MARGRPTPRC Function

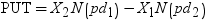

Calculates put prices for European options on stocks, based on the Margrabe model.

| Category: | Financial |

| Returned data type: | DOUBLE |

Syntax

Arguments

X1

is a nonmissing, positive value that specifies the price of the first asset.

| Requirement | Specify X1 and X2 in the same units. |

| Data type | DOUBLE |

t

is a nonmissing value that specifies the time to expiration, in years.

| Data type | DOUBLE |

X2

is a nonmissing, positive value that specifies the price of the second asset.

| Requirement | Specify X2 and X1 in the same units. |

| Data type | DOUBLE |

sigma1

is a nonmissing, positive fraction that specifies the volatility of the first asset.

| Data type | DOUBLE |

sigma2

is a nonmissing, positive fraction that specifies the volatility of the second asset.

| Data type | DOUBLE |

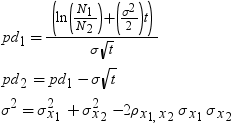

Details

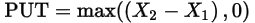

tComparisons

Example

|

Statements

|

Results

|

|---|---|

select margrptprc(2, .25, 3, .06, .2, 1); |

1.0000000000973 |

select margrptprc(3, .25, 4, .05, .3, 1); |

1.00157624907712 |