Taxing a Cashflow

Consider the example described in the section The Compute Menu. To create the earnings, follow these steps:

-

Select Investment

New

New  Generic Cashflow to create a generic cashflow.

Generic Cashflow to create a generic cashflow.

-

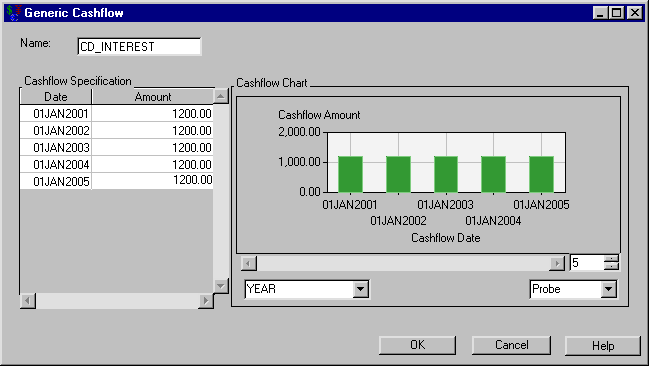

Enter CD_INTEREST for the Name.

-

Enter 1200 for each of the five years starting one year from today as displayed in Figure 56.2.

-

Click OK to return to the Investment Analysis dialog box.

Figure 56.2: Computing the Interest on the CD

To compute the tax on the earnings, follow these steps:

-

Select CD_INTEREST from the Portfolio area.

-

Select Compute

After Tax Cashflow from the pull-down menu.

After Tax Cashflow from the pull-down menu.

-

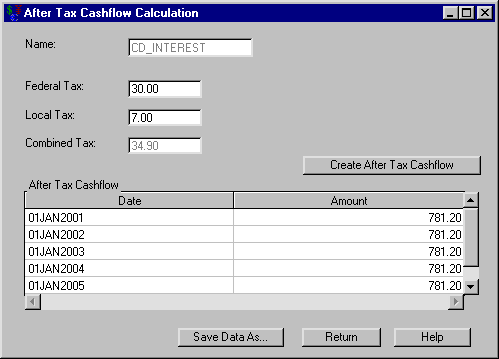

Enter 30 for Federal Tax.

-

Enter 7 for Local Tax. Note that Combined Tax updates.

-

Click Create After Tax Cashflow. The After Tax Cashflow area fills, as displayed in Figure 56.3.

Figure 56.3: Computing the Interest After Taxes

Save the taxed earnings to a SAS data set named WORK.CD_AFTERTAX. Click Return to return to the Investment Analysis dialog box.