| The VARMAX Procedure |

| Vector Autoregressive Process |

Let

denote a

denote a  -dimensional time series vector of random variables of interest. The

-dimensional time series vector of random variables of interest. The  th-order VAR process is written as

th-order VAR process is written as

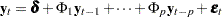

|

where the  is a vector white noise process with

is a vector white noise process with  such that

such that  ,

,  , and

, and  for

for  ;

;  is a constant vector and

is a constant vector and  is a

is a  matrix.

matrix.

Analyzing and modeling the series jointly enables you to understand the dynamic relationships over time among the series and to improve the accuracy of forecasts for individual series by using the additional information available from the related series and their forecasts.

Example of Vector Autoregressive Model

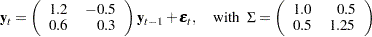

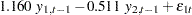

Consider the first-order stationary bivariate vector autoregressive model

|

The following IML procedure statements simulate a bivariate vector time series from this model to provide test data for the VARMAX procedure:

proc iml;

sig = {1.0 0.5, 0.5 1.25};

phi = {1.2 -0.5, 0.6 0.3};

/* simulate the vector time series */

call varmasim(y,phi) sigma = sig n = 100 seed = 34657;

cn = {'y1' 'y2'};

create simul1 from y[colname=cn];

append from y;

quit;

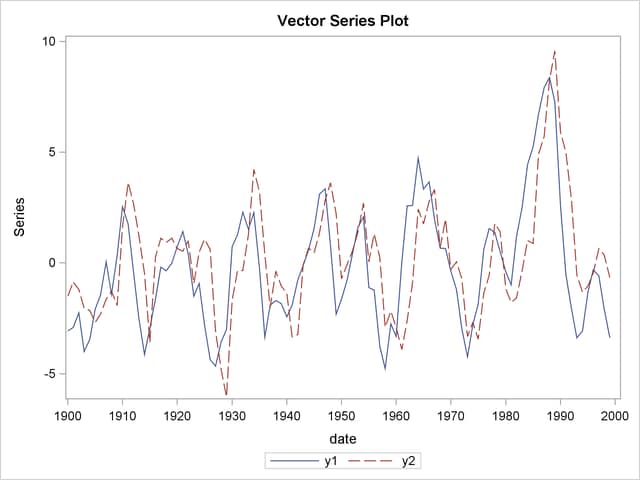

The following statements plot the simulated vector time series  shown in Figure 32.1:

shown in Figure 32.1:

data simul1; set simul1; date = intnx( 'year', '01jan1900'd, _n_-1 ); format date year4.; run; proc timeseries data=simul1 vectorplot=series; id date interval=year; var y1 y2; run;

The following statements fit a VAR(1) model to the simulated data. First, you specify the input data set in the PROC VARMAX statement. Then, you use the MODEL statement to designate the dependent variables,  and

and  . To estimate a VAR model with mean zero, you specify the order of the autoregressive model with the P= option and the NOINT option. The MODEL statement fits the model to the data and prints parameter estimates and their significance. The PRINT=ESTIMATES option prints the matrix form of parameter estimates, and the PRINT=DIAGNOSE option prints various diagnostic tests. The LAGMAX=3 option is used to print the output for the residual diagnostic checks.

. To estimate a VAR model with mean zero, you specify the order of the autoregressive model with the P= option and the NOINT option. The MODEL statement fits the model to the data and prints parameter estimates and their significance. The PRINT=ESTIMATES option prints the matrix form of parameter estimates, and the PRINT=DIAGNOSE option prints various diagnostic tests. The LAGMAX=3 option is used to print the output for the residual diagnostic checks.

To output the forecasts to a data set, you specify the OUTPUT statement with the OUT= option. If you want to forecast five steps ahead, you use the LEAD=5 option. The ID statement specifies the yearly interval between observations and provides the Time column in the forecast output.

The VARMAX procedure output is shown in Figure 32.2 through Figure 32.10.

/*--- Vector Autoregressive Model ---*/

proc varmax data=simul1;

id date interval=year;

model y1 y2 / p=1 noint lagmax=3

print=(estimates diagnose);

output out=for lead=5;

run;

| Number of Observations | 100 |

|---|---|

| Number of Pairwise Missing | 0 |

| Simple Summary Statistics | ||||||

|---|---|---|---|---|---|---|

| Variable | Type | N | Mean | Standard Deviation |

Min | Max |

| y1 | Dependent | 100 | -0.21653 | 2.78210 | -4.75826 | 8.37032 |

| y2 | Dependent | 100 | 0.16905 | 2.58184 | -6.04718 | 9.58487 |

The VARMAX procedure first displays descriptive statistics. The Type column specifies that the variables are dependent variables. The column N stands for the number of nonmissing observations.

Figure 32.3 shows the type and the estimation method of the fitted model for the simulated data. It also shows the AR coefficient matrix in terms of lag 1, the parameter estimates, and their significance, which can indicate how well the model fits the data.

The second table schematically represents the parameter estimates and allows for easy verification of their significance in matrix form.

In the last table, the first column gives the left-hand-side variable of the equation; the second column is the parameter name AR , which indicates the (

, which indicates the ( )th element of the lag

)th element of the lag  autoregressive coefficient; the last column is the regressor that corresponds to the displayed parameter.

autoregressive coefficient; the last column is the regressor that corresponds to the displayed parameter.

| Type of Model | VAR(1) |

|---|---|

| Estimation Method | Least Squares Estimation |

| AR | |||

|---|---|---|---|

| Lag | Variable | y1 | y2 |

| 1 | y1 | 1.15977 | -0.51058 |

| y2 | 0.54634 | 0.38499 | |

| Schematic Representation |

|

|---|---|

| Variable/Lag | AR1 |

| y1 | +- |

| y2 | ++ |

| + is > 2*std error, - is < -2*std error, . is between, * is N/A | |

| Model Parameter Estimates | ||||||

|---|---|---|---|---|---|---|

| Equation | Parameter | Estimate | Standard Error |

t Value | Pr > |t| | Variable |

| y1 | AR1_1_1 | 1.15977 | 0.05508 | 21.06 | 0.0001 | y1(t-1) |

| AR1_1_2 | -0.51058 | 0.05898 | -8.66 | 0.0001 | y2(t-1) | |

| y2 | AR1_2_1 | 0.54634 | 0.05779 | 9.45 | 0.0001 | y1(t-1) |

| AR1_2_2 | 0.38499 | 0.06188 | 6.22 | 0.0001 | y2(t-1) | |

The fitted VAR(1) model with estimated standard errors in parentheses is given as

|

Clearly, all parameter estimates in the coefficient matrix  are significant.

are significant.

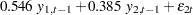

The model can also be written as two univariate regression equations.

|

|

|

|||

|

|

|

The table in Figure 32.4 shows the innovation covariance matrix estimates and the various information criteria results. The smaller value of information criteria fits the data better when it is compared to other models. The variable names in the covariance matrix are printed for convenience;  means the innovation for

means the innovation for  , and

, and  means the innovation for

means the innovation for  .

.

Figure 32.5 shows the cross covariances of the residuals. The values of the lag zero are slightly different from Figure 32.4 due to the different degrees of freedom.

Figure 32.6 and Figure 32.7 show tests for white noise residuals. The output shows that you cannot reject the null hypothesis that the residuals are uncorrelated.

| Cross Correlations of Residuals | |||

|---|---|---|---|

| Lag | Variable | y1 | y2 |

| 0 | y1 | 1.00000 | 0.29401 |

| y2 | 0.29401 | 1.00000 | |

| 1 | y1 | 0.02472 | 0.04284 |

| y2 | -0.03507 | -0.03884 | |

| 2 | y1 | 0.06442 | 0.08001 |

| y2 | 0.02628 | -0.01115 | |

| 3 | y1 | 0.01302 | 0.08858 |

| y2 | 0.00460 | 0.08213 | |

| Schematic Representation of Cross Correlations of Residuals |

||||

|---|---|---|---|---|

| Variable/Lag | 0 | 1 | 2 | 3 |

| y1 | ++ | .. | .. | .. |

| y2 | ++ | .. | .. | .. |

| + is > 2*std error, - is < -2*std error, . is between | ||||

The VARMAX procedure provides diagnostic checks for the univariate form of the equations. The table in Figure 32.8 describes how well each univariate equation fits the data. From two univariate regression equations in Figure 32.3, the values of  in the second column are 0.84 and 0.80 for each equation. The standard deviations in the third column are the square roots of the diagonal elements of the covariance matrix from Figure 32.4. The

in the second column are 0.84 and 0.80 for each equation. The standard deviations in the third column are the square roots of the diagonal elements of the covariance matrix from Figure 32.4. The  statistics are in the fourth column for hypotheses to test

statistics are in the fourth column for hypotheses to test  and

and  , respectively, where

, respectively, where  is the

is the  th element of the matrix

th element of the matrix  . The last column shows the

. The last column shows the  -values of the

-values of the  statistics. The results show that each univariate model is significant.

statistics. The results show that each univariate model is significant.

The check for white noise residuals in terms of the univariate equation is shown in Figure 32.9. This output contains information that indicates whether the residuals are correlated and heteroscedastic. In the first table, the second column contains the Durbin-Watson test statistics to test the null hypothesis that the residuals are uncorrelated. The third and fourth columns show the Jarque-Bera normality test statistics and their  -values to test the null hypothesis that the residuals have normality. The last two columns show

-values to test the null hypothesis that the residuals have normality. The last two columns show  statistics and their

statistics and their  -values for ARCH(1) disturbances to test the null hypothesis that the residuals have equal covariances. The second table includes

-values for ARCH(1) disturbances to test the null hypothesis that the residuals have equal covariances. The second table includes  statistics and their

statistics and their  -values for AR(1), AR(1,2), AR(1,2,3) and AR(1,2,3,4) models of residuals to test the null hypothesis that the residuals are uncorrelated.

-values for AR(1), AR(1,2), AR(1,2,3) and AR(1,2,3,4) models of residuals to test the null hypothesis that the residuals are uncorrelated.

| Univariate Model White Noise Diagnostics | |||||

|---|---|---|---|---|---|

| Variable | Durbin Watson |

Normality | ARCH | ||

| Chi-Square | Pr > ChiSq | F Value | Pr > F | ||

| y1 | 1.94534 | 3.56 | 0.1686 | 0.13 | 0.7199 |

| y2 | 2.06276 | 5.42 | 0.0667 | 2.10 | 0.1503 |

| Univariate Model AR Diagnostics | ||||||||

|---|---|---|---|---|---|---|---|---|

| Variable | AR1 | AR2 | AR3 | AR4 | ||||

| F Value | Pr > F | F Value | Pr > F | F Value | Pr > F | F Value | Pr > F | |

| y1 | 0.02 | 0.8980 | 0.14 | 0.8662 | 0.09 | 0.9629 | 0.82 | 0.5164 |

| y2 | 0.52 | 0.4709 | 0.41 | 0.6650 | 0.32 | 0.8136 | 0.32 | 0.8664 |

The table in Figure 32.10 gives forecasts, their prediction errors, and 95% confidence limits. See the section Forecasting for details.

| Forecasts | ||||||

|---|---|---|---|---|---|---|

| Variable | Obs | Time | Forecast | Standard Error |

95% Confidence Limits | |

| y1 | 101 | 2000 | -3.59212 | 1.13523 | -5.81713 | -1.36711 |

| 102 | 2001 | -3.09448 | 1.70915 | -6.44435 | 0.25539 | |

| 103 | 2002 | -2.17433 | 2.14472 | -6.37792 | 2.02925 | |

| 104 | 2003 | -1.11395 | 2.43166 | -5.87992 | 3.65203 | |

| 105 | 2004 | -0.14342 | 2.58740 | -5.21463 | 4.92779 | |

| y2 | 101 | 2000 | -2.09873 | 1.19096 | -4.43298 | 0.23551 |

| 102 | 2001 | -2.77050 | 1.47666 | -5.66469 | 0.12369 | |

| 103 | 2002 | -2.75724 | 1.74212 | -6.17173 | 0.65725 | |

| 104 | 2003 | -2.24943 | 2.01925 | -6.20709 | 1.70823 | |

| 105 | 2004 | -1.47460 | 2.25169 | -5.88782 | 2.93863 | |

Copyright © SAS Institute, Inc. All Rights Reserved.