Example 19.12 Cauchy Distribution Estimation

In this example a nonlinear model is estimated by using the Cauchy distribution. Then a simulation is done for one observation in the data.

The following DATA step creates the data for the model.

/* Generate a Cauchy distributed Y */

data c;

format date monyy.;

call streaminit(156789);

do t=0 to 20 by 0.1;

date=intnx('month','01jun90'd,(t*10)-1);

x=rand('normal');

e=rand('cauchy') + 10 ;

y=exp(4*x)+e;

output;

end;

run;

The model to be estimated is

|

|

|

|

|

|

|

|

That is, the residuals of the model are distributed as a Cauchy distribution with noncentrality parameter ![]() .

.

The log likelihood for the Cauchy distribution is

|

|

The following SAS statements specify the model and the log-likelihood function.

title1 'Cauchy Distribution';

proc model data=c ;

dependent y;

parm a -2 nc 4;

y=exp(-a*x);

/* Likelihood function for the residuals */

obj = log(constant('pi')*(1+(-resid.y-nc)**2));

errormodel y ~ general(obj) cdf=cauchy(nc);

fit y / outsn=s1 method=marquardt;

solve y / sdata=s1 data=c(obs=1) random=1000

seed=256789 out=out1;

run;

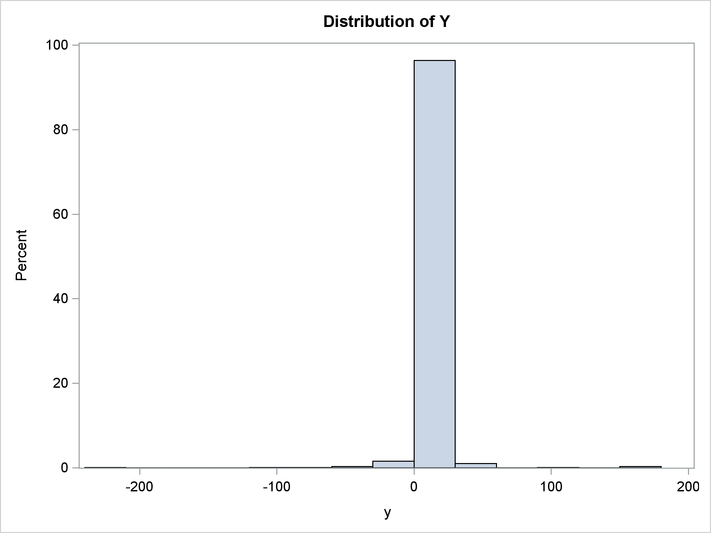

title 'Distribution of Y';

proc sgplot data=out1;

histogram y;

run;

The FIT statement uses the OUTSN= option to output the ![]() matrix for residuals from the normal distribution. The

matrix for residuals from the normal distribution. The ![]() matrix is

matrix is ![]() and has value

and has value ![]() because it is a correlation matrix. The OUTS= matrix is the scalar

because it is a correlation matrix. The OUTS= matrix is the scalar ![]() . Because the distribution is univariate (no covariances), the OUTS= option would produce the same simulation results. The

simulation is performed by using the SOLVE statement.

. Because the distribution is univariate (no covariances), the OUTS= option would produce the same simulation results. The

simulation is performed by using the SOLVE statement.

The distribution of ![]() is shown in the following output.

is shown in the following output.

Output 19.12.1: Distribution of Y