INTRR Function

Returns the internal rate of return as a decimal value.

| Category: | Financial |

| Returned data type: | DOUBLE |

Syntax

Arguments

freq

is numeric, the number of payments over a specified base period of time that is associated with the desired internal rate of return.

| Range | freq > 0 |

| Data type | DOUBLE |

| Tip | The case freq = 0 is a flag to allow continuous compounding. |

c0, c1[ …, cn]

are numeric, the optional cash payments.

| Data type | DOUBLE |

Details

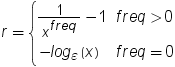

The INTRR function returns

the internal rate of return over a specified base period of time for

the set of cash payments c0, c1,

..., cn. The time intervals

between any two consecutive payments are assumed to be equal. The

argument freq > 0 describes

the number of payments that occur over the specified base period of

time. The number of notes issued from each instance is limited.

The internal rate of

return is the interest rate such that the sequence of payments has

a 0 net present value. (See the NPV Function.) It is given by the following equation.

In this equation, x is

the real root of the polynomial.

In the case of multiple

roots, one real root is returned and a warning is issued concerning

the non-uniqueness of the returned internal rate of return. Depending

on the value of payments, a root for the equation does not always

exist. In that case, a missing value is returned.

Missing values in the

payments are treated as 0 values. When freq >

0, the computed rate of return is the effective rate over the specified

base period. To compute a quarterly internal rate of return (the base

period is three months) with monthly payments, set freq to

3.

If freq is

0, continuous compounding is assumed and the base period is the time

interval between two consecutive payments. The computed internal rate

of return is the nominal rate of return over the base period. To compute

with continuous compounding and monthly payments, set freq to

0. The computed internal rate of return will be a monthly rate.

Comparisons

The IRR function is

identical to INTRR, except for in the IRR function, the internal rate

of return is a percentage.

Example

For an initial outlay

of $400 and expected payments of $100, $200, and $300 over the following

three years, the annual internal rate of return can be expressed as

select intrr(1,-400,100,200,300);

The

value that is returned is 0.1943770996.

See Also

Functions:

Copyright © SAS Institute Inc. All Rights Reserved.

Last updated: February 23, 2017