MARGRPTPRC Function

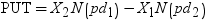

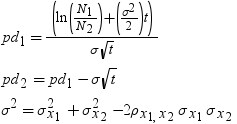

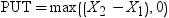

Calculates put prices for European options on stocks, based on the Margrabe model.

| Category: | Financial |

| Returned data type: | DOUBLE |

Syntax

Arguments

X1

is a nonmissing, positive value that specifies the price of the first asset.

| Requirement | Specify X1 and X2 in the same units. |

| Data type | DOUBLE |

t

is a nonmissing value that specifies the time to expiration, in years.

| Data type | DOUBLE |

X2

is a nonmissing, positive value that specifies the price of the second asset.

| Requirement | Specify X2 and X1 in the same units. |

| Data type | DOUBLE |

sigma1

is a nonmissing, positive fraction that specifies the volatility of the first asset.

| Data type | DOUBLE |

sigma2

is a nonmissing, positive fraction that specifies the volatility of the second asset.

| Data type | DOUBLE |

rho12

specifies the correlation

between the first and second assets,

| Range | between –1 and 1 |

| Data type | DOUBLE |