| The MIXED Procedure |

| Notation for the Mixed Model |

This section introduces the mathematical notation used throughout this chapter to describe the mixed linear model. You should be familiar with basic matrix algebra (see Searle 1982). A more detailed description of the mixed model is contained in the section Mixed Models Theory.

A statistical model is a mathematical description of how data are generated. The standard linear model, as used by the GLM procedure, is one of the most common statistical models:

|

In this expression,  represents a vector of observed data,

represents a vector of observed data,  is an unknown vector of fixed-effects parameters with known design matrix

is an unknown vector of fixed-effects parameters with known design matrix  , and

, and  is an unknown random error vector modeling the statistical noise around

is an unknown random error vector modeling the statistical noise around  . The focus of the standard linear model is to model the mean of

. The focus of the standard linear model is to model the mean of  by using the fixed-effects parameters

by using the fixed-effects parameters  . The residual errors

. The residual errors  are assumed to be independent and identically distributed Gaussian random variables with mean 0 and variance

are assumed to be independent and identically distributed Gaussian random variables with mean 0 and variance  .

.

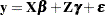

The mixed model generalizes the standard linear model as follows:

|

Here,  is an unknown vector of random-effects parameters with known design matrix

is an unknown vector of random-effects parameters with known design matrix  , and

, and  is an unknown random error vector whose elements are no longer required to be independent and homogeneous.

is an unknown random error vector whose elements are no longer required to be independent and homogeneous.

To further develop this notion of variance modeling, assume that  and

and  are Gaussian random variables that are uncorrelated and have expectations

are Gaussian random variables that are uncorrelated and have expectations  and variances

and variances  and

and  , respectively. The variance of

, respectively. The variance of  is thus

is thus

|

Note that, when  and

and  , the mixed model reduces to the standard linear model.

, the mixed model reduces to the standard linear model.

You can model the variance of the data,  , by specifying the structure (or form) of

, by specifying the structure (or form) of  ,

,  , and

, and  . The model matrix

. The model matrix  is set up in the same fashion as

is set up in the same fashion as  , the model matrix for the fixed-effects parameters. For

, the model matrix for the fixed-effects parameters. For  and

and  , you must select some covariance structure. Possible covariance structures include the following:

, you must select some covariance structure. Possible covariance structures include the following:

variance components

compound symmetry (common covariance plus diagonal)

unstructured (general covariance)

autoregressive

spatial

general linear

factor analytic

By appropriately defining the model matrices  and

and  , as well as the covariance structure matrices

, as well as the covariance structure matrices  and

and  , you can perform numerous mixed model analyses.

, you can perform numerous mixed model analyses.

Copyright © SAS Institute, Inc. All Rights Reserved.