Language Reference

DURATION Function

DURATION (times, flows, ytm);

The DURATION function returns a scalar value that represents the modified duration of a noncontingent cash flow. The arguments are as follows:

- times

-

is an n-dimensional column vector of times. The ith time corresponds to the time (often in years) until the ith cash flow occurs. Elements should be nonnegative.

- flows

-

is an n-dimensional column vector of cash flows.

- ytm

-

is the per-period yield-to-maturity of the cash-flow stream. This is a scalar and should be positive.

Duration of a security is generally defined as

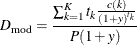

In other words, it is the relative change in price for a unit change in yield. Since prices move in the opposite direction to yields, the sign change preserves positivity for convenience. With cash flows that are not yield-sensitive and the assumption of parallel shifts to a flat term structure, duration is given by

where P is the present value, y is the per-period effective yield-to-maturity, K is the number of cash flows, and the kth cash flow is  ,

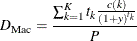

,  periods from the present. This measure is referred to as modified duration to differentiate it from the Macaulay duration:

periods from the present. This measure is referred to as modified duration to differentiate it from the Macaulay duration:

This expression also reveals the reason for the name duration, since it is a present-value-weighted average of the duration (that is, timing) of all the cash flows and is hence an "average time-to-maturity" of the bond.

For example, consider the following statements:

times = 1; flow = 10; ytm = 0.1; duration = duration(times, flow, ytm); print duration;