Details

An asset often loses more of its value early in its lifetime. A method that exhibits this dynamic is desirable.

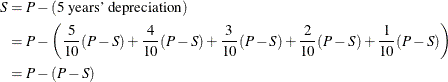

Assume an asset depreciates from price ![]() to salvage value

to salvage value ![]() in

in ![]() years. First compute the sum-of-years as

years. First compute the sum-of-years as ![]() . The depreciation for the years after the asset’s purchase is:

. The depreciation for the years after the asset’s purchase is:

For the ith year of the asset’s use, the annual depreciation is:

For our example, ![]() and the sum of years is

and the sum of years is ![]() . The depreciation during the first year is

. The depreciation during the first year is

Table 59.2 describes how Declining Balance would depreciate the asset.

As expected, the value after ![]() years is

years is ![]() .

.