| After Tax Cashflow Calculation |

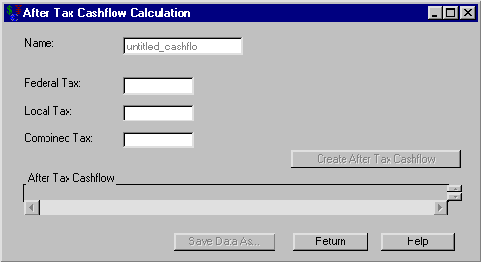

Having selected a generic cashflow from the Investment Analysis dialog box, to perform an after tax calculation, select Compute  After Tax from the Investment Analysis dialog box’s menu bar. This opens the After Tax Cashflow Calculation dialog box displayed in Figure 54.8.

After Tax from the Investment Analysis dialog box’s menu bar. This opens the After Tax Cashflow Calculation dialog box displayed in Figure 54.8.

The following items are displayed:

Name holds the name of the investment for which you are computing the after-tax cashflow.

Federal Tax holds the federal tax rate (a percentage between 0% and 100%).

Local Tax holds the local tax rate (a percentage between 0% and 100%).

Combined Tax holds the effective tax rate from federal and local income taxes.

Create After Tax Cashflow becomes available when Combined Tax is not empty. Clicking Create After Tax Cashflow then fills the After Tax Cashflow area.

After Tax Cashflow fills when you click Create After Tax Cashflow. It holds a list of date-amount pairs where the amount is the amount retained after taxes for that date.

Print becomes available when you fill the after-tax cashflow. Clicking it sends the contents of the after tax cashflow to the SAS session print device.

Save Data As becomes available when you fill the after tax cashflow. Clicking it opens the Save Output Dataset dialog box where you can save the resulting cashflow (or portions thereof) as a SAS Dataset.

Return returns you to the Investment Analysis dialog box.