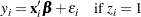

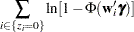

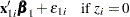

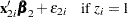

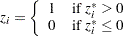

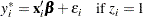

In sample selection models, one or several dependent variables are observed when another variable takes certain values. For example, the standard Heckman selection model can be defined as

where  and

and  are jointly normal with zero mean, standard deviations of 1 and

are jointly normal with zero mean, standard deviations of 1 and  , and correlation of

, and correlation of  .

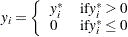

.  is the variable that the selection is based on, and

is the variable that the selection is based on, and  is observed when

is observed when  has a value of 1. Least squares regression using the observed data of

has a value of 1. Least squares regression using the observed data of  produces inconsistent estimates of

produces inconsistent estimates of  . Maximum likelihood method is used to estimate selection models. It is also possible to estimate these models by using Heckman’s method, which is more computationally efficient. But it can be shown that the resulting estimates, although consistent, are not asymptotically efficient under normality assumption. Moreover, this method often violates the constraint on correlation coefficient

. Maximum likelihood method is used to estimate selection models. It is also possible to estimate these models by using Heckman’s method, which is more computationally efficient. But it can be shown that the resulting estimates, although consistent, are not asymptotically efficient under normality assumption. Moreover, this method often violates the constraint on correlation coefficient  .

.

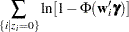

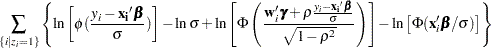

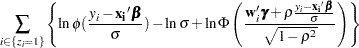

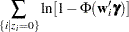

The log-likelihood function of the Heckman selection model is written as

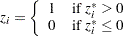

Only one variable is allowed for the selection to be based on, but the selection may lead to several variables. For example, in the following switching regression model,

is the variable that the selection is based on. If

is the variable that the selection is based on. If  , then

, then  is observed. If

is observed. If  , then

, then  is observed. Because it is never the case that

is observed. Because it is never the case that  and

and  are observed at the same time, the correlation between

are observed at the same time, the correlation between  and

and  cannot be estimated. Only the correlation between

cannot be estimated. Only the correlation between  and

and  and the correlation between

and the correlation between  and

and  can be estimated. This estimation uses the maximum likelihood method.

can be estimated. This estimation uses the maximum likelihood method.

A brief example of the code for this model can be found in Sample Selection Model.

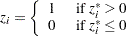

The Heckman selection model can include censoring or truncation. For a brief example of the code for these models see Sample Selection Model with Truncation and Censoring. The following example shows a variable  that is censored from below at zero.

that is censored from below at zero.

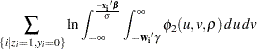

In this case, the log-likelihood function of the Heckman selection model needs to be modified to include the censored region.

In case  is truncated from below at zero instead of censored, the likelihood function can be written as

is truncated from below at zero instead of censored, the likelihood function can be written as

and

and  are jointly normal with zero mean, standard deviations of 1 and

are jointly normal with zero mean, standard deviations of 1 and  , and correlation of

, and correlation of  .

.  is the variable that the selection is based on, and

is the variable that the selection is based on, and  is observed when

is observed when  has a value of 1. Least squares regression using the observed data of

has a value of 1. Least squares regression using the observed data of  produces inconsistent estimates of

produces inconsistent estimates of  . Maximum likelihood method is used to estimate selection models. It is also possible to estimate these models by using Heckman’s method, which is more computationally efficient. But it can be shown that the resulting estimates, although consistent, are not asymptotically efficient under normality assumption. Moreover, this method often violates the constraint on correlation coefficient

. Maximum likelihood method is used to estimate selection models. It is also possible to estimate these models by using Heckman’s method, which is more computationally efficient. But it can be shown that the resulting estimates, although consistent, are not asymptotically efficient under normality assumption. Moreover, this method often violates the constraint on correlation coefficient  .

.

is the variable that the selection is based on. If

is the variable that the selection is based on. If  , then

, then  is observed. If

is observed. If  , then

, then  is observed. Because it is never the case that

is observed. Because it is never the case that  and

and  are observed at the same time, the correlation between

are observed at the same time, the correlation between  and

and  cannot be estimated. Only the correlation between

cannot be estimated. Only the correlation between  and

and  and the correlation between

and the correlation between  and

and  can be estimated. This estimation uses the maximum likelihood method.

can be estimated. This estimation uses the maximum likelihood method.  that is censored from below at zero.

that is censored from below at zero.

is truncated from below at zero instead of censored, the likelihood function can be written as

is truncated from below at zero instead of censored, the likelihood function can be written as