Details

Declining Balance (DB)

Recall that the straight line method assumes a constant depreciation value. Conversely, the declining balance method assumes a constant depreciation rate per year. And like the sum-of-years method, more depreciation tends to occur earlier in the asset’s life.

Assume the price of a depreciating asset is P and its salvage value after N years is N. You could assume the asset depreciates by a factor of  (or a rate of

(or a rate of  ). This method is known as single declining balance. The annual depreciation is:

). This method is known as single declining balance. The annual depreciation is:

![\[ \frac{1}{N} (\text {previous year’s value}) \]](images/etsug_invdetails0026.png)

So for our example, the depreciation during the first year is  . Table 67.3 describes how declining balance would depreciate the asset.

. Table 67.3 describes how declining balance would depreciate the asset.

Table 67.3: Declining Balance Example

|

Year |

Depreciation |

Year-End Value |

|---|---|---|

|

1 |

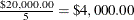

|

|

|

2 |

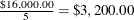

|

|

|

3 |

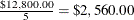

|

|

|

4 |

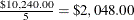

|

|

|

5 |

|

|

DB Factor

You could also accelerate the depreciation by increasing the factor (and hence the rate) at which depreciation occurs. Other

commonly accepted depreciation rates are  (called double declining balance as the depreciation factor becomes

(called double declining balance as the depreciation factor becomes  ) and

) and  . Investment Analysis enables you to choose between these three types for declining balance: 2 (with

. Investment Analysis enables you to choose between these three types for declining balance: 2 (with  depreciation), 1.5 (with

depreciation), 1.5 (with  ), and 1 (with

), and 1 (with  ).

).

Declining Balance and the Salvage Value

The declining balance method assumes that depreciation is faster earlier in an asset’s life; this is what you wanted. But notice the final value is greater than the salvage value. Even if the salvage value were greater than $6,553.60, the final year-end value would not change. The salvage value never enters the calculation, so there is no way for the salvage value to force the depreciation to assume its value. Newnan and Lavelle (1998) describe two ways to adapt the declining balance method to assume the salvage value at the final time. One way is as follows:

Suppose you call the depreciated value after i years  . This sets

. This sets  and

and  .

.

-

If

according to the usual calculation for

according to the usual calculation for  , redefine

, redefine  to equal S.

to equal S.

-

If

according to the usual calculation for

according to the usual calculation for  for some i (and hence for all subsequent

for some i (and hence for all subsequent  values), you can redefine all such

values), you can redefine all such  to equal S.

to equal S.

This alteration to declining balance forces the depreciated value of the asset after N years to be S and keeps  no less than S.

no less than S.

Conversion to SL

The second (and preferred) way to force declining balance to assume the salvage value is by conversion to straight line.

If  , the first way redefines

, the first way redefines  to equal S; you can think of this as converting to the straight line method for the last time step.

to equal S; you can think of this as converting to the straight line method for the last time step.

If the  value supplied by DB is appreciably larger than S, then the depreciation in the final year would be unrealistically large. An alternate way is to compute the DB and SL step

at each timestep and take whichever step gives a larger depreciation (unless DB drops below the salvage value).

value supplied by DB is appreciably larger than S, then the depreciation in the final year would be unrealistically large. An alternate way is to compute the DB and SL step

at each timestep and take whichever step gives a larger depreciation (unless DB drops below the salvage value).

After SL assumes a larger depreciation, it continues to be larger over the life of the asset. SL forces the value at the final time to equal the salvage value. As an algorithm, this looks like the following statements:

V(0) = P;

for i=1 to N

if DB step > SL step from (i,V(i))

take a DB step to make V(i);

else

break;

for j = i to N

take a SL step to make V(j);

The MACRS, which is discussed in the section that describes the Depreciation Table window, is actually a variation on the declining balance method with conversion to the straight line method.