The PDLREG Procedure

Example 21.1 Industrial Conference Board Data

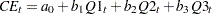

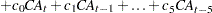

In this example, a second-degree Almon polynomial lag model is fit to a model with a five-period lag, and dummy variables are used for quarter effects. The PDL model is estimated using capital appropriations data series for the period 1952 to 1967. The estimation model is written

where CE represents capital expenditures and CA represents capital appropriations.

title 'National Industrial Conference Board Data'; title2 'Quarterly Series - 1952Q1 to 1967Q4'; data a; input ce ca @@; qtr = mod( _n_-1, 4 ) + 1; q1 = qtr=1; q2 = qtr=2; q3 = qtr=3; datalines; ... more lines ...

proc pdlreg data=a; model ce = q1 q2 q3 ca(5,2) / dwprob; run;

The printed output produced by the PDLREG procedure is shown in Output 21.1.1. The small Durbin-Watson test indicates autoregressive errors.

| National Industrial Conference Board Data |

| Quarterly Series - 1952Q1 to 1967Q4 |

| Dependent Variable | ce |

|---|

| Ordinary Least Squares Estimates | |||

|---|---|---|---|

| SSE | 1205186.4 | DFE | 48 |

| MSE | 25108 | Root MSE | 158.45520 |

| SBC | 733.84921 | AIC | 719.797878 |

| MAE | 107.777378 | AICC | 722.180856 |

| MAPE | 3.71653891 | HQC | 725.231641 |

| Durbin-Watson | 0.6157 | Regress R-Square | 0.9834 |

| Total R-Square | 0.9834 | ||

| Parameter Estimates | |||||

|---|---|---|---|---|---|

| Variable | DF | Estimate | Standard Error | t Value | Approx Pr > |t| |

| Intercept | 1 | 210.0109 | 73.2524 | 2.87 | 0.0061 |

| q1 | 1 | -10.5515 | 61.0634 | -0.17 | 0.8635 |

| q2 | 1 | -20.9887 | 59.9386 | -0.35 | 0.7277 |

| q3 | 1 | -30.4337 | 59.9004 | -0.51 | 0.6137 |

| ca**0 | 1 | 0.3760 | 0.007318 | 51.38 | <.0001 |

| ca**1 | 1 | 0.1297 | 0.0251 | 5.16 | <.0001 |

| ca**2 | 1 | 0.0247 | 0.0593 | 0.42 | 0.6794 |

| Estimate of Lag Distribution | |||||

|---|---|---|---|---|---|

| Variable | Estimate | Standard Error | t Value | Approx Pr > |t| |

0 0.2444 |

| ca(0) | 0.089467 | 0.0360 | 2.49 | 0.0165 | |*************** | |

| ca(1) | 0.104317 | 0.0109 | 9.56 | <.0001 | |***************** | |

| ca(2) | 0.127237 | 0.0255 | 5.00 | <.0001 | |********************* | |

| ca(3) | 0.158230 | 0.0254 | 6.24 | <.0001 | |*************************** | |

| ca(4) | 0.197294 | 0.0112 | 17.69 | <.0001 | |********************************* | |

| ca(5) | 0.244429 | 0.0370 | 6.60 | <.0001 | |*****************************************| |

The following statements use the REG procedure to fit the same polynomial distributed lag model. A DATA step computes lagged values of the regressor X, and RESTRICT statements are used to impose the polynomial lag distribution. Refer to Judge et al. (1985, pp. 357–359) for the restricted least squares estimation of the Almon distributed lag model.

data b; set a; ca_1 = lag( ca ); ca_2 = lag2( ca ); ca_3 = lag3( ca ); ca_4 = lag4( ca ); ca_5 = lag5( ca ); run; proc reg data=b; model ce = q1 q2 q3 ca ca_1 ca_2 ca_3 ca_4 ca_5; restrict - ca + 5*ca_1 - 10*ca_2 + 10*ca_3 - 5*ca_4 + ca_5; restrict ca - 3*ca_1 + 2*ca_2 + 2*ca_3 - 3*ca_4 + ca_5; restrict -5*ca + 7*ca_1 + 4*ca_2 - 4*ca_3 - 7*ca_4 + 5*ca_5; run;

The REG procedure output is shown in Output 21.1.2.

| National Industrial Conference Board Data |

| Quarterly Series - 1952Q1 to 1967Q4 |

| Analysis of Variance | |||||

|---|---|---|---|---|---|

| Source | DF | Sum of Squares |

Mean Square |

F Value | Pr > F |

| Model | 6 | 71343377 | 11890563 | 473.58 | <.0001 |

| Error | 48 | 1205186 | 25108 | ||

| Corrected Total | 54 | 72548564 | |||

| Root MSE | 158.45520 | R-Square | 0.9834 |

|---|---|---|---|

| Dependent Mean | 3185.69091 | Adj R-Sq | 0.9813 |

| Coeff Var | 4.97397 |

| Parameter Estimates | |||||

|---|---|---|---|---|---|

| Variable | DF | Parameter Estimate |

Standard Error |

t Value | Pr > |t| |

| Intercept | 1 | 210.01094 | 73.25236 | 2.87 | 0.0061 |

| q1 | 1 | -10.55151 | 61.06341 | -0.17 | 0.8635 |

| q2 | 1 | -20.98869 | 59.93860 | -0.35 | 0.7277 |

| q3 | 1 | -30.43374 | 59.90045 | -0.51 | 0.6137 |

| ca | 1 | 0.08947 | 0.03599 | 2.49 | 0.0165 |

| ca_1 | 1 | 0.10432 | 0.01091 | 9.56 | <.0001 |

| ca_2 | 1 | 0.12724 | 0.02547 | 5.00 | <.0001 |

| ca_3 | 1 | 0.15823 | 0.02537 | 6.24 | <.0001 |

| ca_4 | 1 | 0.19729 | 0.01115 | 17.69 | <.0001 |

| ca_5 | 1 | 0.24443 | 0.03704 | 6.60 | <.0001 |

| RESTRICT | -1 | 623.63242 | 12697 | 0.05 | 0.9614* |

| RESTRICT | -1 | 18933 | 44803 | 0.42 | 0.6772* |

| RESTRICT | -1 | 10303 | 18422 | 0.56 | 0.5814* |