| The ARIMA Procedure |

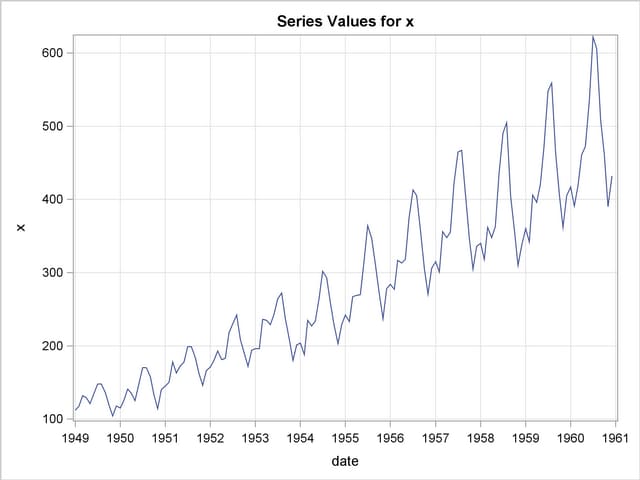

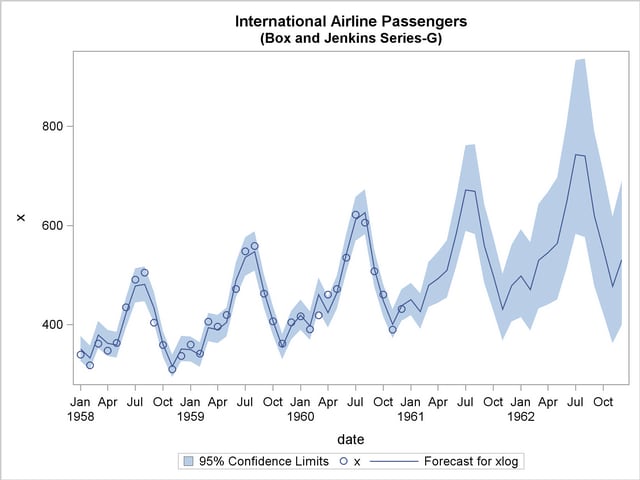

Example 7.2 Seasonal Model for the Airline Series

The airline passenger data, given as Series G in Box and Jenkins (1976), have been used in time series analysis literature as an example of a nonstationary seasonal time series. This example uses PROC ARIMA to fit the airline model, ARIMA(0,1,1) (0,1,1)

(0,1,1) , to Box and Jenkins’ Series G. The following statements read the data and log-transform the series:

, to Box and Jenkins’ Series G. The following statements read the data and log-transform the series:

title1 'International Airline Passengers';

title2 '(Box and Jenkins Series-G)';

data seriesg;

input x @@;

xlog = log( x );

date = intnx( 'month', '31dec1948'd, _n_ );

format date monyy.;

datalines;

... more lines ...

The following PROC TIMESERIES step plots the series, as shown in Output 7.2.1:

proc timeseries data=seriesg plot=series;

id date interval=month;

var x;

run;

The following statements specify an ARIMA(0,1,1) (0,1,1)

(0,1,1) model without a mean term to the logarithms of the airline passengers series, xlog. The model is forecast, and the results are stored in the data set B.

model without a mean term to the logarithms of the airline passengers series, xlog. The model is forecast, and the results are stored in the data set B.

/*-- Seasonal Model for the Airline Series --*/

proc arima data=seriesg;

identify var=xlog(1,12);

estimate q=(1)(12) noint method=ml;

forecast id=date interval=month printall out=b;

run;

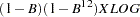

The output from the IDENTIFY statement is shown in Output 7.2.2. The autocorrelation plots shown are for the twice differenced series  . Note that the autocorrelation functions have the pattern characteristic of a first-order moving-average process combined with a seasonal moving-average process with lag 12.

. Note that the autocorrelation functions have the pattern characteristic of a first-order moving-average process combined with a seasonal moving-average process with lag 12.

| Name of Variable = xlog | |

|---|---|

| Period(s) of Differencing | 1,12 |

| Mean of Working Series | 0.000291 |

| Standard Deviation | 0.045673 |

| Number of Observations | 131 |

| Observation(s) eliminated by differencing | 13 |

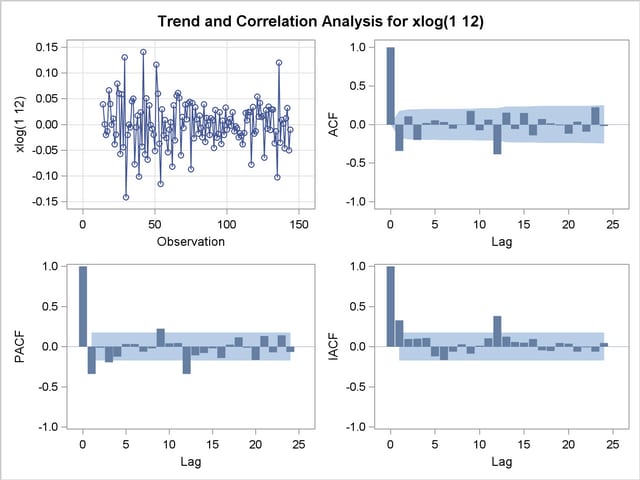

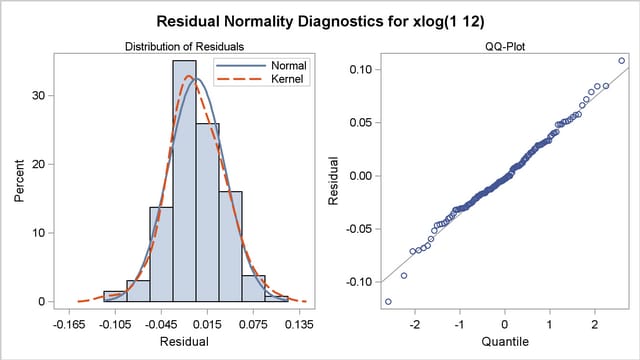

The results of the ESTIMATE statement are shown in Output 7.2.4, Output 7.2.5, and Output 7.2.6. The model appears to fit the data quite well.

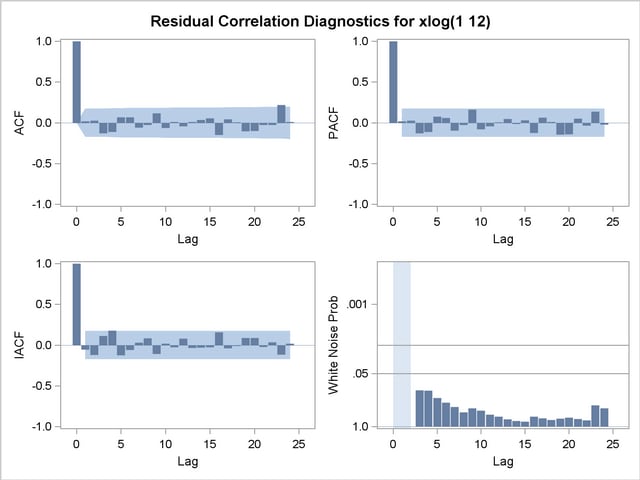

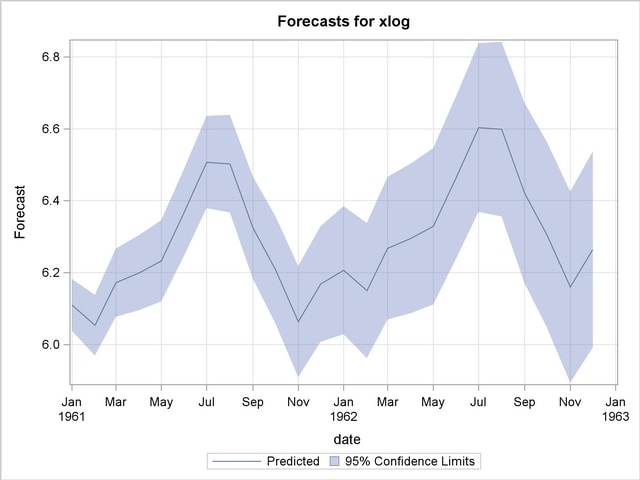

The forecasts and their confidence limits for the transformed series are shown in Output 7.2.7.

The following statements retransform the forecast values to get forecasts in the original scales. See the section Forecasting Log Transformed Data for more information.

data c;

set b;

x = exp( xlog );

forecast = exp( forecast + std*std/2 );

l95 = exp( l95 );

u95 = exp( u95 );

run;

The forecasts and their confidence limits are plotted by using the following PROC SGPLOT step. The plot is shown in Output 7.2.8.

proc sgplot data=c;

where date >= '1jan58'd;

band Upper=u95 Lower=l95 x=date

/ LegendLabel="95% Confidence Limits";

scatter x=date y=x;

series x=date y=forecast;

run;

Copyright © 2008 by SAS Institute Inc., Cary, NC, USA. All rights reserved.