Because there are many types of investments, a tool that manages and analyzes collections of investments must be robust and flexible. Providing specifications for four specific investment types and one generic type, Investment Analysis can model almost any real-world investment.

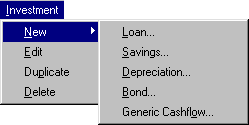

The Investment menu, shown in Figure 55.1, offers the following items:

New ![]() Loan opens the Loan dialog box. Loans are useful for acquiring capital to pursue various interests. Available terms include rate adjustments

for variable rate loans, initialization costs, prepayments, and balloon payments.

Loan opens the Loan dialog box. Loans are useful for acquiring capital to pursue various interests. Available terms include rate adjustments

for variable rate loans, initialization costs, prepayments, and balloon payments.

New ![]() Savings opens the Savings dialog box. Savings are necessary when planning for the future, whether for business or personal purposes. Account summary

calculations available per deposit include starting balance, deposits, interest earned, and ending balance.

Savings opens the Savings dialog box. Savings are necessary when planning for the future, whether for business or personal purposes. Account summary

calculations available per deposit include starting balance, deposits, interest earned, and ending balance.

New ![]() Depreciation opens the Depreciation dialog box. Depreciations are relevant in tax calculation. The available depreciation methods are Straight Line, Sum-of-years

Digits, Depreciation Table, and Declining Balance. Depreciation Tables are necessary when depreciation calculations must conform

to set yearly percentages. Declining Balance with conversion to Straight Line is also provided.

Depreciation opens the Depreciation dialog box. Depreciations are relevant in tax calculation. The available depreciation methods are Straight Line, Sum-of-years

Digits, Depreciation Table, and Declining Balance. Depreciation Tables are necessary when depreciation calculations must conform

to set yearly percentages. Declining Balance with conversion to Straight Line is also provided.

New ![]() Bond opens the Bond dialog box. Bonds have widely varying terms depending on the issuer. Because bond issuers frequently auction their bonds,

the ability to price a bond between the issue date and maturity date is desirable. Fixed-coupon bonds may be analyzed for

the following: price versus yield-to-maturity, duration, and convexity. These are available at different times in the bond’s

life.

Bond opens the Bond dialog box. Bonds have widely varying terms depending on the issuer. Because bond issuers frequently auction their bonds,

the ability to price a bond between the issue date and maturity date is desirable. Fixed-coupon bonds may be analyzed for

the following: price versus yield-to-maturity, duration, and convexity. These are available at different times in the bond’s

life.

New ![]() Generic Cashflow opens the Generic Cashflow dialog box. Generic cashflows are the most flexible investments. Only a sequence of date-amount pairs is necessary for specification.

You can enter date-amount pairs and load values from SAS data sets to specify any type of investment. You can generate uniform,

arithmetic, and geometric cashflows with ease. SAS’s forecasting ability is available to forecast future cashflows as well.

The new graphical display aids in visualization of the cashflow and enables the user to change the frequency of the cashflow

view to aggregate and disaggregate the view.

Generic Cashflow opens the Generic Cashflow dialog box. Generic cashflows are the most flexible investments. Only a sequence of date-amount pairs is necessary for specification.

You can enter date-amount pairs and load values from SAS data sets to specify any type of investment. You can generate uniform,

arithmetic, and geometric cashflows with ease. SAS’s forecasting ability is available to forecast future cashflows as well.

The new graphical display aids in visualization of the cashflow and enables the user to change the frequency of the cashflow

view to aggregate and disaggregate the view.

Edit opens the specification dialog box for an investment selected within the portfolio.

Duplicate creates a duplicate of an investment selected within the portfolio.

Delete removes an investment selected from the portfolio.

If you want to edit, duplicate, or delete a collection of investments, you must select a collection of investments as described in the section Selecting Investments within a Portfolio before performing the menu-option.