What Is Credit Scoring for SAS Enterprise Miner?

Credit

scoring is the set of decision models and their underlying

techniques that aid lenders in the granting of consumer credit. These

techniques describe who should get credit, how much credit they should

receive, and which operational strategies will enhance the profitability

of the borrowers to the lenders (Thomas, Edelman, and Crook 2002).

Credit Scoring, as

defined by SAS, includes the following:

Although credit scoring

is not as glamorous as pricing exotic financial derivatives, it is

one of the most successful applications of statistical and operations

research techniques in finance and banking. Without an accurate and

automated risk assessment tool, the phenomenal growth of consumer

credit would not have been possible over the past 40 years (Thomas,

Edelman, and Crook 2002).

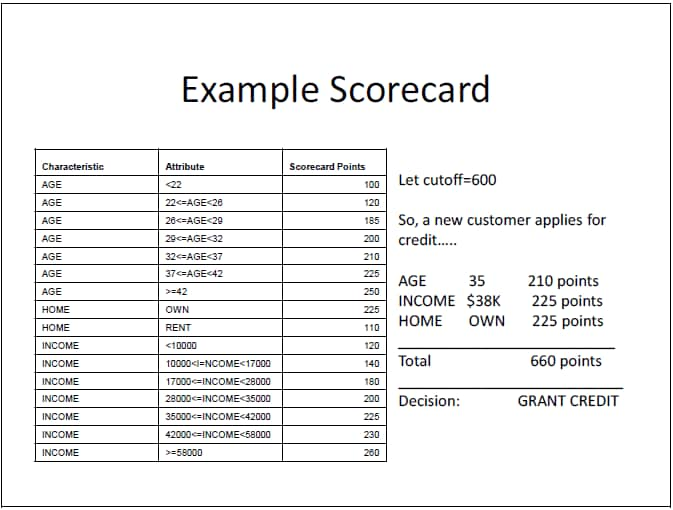

In its simplest form,

a scorecard is built from a number of characteristics (that is, input

or predictor variables). Each characteristic includes a number of

attributes. For example, age is a characteristic, and “25-33”

is an attribute. Each attribute is associated with a number of scorecard

points. These scorecard points are statistically assigned to differentiate

risk, based on the predictive power of the characteristic variables,

correlation between the variables, and business considerations.

For example, using the

Example Scorecard in Figure 1.1, an applicant who is 35, makes $38,000,

and is a homeowner would be accepted for credit by this financial

institution’s scorecard. The total score of an applicant is

the sum of the scores for each attribute that is present in the scorecard.

Lower scores imply a higher risk of default, and higher scores imply

a lower risk of default.

Credit Scoring for SAS

Enterprise Miner contains the following nodes, which are added to

your SAS Enterprise Miner toolbar to support scorecard development:

-

Scorecard — uses the grouped variables as inputs in a logistic regression model and usually follows the Interactive Grouping node. In addition, it scales the regression parameters to compute score points and the resulting scorecard. Finally, the Scorecard node performs score and characteristic (variable) analysis that helps in understanding the scorecard, and aids in crafting a score-based strategy.

Copyright © SAS Institute Inc. All rights reserved.