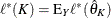

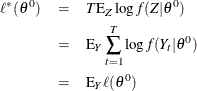

Let  be a

be a  parameter vector that is contained in the parameter space

parameter vector that is contained in the parameter space  . Given the data

. Given the data  , the log-likelihood function is

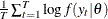

, the log-likelihood function is

![\[ \ell (\theta ) = \sum _{t=1}^ T \log f(y_ t|\theta ) \]](images/imlug_timeseriesexpls0169.png)

Suppose the probability density function  has the true PDF

has the true PDF  , where the true parameter vector

, where the true parameter vector  is contained in

is contained in  . Let

. Let  be a maximum likelihood estimate. The maximum of the log-likelihood function is denoted as

be a maximum likelihood estimate. The maximum of the log-likelihood function is denoted as  . The expected log-likelihood function is defined by

. The expected log-likelihood function is defined by

![\[ \ell ^*(\theta ) = T\mr{E}_ Z \log f(Z|\theta ) \]](images/imlug_timeseriesexpls0175.png)

The Taylor series expansion of the expected log-likelihood function around the true parameter  gives the following asymptotic relationship:

gives the following asymptotic relationship:

![\[ \ell ^*(\theta ) \stackrel{A}{=} \ell ^*(\theta ^0) + T(\theta - \theta ^0)^{\prime }\mr{E}_ Z \frac{\partial \log f(Z|\theta ^0)}{\partial \theta } - \frac{T}{2}(\theta - \theta ^0)^{\prime } I(\theta ^0)(\theta - \theta ^0) \]](images/imlug_timeseriesexpls0176.png)

where  is the information matrix and

is the information matrix and  stands for asymptotic equality. Note that

stands for asymptotic equality. Note that  since

since  is maximized at

is maximized at  . By substituting

. By substituting  , the expected log-likelihood function can be written as

, the expected log-likelihood function can be written as

![\[ \ell ^*(\hat{\theta }_ K) \stackrel{A}{=} \ell ^*(\theta ^0) - \frac{T}{2}(\hat{\theta }_ K - \theta ^0)^{\prime } I(\theta ^0)(\hat{\theta }_ K - \theta ^0) \]](images/imlug_timeseriesexpls0181.png)

The maximum likelihood estimator is asymptotically normally distributed under the regularity conditions

![\[ \sqrt {T}I(\theta ^0)^{1/2}(\hat{\theta }_ K - \theta ^0) \stackrel{d}{\rightarrow }N(0, I_ K) \]](images/imlug_timeseriesexpls0182.png)

Therefore,

![\[ T(\hat{\theta }_ K - \theta ^0)^{\prime }I(\theta ^0)(\hat{\theta }_ K - \theta ^0) \stackrel{a}{\sim } \chi _ K^2 \]](images/imlug_timeseriesexpls0183.png)

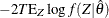

The mean expected log-likelihood function,  , becomes

, becomes

![\[ \ell ^*(K) \stackrel{A}{=} \ell ^*(\theta ^0) - \frac{K}{2} \]](images/imlug_timeseriesexpls0185.png)

When the Taylor series expansion of the log-likelihood function around  is used, the log-likelihood function

is used, the log-likelihood function  is written

is written

![\[ \ell (\theta ) \stackrel{A}{=} \ell (\hat{\theta }_ K) + (\theta - \hat{\theta }_ K)^{\prime } \left. \frac{\partial \ell (\theta )}{\partial \theta } \right|_{\hat{\theta }_ K} + \frac{1}{2}(\theta - \hat{\theta }_ K)^{\prime } \left. \frac{\partial ^2 \ell (\theta )}{\partial \theta \partial \theta ^{\prime }} \right|_{\hat{\theta }_ K}(\theta - \hat{\theta }_ K) \]](images/imlug_timeseriesexpls0187.png)

Since  is the maximum log-likelihood function,

is the maximum log-likelihood function,  . Notice that

. Notice that ![$\mr{plim} \left[ -\frac{1}{T} \left. \frac{\partial ^2 \ell (\theta )}{\partial \theta \partial \theta ^{\prime }} \right|_{\hat{\theta }_ K} \right] = I(\theta ^0)$](images/imlug_timeseriesexpls0190.png) if the maximum likelihood estimator

if the maximum likelihood estimator  is a consistent estimator of

is a consistent estimator of  . Replacing

. Replacing  with the true parameter

with the true parameter  and taking expectations with respect to the random variable Y,

and taking expectations with respect to the random variable Y,

![\[ \mr{E}_ Y \ell (\theta ^0) \stackrel{A}{=} \mr{E}_ Y \ell (\hat{\theta }_ K) - \frac{K}{2} \]](images/imlug_timeseriesexpls0191.png)

Consider the following relationship:

From the previous derivation,

![\[ \ell ^*(K) \stackrel{A}{=} \ell ^*(\theta ^0) - \frac{K}{2} \]](images/imlug_timeseriesexpls0185.png)

Therefore,

![\[ \ell ^*(K) \stackrel{A}{=} \mr{E}_ Y \ell (\hat{\theta }_ K) - K \]](images/imlug_timeseriesexpls0193.png)

The natural estimator for E is

is  . Using this estimator, you can write the mean expected log-likelihood function as

. Using this estimator, you can write the mean expected log-likelihood function as

![\[ \ell ^*(K) \stackrel{A}{=} \ell (\hat{\theta }_ K) - K \]](images/imlug_timeseriesexpls0195.png)

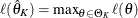

Consequently, the AIC is defined as an asymptotically unbiased estimator of

![\[ \mr{AIC}(K) = -2\ell (\hat{\theta }_ K) + 2K \]](images/imlug_timeseriesexpls0197.png)

In practice, the previous asymptotic result is expected to be valid in finite samples if the number of free parameters does

not exceed  and the upper bound of the number of free parameters is

and the upper bound of the number of free parameters is  . It is worth noting that the amount of AIC is not meaningful in itself, since this value is not the Kullback-Leibler information

measure. The difference of AIC values can be used to select the model. The difference of the two AIC values is considered

insignificant if it is far less than 1. It is possible to find a better model when the minimum AIC model contains many free

parameters.

. It is worth noting that the amount of AIC is not meaningful in itself, since this value is not the Kullback-Leibler information

measure. The difference of AIC values can be used to select the model. The difference of the two AIC values is considered

insignificant if it is far less than 1. It is possible to find a better model when the minimum AIC model contains many free

parameters.

Smoothness Priors Modeling

Consider the time series  :

:

![\[ y_ t = f(t) + \epsilon _ t \]](images/imlug_timeseriesexpls0200.png)

where  is an unknown smooth function and

is an unknown smooth function and  is an iid random variable with zero mean and positive variance

is an iid random variable with zero mean and positive variance  . Whittaker (1923) provides the solution, which balances a tradeoff between closeness to the data and the kth-order difference equation. For a fixed value of

. Whittaker (1923) provides the solution, which balances a tradeoff between closeness to the data and the kth-order difference equation. For a fixed value of  and k, the solution

and k, the solution  satisfies

satisfies

![\[ \min _ f \sum _{t=1}^ T \left\{ [y_ t - f(t)]^2 + \lambda ^2 [\nabla ^ k f(t)]^2 \right\} \]](images/imlug_timeseriesexpls0205.png)

where  denotes the kth-order difference operator. The value of

denotes the kth-order difference operator. The value of  can be viewed as the smoothness tradeoff measure. Akaike (1980a) proposed the Bayesian posterior PDF to solve this problem.

can be viewed as the smoothness tradeoff measure. Akaike (1980a) proposed the Bayesian posterior PDF to solve this problem.

![\[ \ell (f) = \exp \left\{ -\frac{1}{2 \sigma ^2} \sum _{t=1}^ T [y_ t - f(t)]^2 \right\} \exp \left\{ -\frac{\lambda ^2}{2 \sigma ^2} \sum _{t=1}^ T [\nabla ^ k f(t)]^2 \right\} \]](images/imlug_timeseriesexpls0207.png)

Therefore, the solution can be obtained when the function  is maximized.

is maximized.

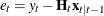

Assume that time series is decomposed as follows:

![\[ y_ t = T_ t + S_ t + \epsilon _ t \]](images/imlug_timeseriesexpls0136.png)

where  denotes the trend component and

denotes the trend component and  is the seasonal component. The trend component follows the kth-order stochastically perturbed difference equation.

is the seasonal component. The trend component follows the kth-order stochastically perturbed difference equation.

![\[ \nabla ^ k T_ t = w_{1t}, w_{1t} \sim N(0,\tau _1^2) \]](images/imlug_timeseriesexpls0209.png)

For example, the polynomial trend component for  is written as

is written as

![\[ T_ t = 2T_{t-1} - T_{t-2} + w_{1t} \]](images/imlug_timeseriesexpls0211.png)

To accommodate regular seasonal effects, the stochastic seasonal relationship is used.

![\[ \sum _{i=0}^{L-1} S_{t-i} = w_{2t} w_{2t} \sim N(0,\tau _2^2) \]](images/imlug_timeseriesexpls0212.png)

where L is the number of seasons within a period. In the context of Whittaker and Akaike, the smoothness priors problem can be solved by the maximization of

![\begin{eqnarray*} \ell (f) & = & \exp \left[ -\frac{1}{2 \sigma ^2} \sum _{t=1}^ T (y_ t - T_ t - S_ t)^2 \right] \exp \left[ -\frac{\tau _1^2}{2 \sigma ^2} \sum _{t=1}^ T (\nabla ^ k T_ t)^2 \right] \\ & & \times \exp \left[ -\frac{\tau _2^2}{2 \sigma ^2} \sum _{t=1}^ T \left( \sum _{i=0}^{L-1} S_{t-i} \right)^2 \right] \end{eqnarray*}](images/imlug_timeseriesexpls0213.png)

The values of hyperparameters  and

and  refer to a measure of uncertainty of prior information. For example, the large value of

refer to a measure of uncertainty of prior information. For example, the large value of  implies a relatively smooth trend component. The ratio

implies a relatively smooth trend component. The ratio  can be considered as a signal-to-noise ratio.

can be considered as a signal-to-noise ratio.

Kitagawa and Gersch (1984) use the Kalman filter recursive computation for the likelihood of the tradeoff parameters. The hyperparameters are estimated by combining the grid search and optimization method. The state space model and Kalman filter recursive computation are discussed in the section State Space and Kalman Filter Method.

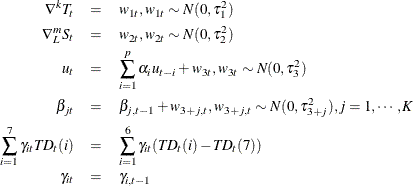

Bayesian Seasonal Adjustment

Seasonal phenomena are frequently observed in many economic and business time series. For example, consumption expenditure might have strong seasonal variations because of Christmas spending. The seasonal phenomena are repeatedly observed after a regular period of time. The number of seasons within a period is defined as the smallest time span for this repetitive observation. Monthly consumption expenditure shows a strong increase during the Christmas season, with 12 seasons per period.

There are three major approaches to seasonal time series: the regression model, the moving average model, and the seasonal ARIMA model.

Regression Model

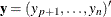

Let the trend component be  and the seasonal component be

and the seasonal component be  . Then the additive time series can be written as the regression model

. Then the additive time series can be written as the regression model

![\[ y_ t = \sum _{i=1}^{m_{\alpha }} \alpha _ i U_{it} + \sum _{j=1}^{m_{\beta }} \beta _ j V_{jt} + \epsilon _ t \]](images/imlug_timeseriesexpls0219.png)

In practice, the trend component can be written as the  th-order polynomial, such as

th-order polynomial, such as

![\[ T_ t = \sum _{i=0}^{m_{\alpha }} \alpha _ i t^ i \]](images/imlug_timeseriesexpls0221.png)

The seasonal component can be approximated by the seasonal dummies

![\[ S_ t = \sum _{j=1}^{L-1} \beta _ j D_{jt} \]](images/imlug_timeseriesexpls0223.png)

where L is the number of seasons within a period. The least squares method is applied to estimate parameters  and

and  .

.

The seasonally adjusted series is obtained by subtracting the estimated seasonal component from the original series. Usually,

the error term  is assumed to be white noise, while sometimes the autocorrelation of the regression residuals needs to be allowed. However,

the regression method is not robust to the regression function type, especially at the beginning and end of the series.

is assumed to be white noise, while sometimes the autocorrelation of the regression residuals needs to be allowed. However,

the regression method is not robust to the regression function type, especially at the beginning and end of the series.

Moving Average Model

If you assume that the annual sum of a seasonal time series has small seasonal fluctuations, the nonseasonal component  can be estimated by using the moving average method.

can be estimated by using the moving average method.

![\[ \hat{N}_ t = \sum _{i=-m}^ m \lambda _ i y_{t-i} \]](images/imlug_timeseriesexpls0226.png)

where m is the positive integer and  is the symmetric constant such that

is the symmetric constant such that  and

and  .

.

When the data are not available, either an asymmetric moving average is used, or the forecast data are augmented to use the symmetric weight. The X-11 procedure is a complex modification of this moving-average method.

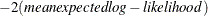

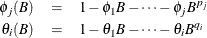

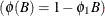

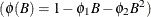

Seasonal ARIMA Model

The regression and moving-average approaches assume that the seasonal component is deterministic and independent of other nonseasonal components. The time series approach is used to handle the stochastic trend and seasonal components.

The general ARIMA model can be written

![\[ \prod _{j=1}^ m \phi _ j(B) \prod _{i=1}^ k (1-B^{s_ i})^{d_ i} \tilde{y}_ t = \theta _0 + \prod _{i=1}^ q \theta _ i(B)\epsilon _ t \]](images/imlug_timeseriesexpls0230.png)

where B is the backshift operator and

and  if

if  ; otherwise,

; otherwise,  . The power of B,

. The power of B,  , can be considered as a seasonal factor. Specifically, the Box-Jenkins multiplicative seasonal ARIMA

, can be considered as a seasonal factor. Specifically, the Box-Jenkins multiplicative seasonal ARIMA model is written as

model is written as

![\[ \phi _ p(B) \Phi _ P(B^ s)(1-B)^ d(1-B^ s)^ D \tilde{y}_ t = \theta _ q(B) \Theta _ Q(B^ s) \epsilon _ t \]](images/imlug_timeseriesexpls0237.png)

ARIMA modeling is appropriate for particular time series and requires burdensome computation.

The TSBAYSEA subroutine combines the simple characteristics of the regression approach and time series modeling. The TSBAYSEA and X-11 procedures use the model-based seasonal adjustment. The symmetric weights of the standard X-11 option can be approximated by using the integrated MA form

![\[ (1-B)(1-B^{12})y_ t = \theta (B)\epsilon _ t \]](images/imlug_timeseriesexpls0238.png)

With a fixed value  , the TSBAYSEA subroutine is approximated as

, the TSBAYSEA subroutine is approximated as

![\[ (1-\phi B)(1-B)(1-B^{12})y_ t = \theta (B) \epsilon _ t \]](images/imlug_timeseriesexpls0240.png)

The subroutine is flexible enough to handle trading-day or leap-year effects, the shift of the base observation, and missing values. The TSBAYSEA-type modeling approach has some advantages: it clearly defines the statistical model of the time series; modification of the basic model can be an efficient method of choosing a particular procedure for the seasonal adjustment of a given time series; and the use of the concept of the likelihood provides a minimum AIC model selection approach.

Nonstationary Time Series

The subroutines TSMLOCAR, TSMLOMAR, and TSTVCAR are used to analyze nonstationary time series models. The AIC statistic is extensively used to analyze the locally stationary model.

Locally Stationary AR Model

When the time series is nonstationary, the TSMLOCAR (univariate) and TSMLOMAR (multivariate) subroutines can be employed. The whole span of the series is divided into locally stationary blocks of data, and then the TSMLOCAR and TSMLOMAR subroutines estimate a stationary AR model by using the least squares method on this stationary block. The homogeneity of two different blocks of data is tested by using the AIC.

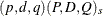

Given a set of data  , the data can be divided into k blocks of sizes

, the data can be divided into k blocks of sizes  , where

, where  , and k and

, and k and  are unknown. The locally stationary model is fitted to the data

are unknown. The locally stationary model is fitted to the data

![\[ y_ t = \alpha _0^ i + \sum _{j=1}^{p_ i} \alpha _ j^ i y_{t-j} + \epsilon _ t^ i \]](images/imlug_timeseriesexpls0245.png)

where

![\[ T_{i-1} = \sum _{j=1}^{i-1} t_ j < t \leq T_ i = \sum _{j=1}^ i t_ j \mbox{ for } i=1,\ldots ,k \]](images/imlug_timeseriesexpls0246.png)

where  is a Gaussian white noise with

is a Gaussian white noise with  and

and  . Therefore, the log-likelihood function of the locally stationary series is

. Therefore, the log-likelihood function of the locally stationary series is

![\[ \ell = -\frac{1}{2}\sum _{i=1}^ k \left[ t_ i\log (2 \pi \sigma _ i^2) + \frac{1}{\sigma _ i^2} \sum _{t=T_{i-1}+1}^{T_ i} \left( y_ t - \alpha _0^ i - \sum _{j=1}^{p_ i} \alpha _ j^ i y_{t-j} \right)^2 \right] \]](images/imlug_timeseriesexpls0250.png)

Given  ,

,  , the maximum of the log-likelihood function is attained at

, the maximum of the log-likelihood function is attained at

![\[ \hat{\sigma }_ i^2 = \frac{1}{t_ i} \sum _{t=T_{i-1}+1}^{T_ i} \left( y_ t - \hat{\alpha }_0^ i - \sum _{j=1}^{p_ i} \hat{\alpha }_ j^ i y_{t-j} \right)^2 \]](images/imlug_timeseriesexpls0253.png)

The concentrated log-likelihood function is given by

![\[ \ell ^* = - \frac{T}{2}[1 + \log (2 \pi )] - \frac{1}{2} \sum _{i=1}^ k t_ i \log (\hat{\sigma }_ i^2) \]](images/imlug_timeseriesexpls0254.png)

Therefore, the maximum likelihood estimates,  and

and  , are obtained by minimizing the following local SSE:

, are obtained by minimizing the following local SSE:

![\[ \mr{SSE} = \sum _{t=T_{i-1}+1}^{T_ i} \left( y_ t - \hat{\alpha }_0^ i - \sum _{j=1}^{p_ i} \hat{\alpha }_ j^ i y_{t-j} \right)^2 \]](images/imlug_timeseriesexpls0257.png)

The least squares estimation of the stationary model is explained in the section Least Squares and Householder Transformation.

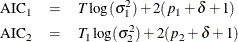

The AIC for the locally stationary model over the pooled data is written as

![\[ \sum _{i=1}^ k t_ i \log (\hat{\sigma }_ i^2) + 2\sum _{i=1}^ k (p_ i + \delta +1) \]](images/imlug_timeseriesexpls0258.png)

where  if the intercept term

if the intercept term  is estimated; otherwise,

is estimated; otherwise,  . The number of stationary blocks (k), the size of each block (

. The number of stationary blocks (k), the size of each block ( ), and the order of the locally stationary model is determined by the AIC. Consider the autoregressive model fitted over the

block of data,

), and the order of the locally stationary model is determined by the AIC. Consider the autoregressive model fitted over the

block of data,  , and let this model

, and let this model  be an AR(

be an AR( ) process. When additional data,

) process. When additional data,  , are available, a new model

, are available, a new model  , an AR(

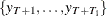

, an AR( ) process, is fitted over this new data set, assuming that these data are independent of the previous data. Then AICs for

models

) process, is fitted over this new data set, assuming that these data are independent of the previous data. Then AICs for

models  and

and  are defined as

are defined as

The joint model AIC for  and

and  is obtained by summation

is obtained by summation

![\[ \mr{AIC}_ J = \mr{AIC}_1 + \mr{AIC}_2 \]](images/imlug_timeseriesexpls0266.png)

When the two data sets are pooled and estimated over the pooled data set,  , the AIC of the pooled model is

, the AIC of the pooled model is

![\[ \mr{AIC}_ A = (T + T_1) \log (\hat{\sigma }_ A^2) + 2(p_ A + \delta + 1) \]](images/imlug_timeseriesexpls0268.png)

where  is the pooled error variance and

is the pooled error variance and  is the order chosen to fit the pooled data set.

is the order chosen to fit the pooled data set.

Decision

-

If

, switch to the new model, since there is a change in the structure of the time series.

, switch to the new model, since there is a change in the structure of the time series.

-

If

, pool the two data sets, since two data sets are considered to be homogeneous.

, pool the two data sets, since two data sets are considered to be homogeneous.

If new observations are available, repeat the preceding steps to determine the homogeneity of the data. The basic idea of locally stationary AR modeling is that, if the structure of the time series is not changed, you should use the additional information to improve the model fitting, but you need to follow the new structure of the time series if there is any change.

Time-Varying AR Coefficient Model

Another approach to nonstationary time series, especially those that are nonstationary in the covariance, is time-varying AR coefficient modeling. When the time series is nonstationary in the covariance, the problem in modeling this series is related to an efficient parameterization. It is possible for a Bayesian approach to estimate the model with a large number of implicit parameters of the complex structure by using a relatively small number of hyperparameters.

The TSTVCAR subroutine uses smoothness priors by imposing stochastically perturbed difference equation constraints on each AR coefficient and frequency response function. The variance of each AR coefficient distribution constitutes a hyperparameter included in the state space model. The likelihood of these hyperparameters is computed by the Kalman filter recursive algorithm.

The time-varying AR coefficient model is written

![\[ y_ t = \sum _{i=1}^ m \alpha _{it} y_{t-i} + \epsilon _ t \]](images/imlug_timeseriesexpls0273.png)

where time-varying coefficients  are assumed to change gradually with time. The following simple stochastic difference equation constraint is imposed on each

coefficient:

are assumed to change gradually with time. The following simple stochastic difference equation constraint is imposed on each

coefficient:

![\[ \nabla ^ k \alpha _{it} = w_{it}, w_{it} \sim N(0,\tau ^2), i=1,\ldots ,m \]](images/imlug_timeseriesexpls0275.png)

The frequency response function of the AR process is written

![\[ A(f) = 1 - \sum _{j=1}^ m \alpha _{jt} \exp (-2 \pi jif) \]](images/imlug_timeseriesexpls0276.png)

The smoothness of this function can be measured by the kth derivative smoothness constraint,

![\[ R_ k = \int _{-1/2}^{1/2} \left| \frac{d^ k A(f)}{df^ k} \right|^2 df = (2 \pi )^{2k} \sum _{j=1}^ m j^{2k} \alpha _{jt}^2 \]](images/imlug_timeseriesexpls0277.png)

Then the TSTVCAR call imposes zero and second derivative smoothness constraints. The time-varying AR coefficients are the solution of the following constrained least squares:

![\[ \sum _{t=1}^ T \left( y_ t - \sum _{i=1}^ m \alpha _{it} y_{t-i} \right)^2 + \tau ^2 \sum _{t=1}^ T \sum _{i=1}^ m \left( \nabla ^ k \alpha _{it} \right)^2 + \lambda ^2 \sum _{t=1}^ T \sum _{i=1}^ m i^2 \alpha _{it}^2 + \nu ^2 \sum _{t=1}^ T \sum _{i=1}^ m \alpha _{it}^2 \]](images/imlug_timeseriesexpls0278.png)

where  ,

,  , and

, and  are hyperparameters of the prior distribution.

are hyperparameters of the prior distribution.

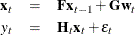

Using a state space representation, the model is

where

![\begin{eqnarray*} \mb{x}_ t & = & (\alpha _{1t},\ldots ,\alpha _{mt},\ldots , \alpha _{1,t-k+1},\ldots ,\alpha _{m,t-k+1})^{\prime } \\ \bH _ t & = & (y_{t-1},\ldots ,y_{t-m},\ldots ,0,\ldots ,0) \\ \mb{w}_ t & = & (w_{1t},\ldots , w_{mt})^{\prime } \\ k & = & 1: \bF = \bI _ m \bG = \bI _ m \\ k & = & 2: \bF = \left[ \begin{array}{cc} 2 \bI _ m & -\bI _ m \\ \bI _ m & 0 \end{array} \right] \bG = \left[ \begin{array}{c} \bI _ m \\ 0 \end{array} \right] \\ k & = & 3: \bF = \left[ \begin{array}{ccc} 3 \bI _ m & -3\bI _ m & \bI _ m \\ \bI _ m & 0 & 0 \\ 0 & \bI _ m & 0 \end{array} \right] \bG = \left[ \begin{array}{c} \bI _ m \\ 0 \\ 0 \end{array} \right] \\ \left[ \begin{array}{c} \mb{w}_ t \\ \epsilon _ t \end{array} \right] & \sim & N \left(\mb{0}, \left[ \begin{array}{cc} \tau ^2\bI & 0 \\ 0 & \sigma ^2 \end{array} \right] \right) \end{eqnarray*}](images/imlug_timeseriesexpls0283.png)

The computation of the likelihood function is straightforward. See the section State Space and Kalman Filter Method for the computation method.

Multivariate Time Series Analysis

The subroutines TSMULMAR, TSMLOMAR, and TSPRED analyze multivariate time series. The periodic AR model, TSPEARS, can also be estimated by using a vector AR procedure, since the periodic AR series can be represented as the covariance-stationary vector autoregressive model.

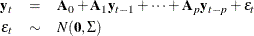

The stationary vector AR model is estimated and the order of the model (or each variable) is automatically determined by the minimum AIC procedure. The stationary vector AR model is written

Using the  factorization method, the error covariance is decomposed as

factorization method, the error covariance is decomposed as

![\[ \Sigma = \bL \bD \bL ^{\prime } \]](images/imlug_timeseriesexpls0286.png)

where  is a unit lower triangular matrix and

is a unit lower triangular matrix and  is a diagonal matrix. Then the instantaneous response model is defined as

is a diagonal matrix. Then the instantaneous response model is defined as

![\[ \bC \mb{y}_ t = \bA _0^* + \bA _1^*\mb{y}_{t-1} + \cdots + \bA _ p^*\mb{y}_{t-p} + \epsilon _ t^* \]](images/imlug_timeseriesexpls0289.png)

where  ,

,  for

for  , and

, and  . Each equation of the instantaneous response model can be estimated independently, since its error covariance matrix has

a diagonal covariance matrix

. Each equation of the instantaneous response model can be estimated independently, since its error covariance matrix has

a diagonal covariance matrix  . Maximum likelihood estimates are obtained through the least squares method when the disturbances are normally distributed

and the presample values are fixed.

. Maximum likelihood estimates are obtained through the least squares method when the disturbances are normally distributed

and the presample values are fixed.

The TSMULMAR subroutine estimates the instantaneous response model. The VAR coefficients are computed by using the relationship between the VAR and instantaneous models.

The general VARMA model can be transformed as an infinite-order MA process under certain conditions.

![\[ \mb{y}_ t = \mu + \epsilon _ t + \sum _{m=1}^{\infty } \Psi _ m \epsilon _{t-m} \]](images/imlug_timeseriesexpls0294.png)

In the context of the VAR(p) model, the coefficient  can be interpreted as the m-lagged response of a unit increase in the disturbances at time t.

can be interpreted as the m-lagged response of a unit increase in the disturbances at time t.

![\[ \Psi _ m = \frac{\partial \mb{y}_{t+m}}{\partial \epsilon ^{\prime }_ t} \]](images/imlug_timeseriesexpls0296.png)

The lagged response on the one-unit increase in the orthogonalized disturbances  is denoted

is denoted

![\[ \frac{\partial \mb{y}_{t+m}}{\partial \epsilon _{jt}^*} = \frac{\partial \mr{E}(\mb{y}_{t+m}|y_{jt},y_{j-1,t},\ldots ,\bX _ t)}{\partial y_{jt}} = \Psi _ m \bL _ j \]](images/imlug_timeseriesexpls0298.png)

where  is the jth column of the unit triangular matrix

is the jth column of the unit triangular matrix  and

and ![$\bX _ t=[\mb{y}_{t-1},\ldots ,\mb{y}_{t-p}]$](images/imlug_timeseriesexpls0300.png) . When you estimate the VAR model by using the TSMULMAR call, it is easy to compute this impulse response function.

. When you estimate the VAR model by using the TSMULMAR call, it is easy to compute this impulse response function.

The MSE of the m-step prediction is computed as

![\[ \mr{E}(\mb{y}_{t+m}-\mb{y}_{t+m|t})(\mb{y}_{t+m}-\mb{y}_{t+m|t})^{\prime } = \Sigma + \Psi _1 \Sigma \Psi ^{\prime }_1 + \cdots + \Psi _{m-1} \Sigma \Psi ^{\prime }_{m-1} \]](images/imlug_timeseriesexpls0301.png)

Note that  . Then the covariance matrix of

. Then the covariance matrix of  is decomposed

is decomposed

![\[ \Sigma = \sum _{i=1}^ n \bL _ i \bL ^{\prime }_ i d_{ii} \]](images/imlug_timeseriesexpls0303.png)

where  is the ith diagonal element of the matrix

is the ith diagonal element of the matrix  and n is the number of variables. The MSE matrix can be written

and n is the number of variables. The MSE matrix can be written

![\[ \sum _{i=1}^ n d_{ii} \left[ \bL _ i \bL ^{\prime }_ i + \Psi _1 \bL _ i \bL ^{\prime }_ i \Psi ^{\prime }_1 + \cdots + \Psi _{m-1} \bL _ i \bL ^{\prime }_ i \Psi ^{\prime }_{m-1} \right] \]](images/imlug_timeseriesexpls0305.png)

Therefore, the contribution of the ith orthogonalized innovation to the MSE is

![\[ \bV _ i = d_{ii} \left[ \bL _ i \bL ^{\prime }_ i + \Psi _1 \bL _ i \bL ^{\prime }_ i \Psi ^{\prime }_1 + \cdots + \Psi _{m-1} \bL _ i \bL ^{\prime }_ i \Psi ^{\prime }_{m-1} \right] \]](images/imlug_timeseriesexpls0306.png)

The ith forecast error variance decomposition is obtained from diagonal elements of the matrix  .

.

The nonstationary multivariate series can be analyzed by the TSMLOMAR subroutine. The estimation and model identification procedure is analogous to the univariate nonstationary procedure, which is explained in the section Nonstationary Time Series.

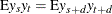

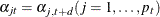

A time series  is periodically correlated with period d if

is periodically correlated with period d if  and

and  . Let

. Let  be autoregressive of period d with AR orders

be autoregressive of period d with AR orders  —that is,

—that is,

![\[ y_ t = \sum _{j=1}^{p_ t} \alpha _{jt}y_{t-j} + \epsilon _ t \]](images/imlug_timeseriesexpls0311.png)

where  is uncorrelated with mean zero and

is uncorrelated with mean zero and  ,

,  ,

,  , and

, and  . Define the new variable such that

. Define the new variable such that  . The vector series,

. The vector series,  , is autoregressive of order p, where

, is autoregressive of order p, where  . The TSPEARS subroutine estimates the periodic autoregressive model by using minimum AIC vector AR modeling.

. The TSPEARS subroutine estimates the periodic autoregressive model by using minimum AIC vector AR modeling.

The TSPRED subroutine computes the one-step or multistep forecast of the multivariate ARMA model if the ARMA parameter estimates are provided. In addition, the subroutine TSPRED produces the (intermediate and permanent) impulse response function and performs forecast error variance decomposition for the vector AR model.

Spectral Analysis

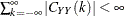

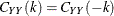

The autocovariance function of the random variable  is defined as

is defined as

![\[ C_{YY}(k) = \mr{E}(Y_{t+k} Y_ t) \]](images/imlug_timeseriesexpls0320.png)

where  . When the real valued process

. When the real valued process  is stationary and its autocovariance is absolutely summable, the population spectral density function is obtained by using

the Fourier transform of the autocovariance function

is stationary and its autocovariance is absolutely summable, the population spectral density function is obtained by using

the Fourier transform of the autocovariance function

![\[ f(g) = \frac{1}{2 \pi } \sum _{k = -\infty }^{\infty } C_{YY}(k) \exp (-igk) -\pi \leq g \leq \pi \]](images/imlug_timeseriesexpls0322.png)

where  and

and  is the autocovariance function such that

is the autocovariance function such that  .

.

Consider the autocovariance generating function

![\[ \gamma (z) = \sum _{k = -\infty }^{\infty } C_{YY}(k) z^ k \]](images/imlug_timeseriesexpls0326.png)

where  and z is a complex scalar. The spectral density function can be represented as

and z is a complex scalar. The spectral density function can be represented as

![\[ f(g) = \frac{1}{2 \pi } \gamma (\exp (-ig)) \]](images/imlug_timeseriesexpls0328.png)

The stationary ARMA( ) process is denoted

) process is denoted

![\[ \phi (B) y_ t = \theta (B) \epsilon _ t \epsilon _ t \sim (0,\sigma ^2) \]](images/imlug_timeseriesexpls0329.png)

where  and

and  do not have common roots. Note that the autocovariance generating function of the linear process

do not have common roots. Note that the autocovariance generating function of the linear process  is given by

is given by

![\[ \gamma (B) = \sigma ^2\psi (B)\psi (B^{-1}) \]](images/imlug_timeseriesexpls0333.png)

For the ARMA( ) process,

) process,  . Therefore, the spectral density function of the stationary ARMA(

. Therefore, the spectral density function of the stationary ARMA( ) process becomes

) process becomes

![\[ f(g) = \frac{\sigma ^2}{2\pi }\left|\frac{\theta (\exp (-ig)) \theta (\exp (ig))}{\phi (\exp (-ig))\phi (\exp (ig))}\right|^2 \]](images/imlug_timeseriesexpls0335.png)

The spectral density function of a white noise is a constant.

![\[ f(g) = \frac{\sigma ^2}{2\pi } \]](images/imlug_timeseriesexpls0336.png)

The spectral density function of the AR(1) process  is given by

is given by

![\[ f(g) = \frac{\sigma ^2}{2\pi (1-\phi _1 \cos (g) + \phi _1^2)} \]](images/imlug_timeseriesexpls0338.png)

The spectrum of the AR(1) process has its minimum at  and its maximum at

and its maximum at  if

if  , while the spectral density function attains its maximum at

, while the spectral density function attains its maximum at  and its minimum at

and its minimum at  , if

, if  . When the series is positively autocorrelated, its spectral density function is dominated by low frequencies. It is interesting

to observe that the spectrum approaches

. When the series is positively autocorrelated, its spectral density function is dominated by low frequencies. It is interesting

to observe that the spectrum approaches  as

as  . This relationship shows that the series is difference-stationary if its spectral density function has a remarkable peak

near 0.

. This relationship shows that the series is difference-stationary if its spectral density function has a remarkable peak

near 0.

The spectrum of AR(2) process  equals

equals

![\[ f(g) = \frac{\sigma ^2}{2\pi }\frac{1}{\left\{ -4\phi _2\left[\cos (g)+\frac{\phi _1(1-\phi _2)}{4\phi _2}\right]^2 + \frac{(1+\phi _2)^2(4\phi _2 + \phi _1^2)}{4\phi _2}\right\} } \]](images/imlug_timeseriesexpls0346.png)

Refer to Anderson (1971) for details of the characteristics of this spectral density function of the AR(2) process.

In practice, the population spectral density function cannot be computed. There are many ways of computing the sample spectral density function. The TSBAYSEA and TSMLOCAR subroutines compute the power spectrum by using AR coefficients and the white noise variance.

The power spectral density function of  is derived by using the Fourier transformation of

is derived by using the Fourier transformation of  .

.

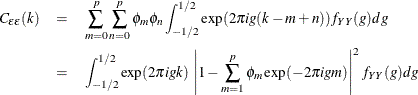

![\[ f_{YY}(g) = \sum _{k=-\infty }^\infty \exp (-2\pi igk)C_{YY}(k), -\frac{1}{2}\leq g \leq \frac{1}{2} \]](images/imlug_timeseriesexpls0347.png)

where  and g denotes frequency. The autocovariance function can also be written as

and g denotes frequency. The autocovariance function can also be written as

![\[ C_{YY}(k) = \int _{-1/2}^{1/2} \exp (2\pi igk)f_{YY}(g)dg \]](images/imlug_timeseriesexpls0348.png)

Consider the following stationary AR(p) process:

![\[ y_ t - \sum _{i=1}^ p \phi _ i y_{t-i} = \epsilon _ t \]](images/imlug_timeseriesexpls0349.png)

where  is a white noise with mean zero and constant variance

is a white noise with mean zero and constant variance  .

.

The autocovariance function of white noise  equals

equals

![\[ C_{\epsilon \epsilon }(k) = \delta _{k0}\sigma ^2 \]](images/imlug_timeseriesexpls0350.png)

where  if

if  ; otherwise,

; otherwise,  . Therefore, the power spectral density of the white noise is

. Therefore, the power spectral density of the white noise is  ,

,  . Note that, with

. Note that, with  ,

,

![\[ C_{\epsilon \epsilon }(k) = \sum _{m=0}^ p \sum _{n=0}^ p \phi _ m\phi _ n C_{YY}(k-m+n) \]](images/imlug_timeseriesexpls0357.png)

Using the following autocovariance function of  ,

,

![\[ C_{YY}(k) = \int _{-1/2}^{1/2} \exp (2\pi igk)f_{YY}(g)dg \]](images/imlug_timeseriesexpls0348.png)

the autocovariance function of the white noise is denoted as

On the other hand, another formula of the  gives

gives

![\[ C_{\epsilon \epsilon }(k) = \int _{-1/2}^{1/2} \exp (2\pi igk) f_{\epsilon \epsilon }(g)dg \]](images/imlug_timeseriesexpls0360.png)

Therefore,

![\[ f_{\epsilon \epsilon }(g) = \left|1-\sum _{m=1}^ p \phi _ m\exp (-2\pi igm) \right|^2 f_{YY}(g) \]](images/imlug_timeseriesexpls0361.png)

Since  , the rational spectrum of

, the rational spectrum of  is

is

![\[ f_{YY}(g) = \frac{\sigma ^2}{\left|1-\sum _{m=1}^ p \phi _ m\exp (-2\pi igm)\right|^2} \]](images/imlug_timeseriesexpls0362.png)

To compute the power spectrum, estimated values of white noise variance  and AR coefficients

and AR coefficients  are used. The order of the AR process can be determined by using the minimum AIC procedure.

are used. The order of the AR process can be determined by using the minimum AIC procedure.

Computational Details

Least Squares and Householder Transformation

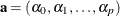

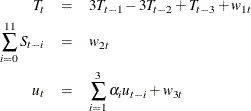

Consider the univariate AR(p) process

![\[ y_ t = \alpha _0 + \sum _{i=1}^ p \alpha _ i y_{t-i} + \epsilon _ t \]](images/imlug_timeseriesexpls0365.png)

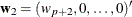

Define the design matrix  .

.

![\[ \bX = \left[\begin{array}{cccc} 1 & y_ p & \cdots & y_1 \\ \vdots & \vdots & \ddots & \vdots \\ 1 & y_{T-1} & \cdots & y_{T-p} \end{array}\right] \]](images/imlug_timeseriesexpls0367.png)

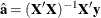

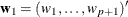

Let  . The least squares estimate,

. The least squares estimate,  , is the approximation to the maximum likelihood estimate of

, is the approximation to the maximum likelihood estimate of  if

if  is assumed to be Gaussian error disturbances. Combining

is assumed to be Gaussian error disturbances. Combining  and

and  as

as

![\[ \bZ = [\bX \, \vdots \, \mb{y}] \]](images/imlug_timeseriesexpls0371.png)

the  matrix can be decomposed as

matrix can be decomposed as

![\[ \bZ = \bQ \bU = \bQ \left[\begin{array}{cc} \bR & \mb{w}_1 \\ \mb{0} & \mb{w}_2 \end{array}\right] \]](images/imlug_timeseriesexpls0373.png)

where  is an orthogonal matrix and

is an orthogonal matrix and  is an upper triangular matrix,

is an upper triangular matrix,  , and

, and  .

.

![\[ \bQ ^{\prime }\mb{y} = \left[\begin{array}{c} w_1 \\ w_2 \\ \vdots \\ w_{T-p} \end{array}\right] \]](images/imlug_timeseriesexpls0377.png)

The least squares estimate that uses Householder transformation is computed by solving the linear system

![\[ \bR \mb{a} = \mb{w}_1 \]](images/imlug_timeseriesexpls0378.png)

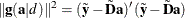

The unbiased residual variance estimate is

![\[ \hat{\sigma }^2 = \frac{1}{T-p} \sum _{i=p+2}^{T-p} w_ i^2 = \frac{w_{p+2}^2}{T-p} \]](images/imlug_timeseriesexpls0379.png)

and

![\[ \mr{AIC}=(T-p)\log (\hat{\sigma }^2) + 2(p+1) \]](images/imlug_timeseriesexpls0380.png)

In practice, least squares estimation does not require the orthogonal matrix  . The TIMSAC subroutines compute the upper triangular matrix without computing the matrix

. The TIMSAC subroutines compute the upper triangular matrix without computing the matrix  .

.

Bayesian Constrained Least Squares

Consider the additive time series model

![\[ y_ t = T_ t + S_ t + \epsilon _ t,\epsilon _ t\sim N(0,\sigma ^2) \]](images/imlug_timeseriesexpls0381.png)

Practically, it is not possible to estimate parameters  , since the number of parameters exceeds the number of available observations. Let

, since the number of parameters exceeds the number of available observations. Let  denote the seasonal difference operator with L seasons and degree of m; that is,

denote the seasonal difference operator with L seasons and degree of m; that is,  . Suppose that

. Suppose that  . Some constraints on the trend and seasonal components need to be imposed such that the sum of squares of

. Some constraints on the trend and seasonal components need to be imposed such that the sum of squares of  ,

,  , and

, and  is small. The constrained least squares estimates are obtained by minimizing

is small. The constrained least squares estimates are obtained by minimizing

![\[ \sum _{t=1}^ T \left\{ (y_ t-T_ t-S_ t)^2 + d^2\left[s^2(\nabla ^ k T_ t)^2 + (\nabla _ L^ m S_ t)^2 + z^2(S_ t+\cdots +S_{t-L+1})^2\right]\right\} \]](images/imlug_timeseriesexpls0389.png)

Using matrix notation,

![\[ (\mb{y}-\bM \mb{a})^{\prime }(\mb{y}-\bM \mb{a}) + (\mb{a}-\mb{a}_0)^{\prime }\bD ^{\prime }\bD (\mb{a}-\mb{a}_0) \]](images/imlug_timeseriesexpls0390.png)

where ![$\bM = [\bI _ T\, \vdots \, \bI _ T]$](images/imlug_timeseriesexpls0391.png) ,

,  , and

, and  is the initial guess of

is the initial guess of  . The matrix

. The matrix  is a

is a  control matrix in which structure varies according to the order of differencing in trend and season.

control matrix in which structure varies according to the order of differencing in trend and season.

![\[ \bD = d \left[\begin{array}{cc} \bE _ m & \mb{0} \\ z\bF & \mb{0} \\ \mb{0} & s\bG _ k \end{array}\right] \]](images/imlug_timeseriesexpls0396.png)

where

![\begin{eqnarray*} \bE _ m & = & \bC _ m\otimes \bI _ L, m=1,2,3 \\ \bF & = & \left[\begin{array}{cccc} 1 & 0 & \cdots & 0 \\ 1 & 1 & \ddots & \vdots \\ \vdots & \ddots & \ddots & 0 \\ 1 & \cdots & 1 & 1 \end{array}\right]_{T\times T} \\ \bG _1 & = & \left[\begin{array}{rrrrr} 1 & 0 & 0 & \cdots & 0 \\ -1 & 1 & 0 & \cdots & 0 \\ 0 & -1 & 1 & \ddots & \vdots \\ \vdots & \ddots & \ddots & \ddots & 0 \\ 0 & \cdots & 0 & -1 & 1 \end{array}\right]_{T\times T} \\ \bG _2 & = & \left[\begin{array}{rrrrrr} 1 & 0 & 0 & 0 & \cdots & 0 \\ -2 & 1 & 0 & 0 & \cdots & 0 \\ 1 & -2 & 1 & 0 & \cdots & 0 \\ 0 & 1 & -2 & 1 & \ddots & \vdots \\ \vdots & \ddots & \ddots & \ddots & \ddots & 0 \\ 0 & \cdots & 0 & 1 & -2 & 1 \end{array}\right]_{T\times T} \\ \bG _3 & = & \left[\begin{array}{rrrrrrr} 1 & 0 & 0 & 0 & 0 & \cdots & 0 \\ -3 & 1 & 0 & 0 & 0 & \cdots & 0 \\ 3 & -3 & 1 & 0 & 0 & \cdots & 0 \\ -1 & 3 & -3 & 1 & 0 & \cdots & 0 \\ 0 & -1 & 3 & -3 & 1 & \ddots & \vdots \\ \vdots & \ddots & \ddots & \ddots & \ddots & \ddots & 0 \\ 0 & \cdots & 0 & -1 & 3 & -3 & 1 \end{array}\right]_{T\times T} \end{eqnarray*}](images/imlug_timeseriesexpls0397.png)

The  matrix

matrix  has the same structure as the matrix

has the same structure as the matrix  , and

, and  is the

is the  identity matrix. The solution of the constrained least squares method is equivalent to that of maximizing the function

identity matrix. The solution of the constrained least squares method is equivalent to that of maximizing the function

![\[ L(\mb{a}) = \exp \left\{ -\frac{1}{2\sigma ^2}(\mb{y}-\bM \mb{a})^{\prime }(\mb{y}-\bM \mb{a})\right\} \exp \left\{ -\frac{1}{2\sigma ^2}(\mb{a}-\mb{a}_0)^{\prime }\bD ^{\prime }\bD (\mb{a}-\mb{a}_0)\right\} \]](images/imlug_timeseriesexpls0403.png)

Therefore, the PDF of the data  is

is

![\[ f(\mb{y}|\sigma ^2,\mb{a}) = \left(\frac{1}{2\pi }\right)^{T/2} \left(\frac{1}{\sigma }\right)^ T \exp \left\{ -\frac{1}{2\sigma ^2}(\mb{y}-\bM \mb{a})^{\prime }(\mb{y}-\bM \mb{a})\right\} \]](images/imlug_timeseriesexpls0404.png)

The prior PDF of the parameter vector  is

is

![\[ \pi (\mb{a}|\bD ,\sigma ^2,\mb{a}_0) = \left(\frac{1}{2\pi }\right)^ T \left(\frac{1}{\sigma }\right)^{2T}|\bD ^{\prime }\bD | \exp \left\{ -\frac{1}{2\sigma ^2}(\mb{a}-\mb{a}_0)^{\prime }\bD ^{\prime }\bD (\mb{a}-\mb{a}_0)\right\} \]](images/imlug_timeseriesexpls0405.png)

When the constant d is known, the estimate  of

of  is the mean of the posterior distribution, where the posterior PDF of the parameter

is the mean of the posterior distribution, where the posterior PDF of the parameter  is proportional to the function

is proportional to the function  . It is obvious that

. It is obvious that  is the minimizer of

is the minimizer of  , where

, where

![\[ \tilde{\mb{y}} = \left[\begin{array}{c} \mb{y} \\ \bD \mb{a}_0 \end{array}\right] \]](images/imlug_timeseriesexpls0409.png)

![\[ \tilde{\bD } = \left[\begin{array}{c} \bM \\ \bD \end{array}\right] \]](images/imlug_timeseriesexpls0410.png)

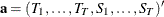

The value of d is determined by the minimum ABIC procedure. The ABIC is defined as

![\[ \mr{ABIC} = T\log \left[\frac{1}{T}\| \mb{g}(\mb{a}|d)\| ^2\right] + 2\{ \log [\det (\bD ^{\prime }\bD +\bM ^{\prime }\bM )] - \log [\det (\bD ^{\prime }\bD )]\} \]](images/imlug_timeseriesexpls0411.png)

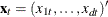

State Space and Kalman Filter Method

In this section, the mathematical formulas for state space modeling are introduced. The Kalman filter algorithms are derived from the state space model. As an example, the state space model of the TSDECOMP subroutine is formulated.

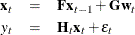

Define the following state space model:

where  and

and  . If the observations,

. If the observations,  , and the initial conditions,

, and the initial conditions,  and

and  , are available, the one-step predictor

, are available, the one-step predictor  of the state vector

of the state vector  and its mean square error (MSE) matrix

and its mean square error (MSE) matrix  are written as

are written as

![\[ \mb{x}_{t|t-1} = \bF \mb{x}_{t-1|t-1} \]](images/imlug_timeseriesexpls0421.png)

![\[ \bP _{t|t-1} = \bF \bP _{t-1|t-1}\bF ^{\prime } + \bG \bQ \bG ^{\prime } \]](images/imlug_timeseriesexpls0422.png)

Using the current observation, the filtered value of  and its variance

and its variance  are updated.

are updated.

![\[ \mb{x}_{t|t} = \mb{x}_{t|t-1} + \bK _ t e_ t \]](images/imlug_timeseriesexpls0423.png)

![\[ \bP _{t|t} = (\bI - \bK _ t \bH _ t)\bP _{t|t-1} \]](images/imlug_timeseriesexpls0424.png)

where  and

and ![$\bK _ t = \bP _{t|t-1}\bH ^{\prime }_ t[\bH _ t \bP _{t|t-1}\bH ^{\prime }_ t + \sigma ^2\bI ]^{-1}$](images/imlug_timeseriesexpls0426.png) . The log-likelihood function is computed as

. The log-likelihood function is computed as

![\[ \ell = -\frac{1}{2}\sum _{t=1}^ T \log (2\pi v_{t|t-1}) - \sum _{t=1}^ T \frac{e_ t^2}{2v_{t|t-1}} \]](images/imlug_timeseriesexpls0427.png)

where  is the conditional variance of the one-step prediction error

is the conditional variance of the one-step prediction error  .

.

Consider the additive time series decomposition

![\[ y_ t = T_ t + S_ t + T\! D_ t + u_ t + \mb{x}^{\prime }_ t\beta _ t + \epsilon _ t \]](images/imlug_timeseriesexpls0430.png)

where  is a

is a  regressor vector and

regressor vector and  is a

is a  time-varying coefficient vector. Each component has the following constraints:

time-varying coefficient vector. Each component has the following constraints:

where  and

and  . The AR component

. The AR component  is assumed to be stationary. The trading-day component

is assumed to be stationary. The trading-day component  represents the number of the ith day of the week in time t. If

represents the number of the ith day of the week in time t. If  , and

, and  (monthly data),

(monthly data),

The state vector is defined as

![\[ \mb{x}_ t = (T_ t,T_{t-1},T_{t-2},S_ t,\ldots ,S_{t-11},u_ t,u_{t-1},u_{t-2}, \gamma _{1t},\ldots ,\gamma _{6t})^{\prime } \]](images/imlug_timeseriesexpls0439.png)

The matrix  is

is

![\[ \bF = \left[\begin{array}{cccc} \bF _1 & 0 & 0 & 0 \\ 0 & \bF _2 & 0 & 0 \\ 0 & 0 & \bF _3 & 0 \\ 0 & 0 & 0 & \bF _4 \end{array}\right] \]](images/imlug_timeseriesexpls0440.png)

where

![\[ \bF _1 = \left[\begin{array}{rrr} 3 & -3 & 1 \\ 1 & 0 & 0 \\ 0 & 1 & 0 \end{array}\right] \]](images/imlug_timeseriesexpls0441.png)

![\[ \bF _2 = \left[\begin{array}{rr} -\mb{1}^{\prime } & -1 \\ \bI _{10} & 0 \end{array}\right] \]](images/imlug_timeseriesexpls0442.png)

![\[ \bF _3 = \left[\begin{array}{ccc} \alpha _1 & \alpha _2 & \alpha _3 \\ 1 & 0 & 0 \\ 0 & 1 & 0 \end{array}\right] \]](images/imlug_timeseriesexpls0443.png)

![\[ \bF _4 = \bI _6 \]](images/imlug_timeseriesexpls0444.png)

![\[ \mb{1}^{\prime } = (1,1,\ldots ,1) \]](images/imlug_timeseriesexpls0445.png)

The matrix G can be denoted as

![\[ G = \left[\begin{array}{ccc} \mb{g}_1 & 0 & 0 \\ 0 & \mb{g}_2 & 0 \\ 0 & 0 & \mb{g}_3 \\ 0 & 0 & 0 \\ 0 & 0 & 0 \\ 0 & 0 & 0 \\ 0 & 0 & 0 \\ 0 & 0 & 0 \\ 0 & 0 & 0 \end{array}\right] \]](images/imlug_timeseriesexpls0446.png)

where

![\[ \mb{g}_1 = \mb{g}_3 = \left[\begin{array}{ccc} 1 & 0 & 0 \end{array}\right]^{\prime } \]](images/imlug_timeseriesexpls0447.png)

![\[ \mb{g}_2 = \left[\begin{array}{cccccc} 1 & 0 & 0 & 0 & 0 & 0 \end{array}\right]^{\prime } \]](images/imlug_timeseriesexpls0448.png)

Finally, the matrix  is time-varying,

is time-varying,

![\[ \bH _ t = \left[\begin{array}{cccccccccccccccccc} 1 & 0 & 0 & 1 & 0 & 0 & 0 & 0 & 0 & 0 & 0 & 0 & 0 & 0 & 1 & 0 & 0 & \mb{h}^{\prime }_ t \end{array}\right] \]](images/imlug_timeseriesexpls0449.png)

where

![\begin{eqnarray*} \mb{h}_ t & = & \left[\begin{array}{cccccc} D_ t(1) & D_ t(2) & D_ t(3) & D_ t(4) & D_ t(5) & D_ t(6) \end{array}\right]^{\prime } \\ D_ t(i) & = & T\! D_ t(i)-T\! D_ t(7),i=1,\ldots ,6 \end{eqnarray*}](images/imlug_timeseriesexpls0450.png)

Missing Values

The TIMSAC subroutines skip any missing values at the beginning of the data set. When the univariate and multivariate AR models are estimated via least squares (TSMLOCAR, TSMLOMAR, TSUNIMAR, TSMULMAR, and TSPEARS), there are three options available; that is, MISSING=0, MISSING=1, or MISSING=2. When the MISSING=0 (default) option is specified, the first contiguous observations with no missing values are used. The MISSING=1 option specifies that only nonmissing observations should be used by ignoring the observations with missing values. If the MISSING=2 option is specified, the missing values are filled with the sample mean. The least squares estimator with the MISSING=2 option is biased in general.

The BAYSEA subroutine assumes the same prior distribution of the trend and seasonal components that correspond to the missing

observations. A modification is made to skip the components of the vector  that correspond to the missing observations. The vector

that correspond to the missing observations. The vector  is defined in the section Bayesian Constrained Least Squares. In addition, the TSBAYSEA subroutine considers outliers as missing values. The TSDECOMP and TSTVCAR subroutines skip the

Kalman filter updating equation when the current observation is missing.

is defined in the section Bayesian Constrained Least Squares. In addition, the TSBAYSEA subroutine considers outliers as missing values. The TSDECOMP and TSTVCAR subroutines skip the

Kalman filter updating equation when the current observation is missing.