Suppose a rock quarry needs equipment to use the next five years. It has two alternatives:

-

a box loader and conveyer system that has a one-time cost of $264,000

-

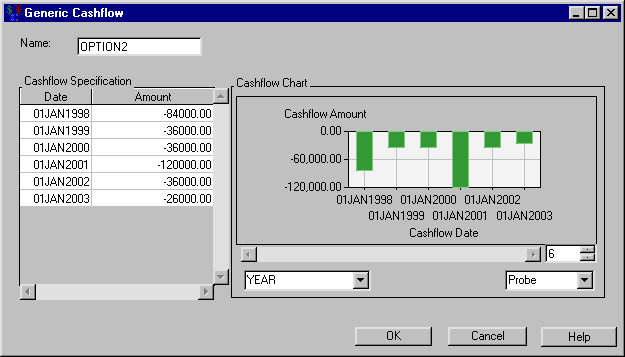

a two-shovel loader, which costs $84,000 but has a yearly operating cost of $36,000. This loader has a service life of three years, which necessitates the purchase of a new loader for the final two years of the rock quarry project. Assume the second loader also costs $84,000 and its salvage value after its two-year service is $10,000. A SAS data set that describes this is available at

SASHELP.ROCKPIT

You expect a 13% MARR. Which is the better alternative?

To create the cashflows, follow these steps:

-

Create a cashflow with the single amount –264,000. Date the amount 01JAN1998 to be consistent with the SAS data set you load.

-

Load

SASHELP.ROCKPITinto a second cashflow, as displayed in Figure 57.2.

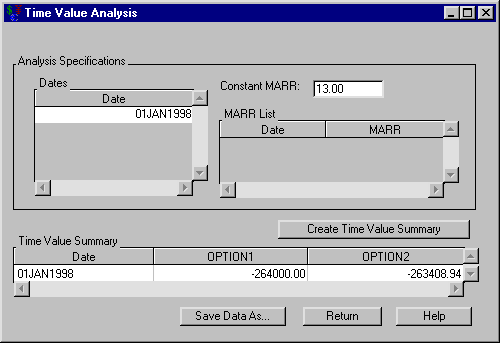

To compute the time values of these investments, follow these steps:

-

Select both cashflows.

-

Select Analyze

Time Value. This opens the Time Value Analysis dialog box.

Time Value. This opens the Time Value Analysis dialog box.

-

Enter the date 01JAN1998 into the Dates area.

-

Enter 13 for the Constant MARR.

-

Click Create Time Value Summary.

As shown in Figure 57.3, option 1 has a time value of –$264,000.00 naturally on 01JAN1998. However, option 2 has a time value of –$263,408.94, which is slightly less expensive.