| The PANEL Procedure |

| Dynamic Panel Estimator |

For an example on dynamic panel estimation using GMM option, see The Cigarette Sales Data: Dynamic Panel Estimation with GMM.

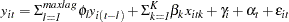

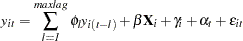

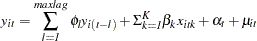

Consider the case of the following general model:

|

The  variables can include ones that are correlated or uncorrelated to the individual effects, predetermined, or strictly exogenous. The

variables can include ones that are correlated or uncorrelated to the individual effects, predetermined, or strictly exogenous. The  and

and  are cross-sectional and time series fixed effects, respectively. Arellano and Bond (1991) show that it is possible to define conditions that should result in a consistent estimator.

are cross-sectional and time series fixed effects, respectively. Arellano and Bond (1991) show that it is possible to define conditions that should result in a consistent estimator.

Consider the simple case of an autoregression in a panel setting (with only individual effects):

|

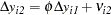

Differencing the preceding relationship results in:

|

where  .

.

Obviously,  is not exogenous. However, Arellano and Bond (1991) show that it is still useful as an instrument, if properly lagged.

is not exogenous. However, Arellano and Bond (1991) show that it is still useful as an instrument, if properly lagged.

For  (assuming the first observation corresponds to time period 1) you have,

(assuming the first observation corresponds to time period 1) you have,

|

Using  as an instrument is not a good idea since

as an instrument is not a good idea since  . Therefore, since it is not possible to form a moment restriction, you discard this observation.

. Therefore, since it is not possible to form a moment restriction, you discard this observation.

For  you have,

you have,

|

Clearly, you have every reason to suspect that  . This condition forms one restriction.

. This condition forms one restriction.

For  , both

, both  and

and  must hold.

must hold.

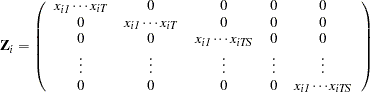

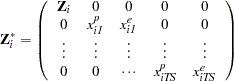

Proceeding in that fashion, you have the following matrix of instruments,

|

Using the instrument matrix, you form the weighting matrix  as

as

|

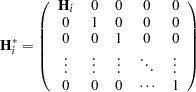

The initial weighting matrix is

|

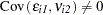

Note that the maximum size of the  matrix is T–2. The origins of the initial weighting matrix are the expected error covariances. Notice that on the diagonals,

matrix is T–2. The origins of the initial weighting matrix are the expected error covariances. Notice that on the diagonals,

|

and off diagonals,

|

If you let the vector of lagged differences (in the series  ) be denoted as

) be denoted as  and the dependent variable as

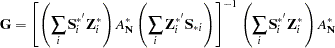

and the dependent variable as  , then the optimal GMM estimator is

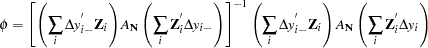

, then the optimal GMM estimator is

|

Using the estimate,  , you can obtain estimates of the errors,

, you can obtain estimates of the errors,  , or the differences,

, or the differences,  . From the errors, the variance is calculated as,

. From the errors, the variance is calculated as,

|

where  is the total number of observations.

is the total number of observations.

Furthermore, you can calculate the variance of the parameter as,

|

Alternatively, you can view the initial estimate of the  as a first step. That is, by using

as a first step. That is, by using  , you can improve the estimate of the weight matrix,

, you can improve the estimate of the weight matrix,  .

.

Instead of imposing the structure of the weighting, you form the  matrix through the following:

matrix through the following:

|

You then complete the calculation as previously shown. The PROC PANEL option TWOSTEP specifies this estimation.

The case of multiple right-hand-side variables illustrates more clearly the power of Arellano and Bond (1991) and Arellano and Bover (1995).

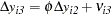

Considering the general case you have:

|

It is clear that lags of the dependent variable are both not exogenous and correlated to the fixed effects. However, the independent variables can fall into one of several categories. An independent variable can be correlated and exogenous, uncorrelated and exogenous, correlated and predetermined, and uncorrelated and predetermined. The category in which an independent variable is found influences when or whether it becomes a suitable instrument. Note, however, that neither PROC PANEL nor Arellano and Bond require that a regressor be an instrument or that an instrument be a regressor.

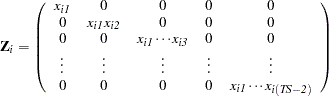

First, consider the question of exogenous or endogenous. An exogenous variable is not correlated with the error term in the model at all. Therefore, all observations (on the exogenous variable) become valid instruments at all time periods. If the model has only one instrument and it happens to be exogenous, then the optimal instrument matrix looks like,

|

The situation for the predetermined variables becomes a little more difficult. A predetermined variable is one whose future realizations can be correlated to current shocks in the dependent variable. With such an understanding, it is admissible to allow all current and lagged realizations as instruments. In other words you have,

|

When the data contain a mix of endogenous, exogenous, and predetermined variables, the instrument matrix is formed by combining the three. The third observation would have one observation on the dependent variable as an instrument, three observations on the predetermined variables as instruments, and all observations on the exogenous variables.

There is yet another set of moment restrictions that can be employed. An uncorrelated variable means that the variable’s level is not affected by the individual specific effect. You write the general model presented above as:

|

where  .

.

Since the variables are uncorrelated with  and uncorrelated with the error, you can perform a system estimation with the difference and level equations. That is, the uncorrelated variables imply moment restrictions on the level equation. If you denote the new instrument matrix with the full complement of instruments available by a

and uncorrelated with the error, you can perform a system estimation with the difference and level equations. That is, the uncorrelated variables imply moment restrictions on the level equation. If you denote the new instrument matrix with the full complement of instruments available by a  and both

and both  and

and  are uncorrelated, then you have:

are uncorrelated, then you have:

|

The formation of the initial weighting matrix becomes somewhat problematic. If you denote the new weighting matrix with a  , then you can write the following:

, then you can write the following:

|

where

|

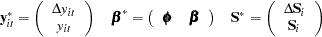

To finish, you write out the two equations (or two stages) that are estimated.

|

where  is the matrix of all explanatory variables, lagged endogenous, exogenous, and predetermined.

is the matrix of all explanatory variables, lagged endogenous, exogenous, and predetermined.

Let  be given by

be given by

|

Using the information above,

|

If the TWOSTEP or ITGMM option is not requested, estimation terminates here. If it terminates, you can obtain the following information.

Variance of the error term comes from the second stage equation—that is,

|

where  is the number of regressors.

is the number of regressors.

The variance covariance matrix can be obtained from

|

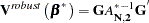

Alternatively, a robust estimate of the variance covariance matrix can be obtained by specifying the ROBUST option. Without further reestimation of the model, the  matrix is recalculated as follows:

matrix is recalculated as follows:

|

And the weighting matrix becomes

|

Using the information above, you construct the robust variance covariance matrix from the following:

Let  denote a temporary matrix.

denote a temporary matrix.

|

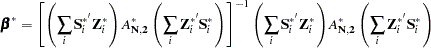

The robust variance covariance estimate of  is:

is:

|

Alternatively, the new weighting matrix can be used to form an updated estimate of the regression parameters. This results when the TWOSTEP option is requested. In short,

|

The variance covariance estimate of the two step  becomes

becomes

|

As a final note, it possible to iterate more than twice by specifying the ITGMM option. Such a multiple iteration should result in a more stable estimate of the variance covariance estimate. PROC PANEL allows two convergence criteria. Convergence can occur in the parameter estimates or in the weighting matrices. Iterate until

|

or

|

where ATOL is the tolerance for convergence in the weighting matrix and BTOL is the tolerance for convergence in the parameter estimate matrix. The default convergence criteria is BTOL = 1E–8 for PROC PANEL.

Copyright © 2008 by SAS Institute Inc., Cary, NC, USA. All rights reserved.