BLACKCLPRC Function

Calculates call prices for European options on futures, based on the Black model.

| Category: | Financial |

| Returned data type: | DOUBLE |

Syntax

Arguments

E

is a nonmissing, positive value that specifies exercise price.

| Requirement | Specify E and F in the same units. |

| Data type | DOUBLE |

t

is a nonmissing value that specifies time to maturity, in years.

| Data type | DOUBLE |

F

is a nonmissing, positive value that specifies future price.

| Requirement | Specify F and E in the same units. |

| Data type | DOUBLE |

r

is a nonmissing, positive value that specifies the annualized risk-free interest rate, continuously compounded.

| Data type | DOUBLE |

sigma

is a nonmissing, positive fraction that specifies the volatility (the square root of the variance of r).

| Data type | DOUBLE |

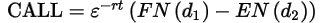

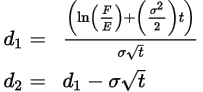

Details

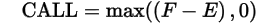

Comparisons

Example

|

Statements

|

Results

|

|---|---|

----+----1----+-—-2-- |

|

select blackclprc(50,.25,48,.05,.25); |

1.55130142723117 |

select blackclprc(9,1/12,10,.05,.2); |

1 |