Details

Sum-of-Years Digits

An asset often loses more of its value early in its lifetime. A method that exhibits this dynamic is desirable.

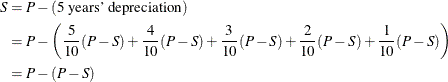

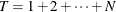

Assume an asset depreciates from price P to salvage value N in S years. First compute the sum-of-years as  . The depreciation for the years after the asset’s purchase is:

. The depreciation for the years after the asset’s purchase is:

Table 67.1: Sum-of-Years General Example

|

Year Number |

Annual Depreciation |

|---|---|

|

first |

|

|

second |

|

|

third |

|

|

|

|

|

final |

|

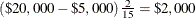

For the ith year of the asset’s use, the annual depreciation is:

![\[ \frac{N+1-i}{T}(P-S) \]](images/etsug_invdetails0009.png)

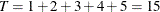

For our example,  and the sum of years is

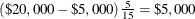

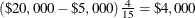

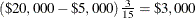

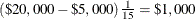

and the sum of years is  . The depreciation during the first year is

. The depreciation during the first year is

![\[ (\$ 20,000-\$ 5,000)\frac{5}{15}=\$ 5,000 \]](images/etsug_invdetails0012.png)

Table 67.2 describes how Declining Balance would depreciate the asset.

Table 67.2: Sum-of-Years Example

|

Year |

Depreciation |

Year-End Value |

|---|---|---|

|

1 |

|

|

|

2 |

|

|

|

3 |

|

|

|

4 |

|

|

|

5 |

|

|

As expected, the value after N years is S.