| Analyses |

| Performing a Benefit-Cost Ratio Analysis |

Suppose a municipality has excess funds to invest. It is choosing between the same investments described in the previous example. Government agencies often compute benefit-cost ratios to decide which investment to pursue. Which is best in this case?

Open the portfolio SASHELP.INVSAMP.NVST and compare the investments.

To compute the benefit-cost ratios, follow these steps:

Select all five investments.

Select Analyze

Benefit-Cost Ratio.

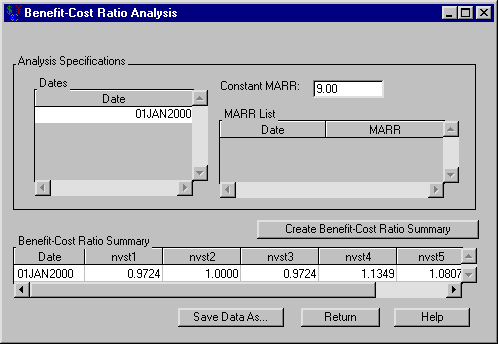

Benefit-Cost Ratio. Enter 01JAN1996 for the Date.

Enter 9 for Constant MARR.

Click Create Benefit-Cost Ratio Summary to fill the Benefit-Cost Ratio Summary area.

The results displayed in Figure 49.5 indicate that investments 2, 4, and 5 have ratios greater than 1. Therefore, each is profitable with a MARR of 9%.

Copyright © 2008 by SAS Institute Inc., Cary, NC, USA. All rights reserved.