BLKSHCLPRC Function

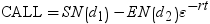

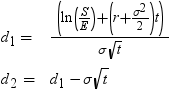

Calculates call prices for European options on stocks, based on the Black-Scholes model.

| Category: | Financial |

| Returned data type: | DOUBLE |

Syntax

Arguments

E

is a nonmissing, positive value that specifies the exercise price.

| Requirement | Specify E and S in the same units. |

| Data type | DOUBLE |

t

is a nonmissing value that specifies the time to maturity, in years.

| Data type | INTEGER |

S

is a nonmissing, positive value that specifies the share price.

| Requirement | Specify S and E in the same units. |

| Data type | DOUBLE |

r

is a nonmissing, positive value that specifies the annualized risk-free interest rate, continuously compounded.

| Data type | DOUBLE |

sigma

is a nonmissing, positive fraction that specifies the volatility of the underlying asset.

| Data type | DOUBLE |

Details

Comparisons

Example

|

Statements

|

Results

|

|---|---|

|

|

----+----1----+-—-2-- |

select blkshclprc(50,.25,48,.05,.25); |

1.79894201954463 |

select blkshclprc(9,1/12,10,.05,.2); |

1 |